I’m sorry, but economists...

Comments

-

There's a lot of freeways and bridges that need fixing for starters. And I'm all for places like Seattle building out mass transit even if it's a bit of a boondoggle. I also think we need to treat China as a Sputnik type moment and spend money on military R&D accordingly. We don't want to let those guys catch up to us in military technology. Historically, the spin offs from military R&D have been very advantageous.HoustonHusky said:

You'd be amazed at the US GDP multiple of funding gender studies in Pakistan...YellowSnow said:

Probably someone like Krugman.HoustonHusky said:Guy got a question on if there is a limit to how much money the Fed can print and how large the Federal Government deficits can go and he replied by saying 'the interest rates are incredibly low so the Federal Government should be borrowing everything it can'.

Same guy literally got several questions about unnaturally high oil prices considering the reduction in usage, rapidly rising housing prices, and if the stock market is overvalued and then went on a long talk about how amazingly low inflation numbers are...

Guy forecasts 6% GDP growth for at least the next 2 years...

Had a sweet graph too on how the economy as a whole will be above prepandamic forecasts for 2023 if we pass the large stimulus in front of Congress...admitted under questioning that there is a minor assumption of just using standard multipliers (i.e. if you borrow 10 trillion than the GDP will grow to 50 trillion, or the more the govt spends the better the economy looks...).

With these folks in charge we might get some of those Chinese empty cities built yet...

I'd avoid Spanish banks.

I'm not opposed to still borrowing money at amazingly low interest rates, but that spending has to go into things like infrastructure and/or R&D which increase productivity and have long term ROI. I don't see the point in just giving everyone $2K.

I'm sure if somebody asked him he'd realize/admit the only reason the interest rates are low is because the Fed is monetizing the debt...I doubt he'd ever admit that process drives massive asset inflation currently happening that isn't recorded in the Fed inflation stats. I'm sure the guy LOVES Krugman.

Seriously though...the idea the govt has a list of infrastructure/R&D projects to fund that have any meaningful return is not realistic, much less $2 trillion worth of them. You may get a few more worthless Solyndras out of it, but most of that money is for bailing out cities and states on money already spent, and the idea bailing out NYC or the state of Illinois from their funding mess has a 5x multiple (or whatever this guy was using) is just comical. Its amazing at times how people say things with such authority that if they stopped to think about it for a second they would realize it sounds completely asinine. -

They tyranny of the experts. When someone has the ballz to challenge them, many reveal how thin the exterior of their knowledge really happens to be.HoustonHusky said:

You'd be amazed at the US GDP multiple of funding gender studies in Pakistan...YellowSnow said:

Probably someone like Krugman.HoustonHusky said:Guy got a question on if there is a limit to how much money the Fed can print and how large the Federal Government deficits can go and he replied by saying 'the interest rates are incredibly low so the Federal Government should be borrowing everything it can'.

Same guy literally got several questions about unnaturally high oil prices considering the reduction in usage, rapidly rising housing prices, and if the stock market is overvalued and then went on a long talk about how amazingly low inflation numbers are...

Guy forecasts 6% GDP growth for at least the next 2 years...

Had a sweet graph too on how the economy as a whole will be above prepandamic forecasts for 2023 if we pass the large stimulus in front of Congress...admitted under questioning that there is a minor assumption of just using standard multipliers (i.e. if you borrow 10 trillion than the GDP will grow to 50 trillion, or the more the govt spends the better the economy looks...).

With these folks in charge we might get some of those Chinese empty cities built yet...

I'd avoid Spanish banks.

I'm not opposed to still borrowing money at amazingly low interest rates, but that spending has to go into things like infrastructure and/or R&D which increase productivity and have long term ROI. I don't see the point in just giving everyone $2K.

I'm sure if somebody asked him he'd realize/admit the only reason the interest rates are low is because the Fed is monetizing the debt...I doubt he'd ever admit that process drives massive asset inflation currently happening that isn't recorded in the Fed inflation stats. I'm sure the guy LOVES Krugman.

Seriously though...the idea the govt has a list of infrastructure/R&D projects to fund that have any meaningful return is not realistic, much less $2 trillion worth of them. You may get a few more worthless Solyndras out of it, but most of that money is for bailing out cities and states on money already spent, and the idea bailing out NYC or the state of Illinois from their funding mess has a 5x multiple (or whatever this guy was using) is just comical. Its amazing at times how people say things with such authority that if they stopped to think about it for a second they would realize it sounds completely asinine. -

I'll keep this coolYellowSnow said:

There's a lot of freeways and bridges that need fixing for starters. And I'm all for places like Seattle building out mass transit even if it's a bit of a boondoggle. I also think we need to treat China as a Sputnik type moment and spend money on military R&D accordingly. We don't want to let those guys catch up to us in military technology. Historically, the spin offs from military R&D have been very advantageous.HoustonHusky said:

You'd be amazed at the US GDP multiple of funding gender studies in Pakistan...YellowSnow said:

Probably someone like Krugman.HoustonHusky said:Guy got a question on if there is a limit to how much money the Fed can print and how large the Federal Government deficits can go and he replied by saying 'the interest rates are incredibly low so the Federal Government should be borrowing everything it can'.

