For Houston and the other deficit Hawks out there

https://www.fiscal.treasury.gov/fsreports/rpt/mthTreasStmt/mts0718.pdf

Comments

-

Tax receipts have never been higher!!

-

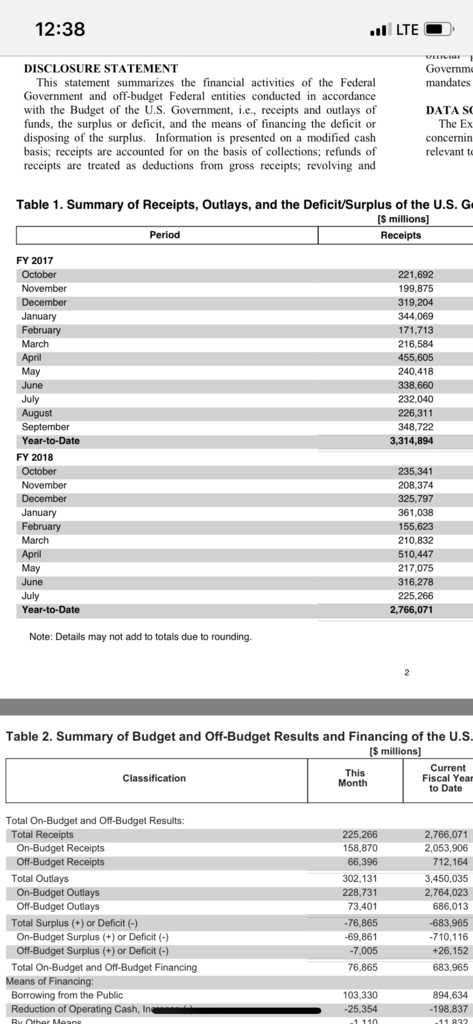

