Delta Lost $12 billion in 2020

Comments

-

Because its personal not politicalcreepycoug said:

I hear you. I'm not in a hurry to get the vax; but I (we) are also not anti-vax. I just want to see it roll out for a while. I've never wanted to be the canary.BleachedAnusDawg said:Are airlines really going to be stupid enough to require proof of vaccination? I, and many others I know, will not fly if that's the case. We just won't.

Quasi-tug comment, but relevant.

The anti-vax group is a chintresting one. They seem to cross the political spectrum. I know people who are fairly described as close to alt-right and people who border on collectivism who won't touch a vax and will argue with you about it all day if you let them.

And this fast of a vaccine is new

-

RaceBannon said:

Because its personal not politicalcreepycoug said:

I hear you. I'm not in a hurry to get the vax; but I (we) are also not anti-vax. I just want to see it roll out for a while. I've never wanted to be the canary.BleachedAnusDawg said:Are airlines really going to be stupid enough to require proof of vaccination? I, and many others I know, will not fly if that's the case. We just won't.

Quasi-tug comment, but relevant.

The anti-vax group is a chintresting one. They seem to cross the political spectrum. I know people who are fairly described as close to alt-right and people who border on collectivism who won't touch a vax and will argue with you about it all day if you let them.

And this fast of a vaccine is new

-

creepycoug said:

I hear you. I'm not in a hurry to get the vax; but I (we) are also not anti-vax. I just want to see it roll out for a while. I've never wanted to be the canary.BleachedAnusDawg said:Are airlines really going to be stupid enough to require proof of vaccination? I, and many others I know, will not fly if that's the case. We just won't.

Quasi-tug comment, but relevant.

The anti-vax group is a chintresting one. They seem to cross the political spectrum. I know people who are fairly described as close to alt-right and people who border on collectivism who won't touch a vax and will argue with you about it all day if you let them.

Contrary to popular opinion, I'm not anti-vaxx either. I just want to reserve the right to be skeptical and ask (uncomfortable) questions.RaceBannon said:

Because its personal not politicalcreepycoug said:

I hear you. I'm not in a hurry to get the vax; but I (we) are also not anti-vax. I just want to see it roll out for a while. I've never wanted to be the canary.BleachedAnusDawg said:Are airlines really going to be stupid enough to require proof of vaccination? I, and many others I know, will not fly if that's the case. We just won't.

Quasi-tug comment, but relevant.

The anti-vax group is a chintresting one. They seem to cross the political spectrum. I know people who are fairly described as close to alt-right and people who border on collectivism who won't touch a vax and will argue with you about it all day if you let them.

And this fast of a vaccine is new

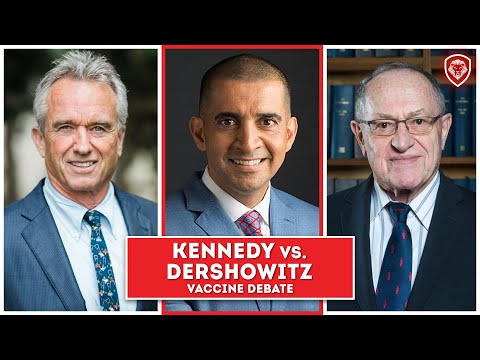

He makes some good poonts. https://youtu.be/IfnJi7yLKgE

https://youtu.be/IfnJi7yLKgE

-

Same. I think that's probably 1/3 of the country.creepycoug said:

I hear you. I'm not in a hurry to get the vax; but I (we) are also not anti-vax. I just want to see it roll out for a while. I've never wanted to be the canary.BleachedAnusDawg said:Are airlines really going to be stupid enough to require proof of vaccination? I, and many others I know, will not fly if that's the case. We just won't.

Quasi-tug comment, but relevant.

The anti-vax group is a chintresting one. They seem to cross the political spectrum. I know people who are fairly described as close to alt-right and people who border on collectivism who won't touch a vax and will argue with you about it all day if you let them.

-

Pretty sure it's standard practice for international travel to verify vaccinations against or non-carrier of certain diseases. Don't really pay that much attention to it - but obviously, if you're going to the jungle of deepest darkest Africa (ISAFNRC), you'd want to be up on getting all your bug shots.

For domestic travel, they can fuck the fuck off with demanding vaccination records. Take my temperature when i get on the plane and STFU about any other medical inquiries. If it's good enough for the engine casinos, it's good enough to jump on a flight.

-

There are a lot of mixed messages on the vax

-

If you follow the gab.com, it's been reported that there's about 3% severe allergic reaction to the vaccine in the UK - including anaphylactic shock and death. But that ain't getting any play from the MSM because it's not worse than Watergate.RaceBannon said:There are a lot of mixed messages on the vax

#takeittothetug

#tiptoeuptotheline

-

They aren’t going to require proof of vax unless they find that is required to get people to travel in the first place.BleachedAnusDawg said:Are airlines really going to be stupid enough to require proof of vaccination? I, and many others I know, will not fly if that's the case. We just won't.

Quasi-tug comment, but relevant.

Now governments on the other hand is a whole different story. I expect negative tests to be required for international travel for a while and possibly proof of vax. It’s not uncommon for this today- travel in and out of regions with yellow fever requires proof of a vaccine, which I’ve had and carry the “yellow card” with me. But usually for American travelers no one cares.

And that will probably be one of the biggest travel changes with COVID. Show up at passport control in any country, US passport in hand, and off you went, especially if you looked the part. Now the US is that dirty country where Covid spread out of control. No more zipping through at Heathrow or Frankfurt; we’ll be in line with the masses from SE Asia as we get investigated to ensure we’re not bringing nasty shit in. That will suck and I will have my vaccine proof with me in order to keep moving. -

Global Entry, bitches.whlinder said:

They aren’t going to require proof of vax unless they find that is required to get people to travel in the first place.BleachedAnusDawg said:Are airlines really going to be stupid enough to require proof of vaccination? I, and many others I know, will not fly if that's the case. We just won't.

Quasi-tug comment, but relevant.

Now governments on the other hand is a whole different story. I expect negative tests to be required for international travel for a while and possibly proof of vax. It’s not uncommon for this today- travel in and out of regions with yellow fever requires proof of a vaccine, which I’ve had and carry the “yellow card” with me. But usually for American travelers no one cares.

And that will probably be one of the biggest travel changes with COVID. Show up at passport control in any country, US passport in hand, and off you went, especially if you looked the part. Now the US is that dirty country where Covid spread out of control. No more zipping through at Heathrow or Frankfurt; we’ll be in line with the masses from SE Asia as we get investigated to ensure we’re not bringing nasty shit in. That will suck and I will have my vaccine proof with me in order to keep moving.

At least coming back home.

-

Moderna seems to be the one popping up (off?) the most with the allergic reaction incidents.RaceBannon said:There are a lot of mixed messages on the vax