Same guy literally got several questions about unnaturally high oil prices considering the reduction in usage, rapidly rising housing prices, and if the stock market is overvalued and then went on a long talk about how amazingly low inflation numbers are...

Guy forecasts 6% GDP growth for at least the next 2 years...

Had a sweet graph too on how the economy as a whole will be above prepandamic forecasts for 2023 if we pass the large stimulus in front of Congress...admitted under questioning that there is a minor assumption of just using standard multipliers (i.e. if you borrow 10 trillion than the GDP will grow to 50 trillion, or the more the govt spends the better the economy looks...).

With these folks in charge we might get some of those Chinese empty cities built yet...

I'd avoid Spanish banks.

I'm not opposed to still borrowing money at amazingly low interest rates, but that spending has to go into things like infrastructure and/or R&D which increase productivity and have long term ROI. I don't see the point in just giving everyone $2K.

I'm sure if somebody asked him he'd realize/admit the only reason the interest rates are low is because the Fed is monetizing the debt...I doubt he'd ever admit that process drives massive asset inflation currently happening that isn't recorded in the Fed inflation stats. I'm sure the guy LOVES Krugman.

Seriously though...the idea the govt has a list of infrastructure/R&D projects to fund that have any meaningful return is not realistic, much less $2 trillion worth of them. You may get a few more worthless Solyndras out of it, but most of that money is for bailing out cities and states on money already spent, and the idea bailing out NYC or the state of Illinois from their funding mess has a 5x multiple (or whatever this guy was using) is just comical. Its amazing at times how people say things with such authority that if they stopped to think about it for a second they would realize it sounds completely asinine.

In our the other guys spend to much politics we are in the wrong cycle for military spending but we did do some build up the last few years

Really think we missed an opportunity on infrastructure. Blame who you want on the tug but we had a big spending president with a big spending congress and couldn't get it done. -