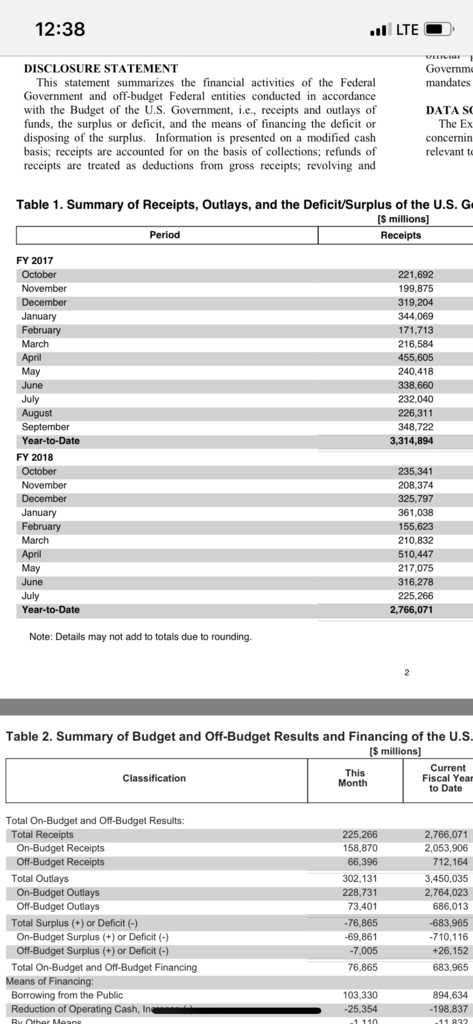

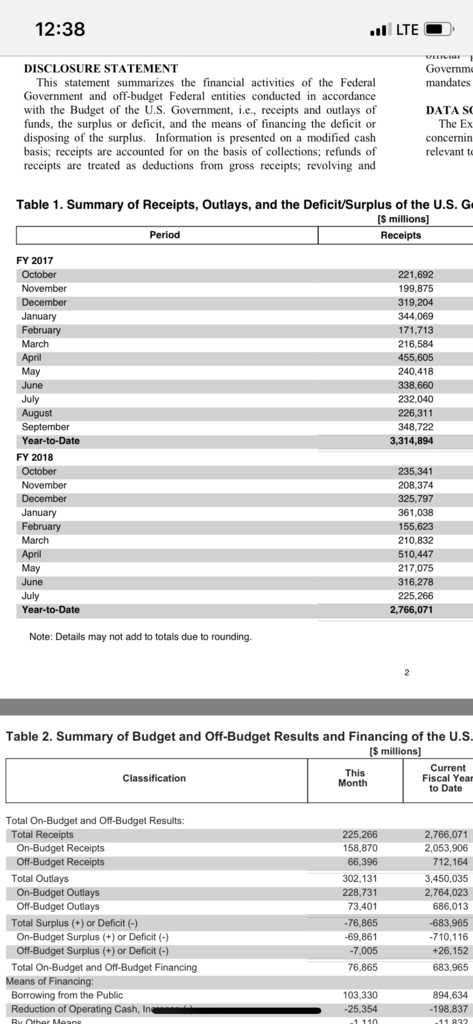

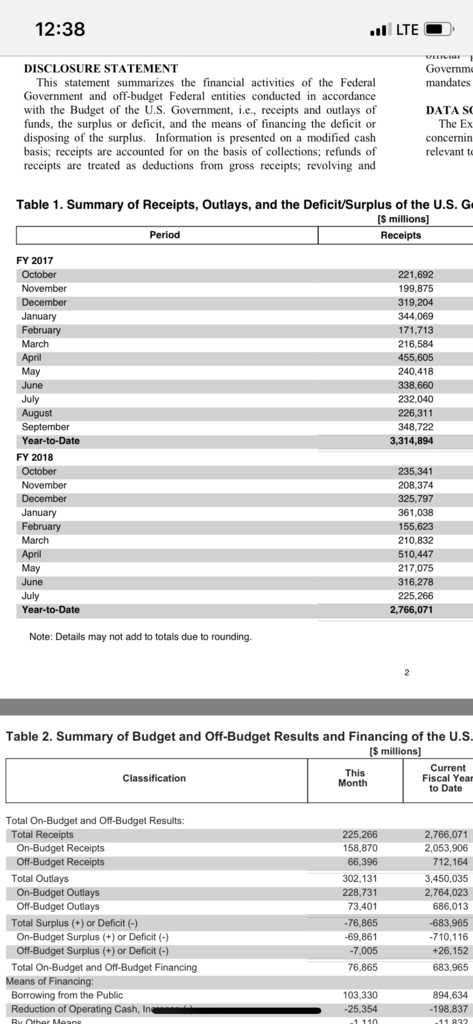

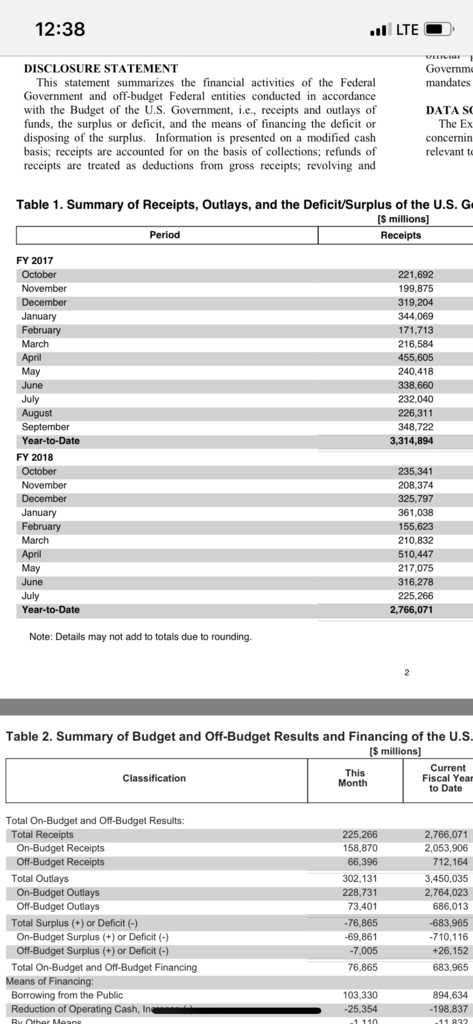

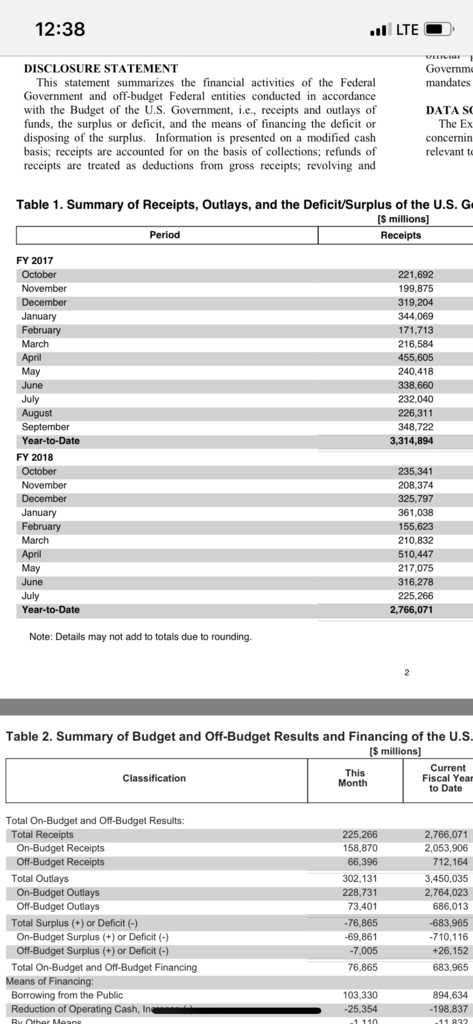

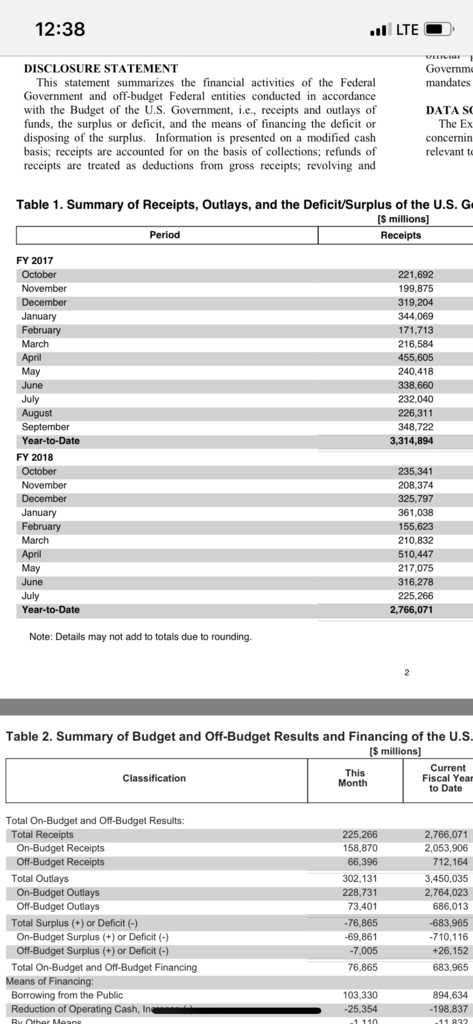

Here are the receipts but month. For the record. The change in withholding came in February 18 and April of 18 includes payments for 17 under the prior tax laws.