Economis are important

-

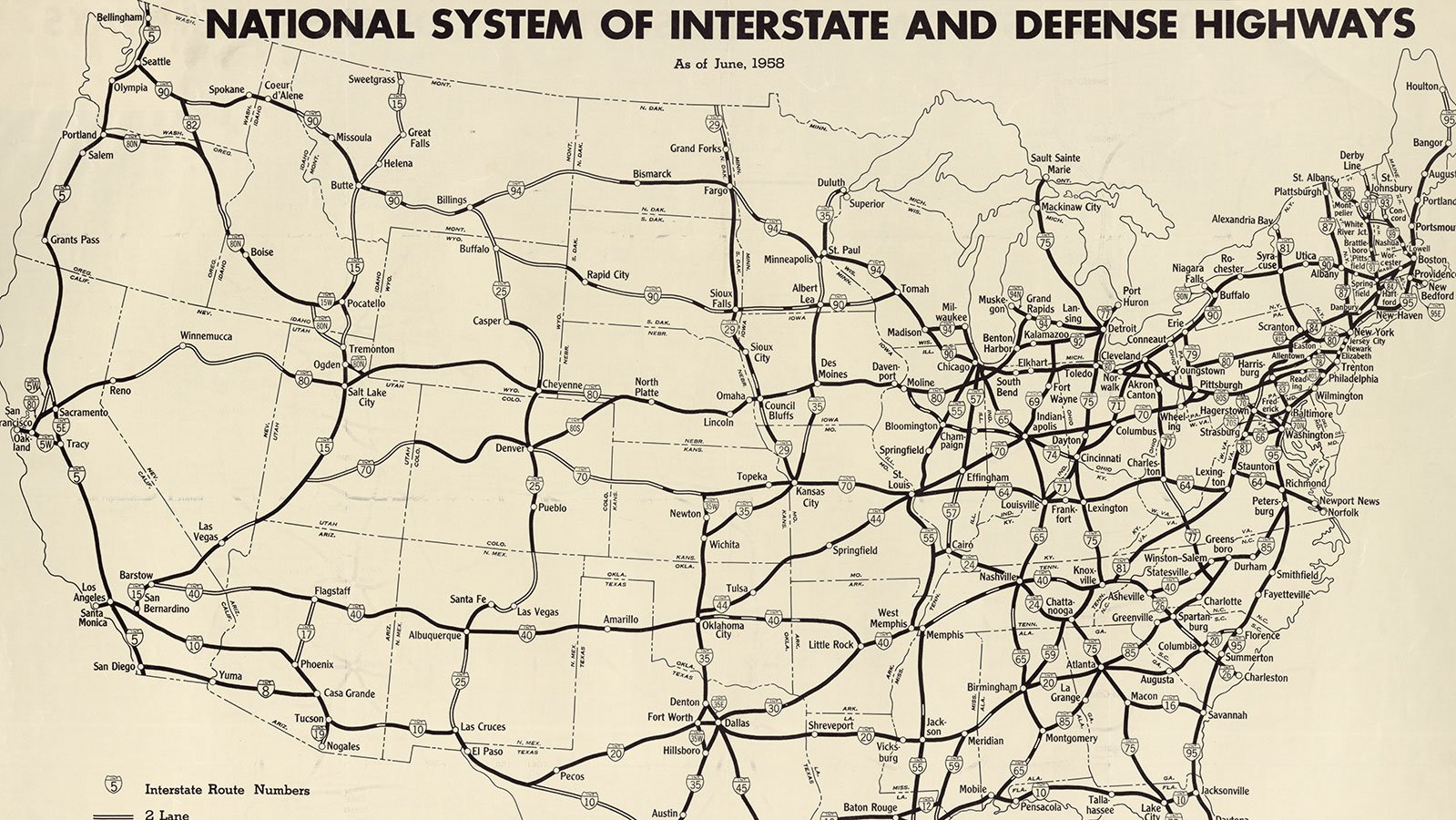

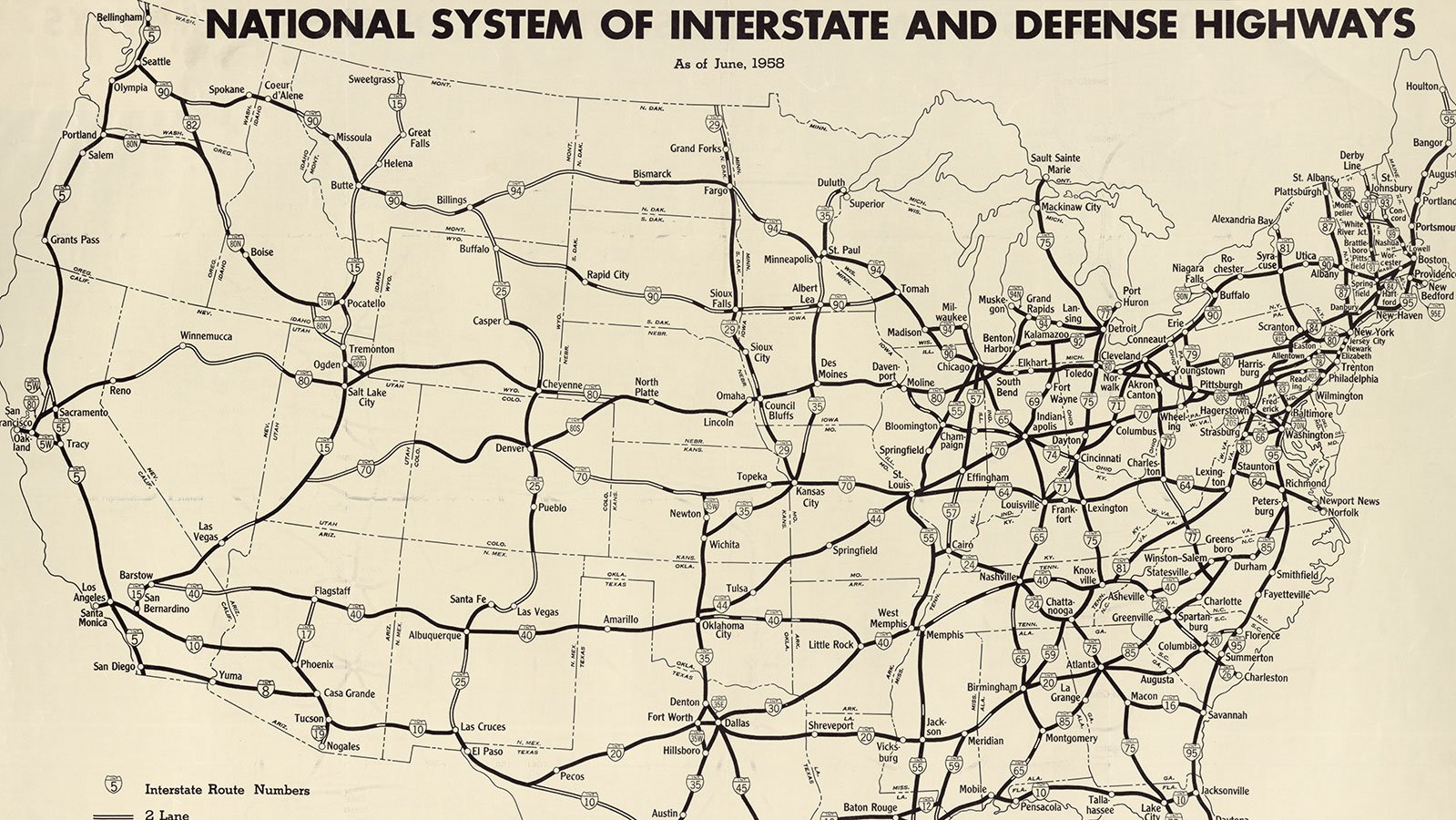