I still don't know what this means. Maybe @HoustonHusky can chime in and tell us. -

I can’t but I bet @thechart got a boner.2001400ex said:Can you explain what this all means?

https://www.fiscal.treasury.gov/fsreports/rpt/mthTreasStmt/mts0718.pdf -

Not that you will understand, but receipts are up over last year even with the tax cuts ("Dynamic" scoring said they would be down). Main problem with the budget right now is that the economy is booming which is pushing up interest rates...interest rate payments on the debt this year are up and interest rates hikes will make that balloon.2001400ex said:Here are the receipts but month. For the record. The change in withholding came in February 18 and April of 18 includes payments for 17 under the prior tax laws.

I still don't know what this means. Maybe @HoustonHusky can chime in and tell us.

Trumps been fine on the revenue side...he should have fought harder on the last spending bill. And it doesn't help when the previous guy adds $10 trillion to the debt...

-

How did I know you wouldn't even look at it. Look at February though July compared to 18. Every month except April is down from the prior year. Why is that?HoustonHusky said:

Not that you will understand, but receipts are up over last year even with the tax cuts ("Dynamic" scoring said they would be down). Main problem with the budget right now is that the economy is booming which is pushing up interest rates...interest rate payments on the debt this year are up and interest rates hikes will make that balloon.2001400ex said:Here are the receipts but month. For the record. The change in withholding came in February 18 and April of 18 includes payments for 17 under the prior tax laws.

I still don't know what this means. Maybe @HoustonHusky can chime in and tell us.

Trumps been fine on the revenue side...he should have fought harder on the last spending bill. And it doesn't help when the previous guy adds $10 trillion to the debt...

Do like the look of blaming Obama. Nice work!!! -

But...but...but...if you leave this out and then leave that out....and then close one eye and spin around it says something I want it to say. YTD last year $2.73 trillion, YTD this year $2.76 trillion.2001400ex said:

How did I know you wouldn't even look at it. Look at February though July compared to 18. Every month except April is down from the prior year. Why is that?HoustonHusky said:

Not that you will understand, but receipts are up over last year even with the tax cuts ("Dynamic" scoring said they would be down). Main problem with the budget right now is that the economy is booming which is pushing up interest rates...interest rate payments on the debt this year are up and interest rates hikes will make that balloon.2001400ex said:Here are the receipts but month. For the record. The change in withholding came in February 18 and April of 18 includes payments for 17 under the prior tax laws.

I still don't know what this means. Maybe @HoustonHusky can chime in and tell us.

Trumps been fine on the revenue side...he should have fought harder on the last spending bill. And it doesn't help when the previous guy adds $10 trillion to the debt...

Do like the look of blaming Obama. Nice work!!!

Helpful hint...what is the yearly debt payment on $10 trillion dollars at 3% again? -

Answer the question.HoustonHusky said:

But...but...but...if you leave this out and then leave that out....and then close one eye and spin around it says something I want it to say. YTD last year $2.73 trillion, YTD this year $2.76 trillion.2001400ex said:

How did I know you wouldn't even look at it. Look at February though July compared to 18. Every month except April is down from the prior year. Why is that?HoustonHusky said:

Not that you will understand, but receipts are up over last year even with the tax cuts ("Dynamic" scoring said they would be down). Main problem with the budget right now is that the economy is booming which is pushing up interest rates...interest rate payments on the debt this year are up and interest rates hikes will make that balloon.2001400ex said:Here are the receipts but month. For the record. The change in withholding came in February 18 and April of 18 includes payments for 17 under the prior tax laws.

I still don't know what this means. Maybe @HoustonHusky can chime in and tell us.

Trumps been fine on the revenue side...he should have fought harder on the last spending bill. And it doesn't help when the previous guy adds $10 trillion to the debt...

Do like the look of blaming Obama. Nice work!!!

Helpful hint...what is the yearly debt payment on $10 trillion dollars at 3% again?

And the government doesn't pay 3%. -

God you are a dumbass.2001400ex said:

Answer the question.HoustonHusky said:

But...but...but...if you leave this out and then leave that out....and then close one eye and spin around it says something I want it to say. YTD last year $2.73 trillion, YTD this year $2.76 trillion.2001400ex said:

How did I know you wouldn't even look at it. Look at February though July compared to 18. Every month except April is down from the prior year. Why is that?HoustonHusky said:

Not that you will understand, but receipts are up over last year even with the tax cuts ("Dynamic" scoring said they would be down). Main problem with the budget right now is that the economy is booming which is pushing up interest rates...interest rate payments on the debt this year are up and interest rates hikes will make that balloon.2001400ex said:Here are the receipts but month. For the record. The change in withholding came in February 18 and April of 18 includes payments for 17 under the prior tax laws.

I still don't know what this means. Maybe @HoustonHusky can chime in and tell us.

Trumps been fine on the revenue side...he should have fought harder on the last spending bill. And it doesn't help when the previous guy adds $10 trillion to the debt...

Do like the look of blaming Obama. Nice work!!!

Helpful hint...what is the yearly debt payment on $10 trillion dollars at 3% again?

And the government doesn't pay 3%.

From my previous poast: " YTD last year $2.73 trillion, YTD this year $2.76 trillion."

Helpful hint $2.76 > $2.73. And since the GDP is growing faster than previously expected/forecasted that means future govt revenues will be higher than previously expected as well.

And for those who follow the Fed, the current expectation is that the Fed will have interest rates at 2.1% by the end of this year and 2.9% by the end of next year (which means the govt will be paying over 3% soon). The current effective borrowing rate is something like 2.4% with the Fed Funds Rate at 2%. Maybe we should go back to having a shitty economy so we can drop the interest rates?

Now GFY Moron...

-

You still didn't answer the question. Why do all but one month since the tax law was passed have lower revenues than the prior year?HoustonHusky said:

God you are a dumbass.2001400ex said:

Answer the question.HoustonHusky said:

But...but...but...if you leave this out and then leave that out....and then close one eye and spin around it says something I want it to say. YTD last year $2.73 trillion, YTD this year $2.76 trillion.2001400ex said:

How did I know you wouldn't even look at it. Look at February though July compared to 18. Every month except April is down from the prior year. Why is that?HoustonHusky said:

Not that you will understand, but receipts are up over last year even with the tax cuts ("Dynamic" scoring said they would be down). Main problem with the budget right now is that the economy is booming which is pushing up interest rates...interest rate payments on the debt this year are up and interest rates hikes will make that balloon.2001400ex said:Here are the receipts but month. For the record. The change in withholding came in February 18 and April of 18 includes payments for 17 under the prior tax laws.

I still don't know what this means. Maybe @HoustonHusky can chime in and tell us.

Trumps been fine on the revenue side...he should have fought harder on the last spending bill. And it doesn't help when the previous guy adds $10 trillion to the debt...

Do like the look of blaming Obama. Nice work!!!

Helpful hint...what is the yearly debt payment on $10 trillion dollars at 3% again?

And the government doesn't pay 3%.

From my previous poast: " YTD last year $2.73 trillion, YTD this year $2.76 trillion."

Helpful hint $2.76 > $2.73. And since the GDP is growing faster than previously expected/forecasted that means future govt revenues will be higher than previously expected as well.

And for those who follow the Fed, the current expectation is that the Fed will have interest rates at 2.1% by the end of this year and 2.9% by the end of next year (which means the govt will be paying over 3% soon). The current effective borrowing rate is something like 2.4% with the Fed Funds Rate at 2%. Maybe we should go back to having a shitty economy so we can drop the interest rates?

Now GFY Moron...

Also, glad you agree the government doesn't pay 3% interest and you were wrong. But what da fuq does interest expense have to do with revenues? -

Lol at this after @HoustonHusky response.YellowSnow said:Tax receipts have never been higher!!