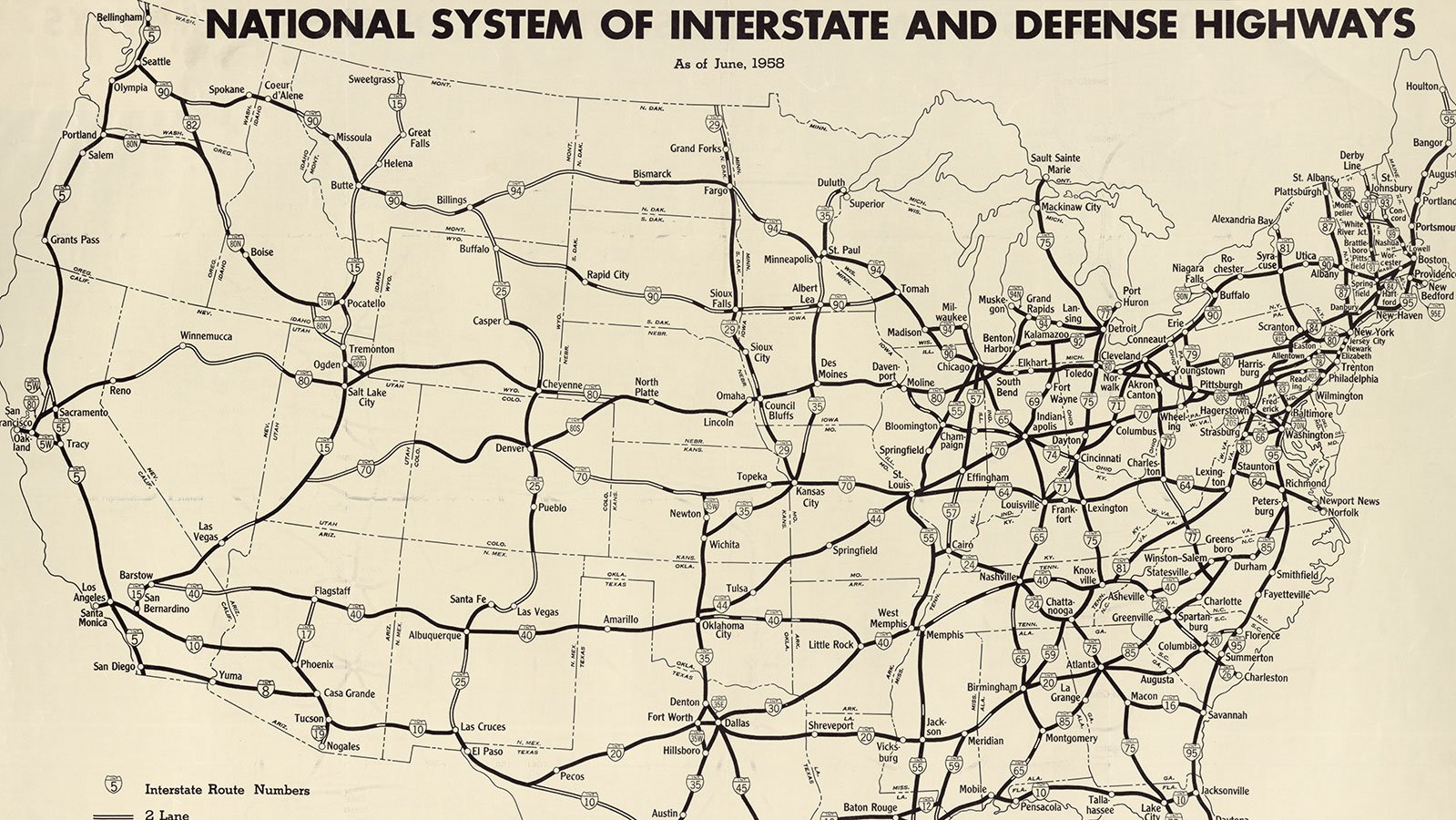

Sad how far we've fallen. We used to have no problem building cool shit in the country.RaceBannon said:

I'll keep this coolYellowSnow said:

There's a lot of freeways and bridges that need fixing for starters. And I'm all for places like Seattle building out mass transit even if it's a bit of a boondoggle. I also think we need to treat China as a Sputnik type moment and spend money on military R&D accordingly. We don't want to let those guys catch up to us in military technology. Historically, the spin offs from military R&D have been very advantageous.HoustonHusky said:

You'd be amazed at the US GDP multiple of funding gender studies in Pakistan...YellowSnow said:

Probably someone like Krugman.HoustonHusky said:Guy got a question on if there is a limit to how much money the Fed can print and how large the Federal Government deficits can go and he replied by saying 'the interest rates are incredibly low so the Federal Government should be borrowing everything it can'.

Same guy literally got several questions about unnaturally high oil prices considering the reduction in usage, rapidly rising housing prices, and if the stock market is overvalued and then went on a long talk about how amazingly low inflation numbers are...

Guy forecasts 6% GDP growth for at least the next 2 years...

Had a sweet graph too on how the economy as a whole will be above prepandamic forecasts for 2023 if we pass the large stimulus in front of Congress...admitted under questioning that there is a minor assumption of just using standard multipliers (i.e. if you borrow 10 trillion than the GDP will grow to 50 trillion, or the more the govt spends the better the economy looks...).

With these folks in charge we might get some of those Chinese empty cities built yet...

I'd avoid Spanish banks.

I'm not opposed to still borrowing money at amazingly low interest rates, but that spending has to go into things like infrastructure and/or R&D which increase productivity and have long term ROI. I don't see the point in just giving everyone $2K.

I'm sure if somebody asked him he'd realize/admit the only reason the interest rates are low is because the Fed is monetizing the debt...I doubt he'd ever admit that process drives massive asset inflation currently happening that isn't recorded in the Fed inflation stats. I'm sure the guy LOVES Krugman.

Seriously though...the idea the govt has a list of infrastructure/R&D projects to fund that have any meaningful return is not realistic, much less $2 trillion worth of them. You may get a few more worthless Solyndras out of it, but most of that money is for bailing out cities and states on money already spent, and the idea bailing out NYC or the state of Illinois from their funding mess has a 5x multiple (or whatever this guy was using) is just comical. Its amazing at times how people say things with such authority that if they stopped to think about it for a second they would realize it sounds completely asinine.

In our the other guys spend to much politics we are in the wrong cycle for military spending but we did do some build up the last few years

Really think we missed an opportunity on infrastructure. Blame who you want on the tug but we had a big spending president with a big spending congress and couldn't get it done.

-

Those should all be high speed interweb pipes with branch service to every single doorstep in America.YellowSnow said:

Sad how far we've fallen. We used to have no problem building cool shit in the country.RaceBannon said:

I'll keep this coolYellowSnow said:

There's a lot of freeways and bridges that need fixing for starters. And I'm all for places like Seattle building out mass transit even if it's a bit of a boondoggle. I also think we need to treat China as a Sputnik type moment and spend money on military R&D accordingly. We don't want to let those guys catch up to us in military technology. Historically, the spin offs from military R&D have been very advantageous.HoustonHusky said:

You'd be amazed at the US GDP multiple of funding gender studies in Pakistan...YellowSnow said:

Probably someone like Krugman.HoustonHusky said:Guy got a question on if there is a limit to how much money the Fed can print and how large the Federal Government deficits can go and he replied by saying 'the interest rates are incredibly low so the Federal Government should be borrowing everything it can'.

Same guy literally got several questions about unnaturally high oil prices considering the reduction in usage, rapidly rising housing prices, and if the stock market is overvalued and then went on a long talk about how amazingly low inflation numbers are...

Guy forecasts 6% GDP growth for at least the next 2 years...

Had a sweet graph too on how the economy as a whole will be above prepandamic forecasts for 2023 if we pass the large stimulus in front of Congress...admitted under questioning that there is a minor assumption of just using standard multipliers (i.e. if you borrow 10 trillion than the GDP will grow to 50 trillion, or the more the govt spends the better the economy looks...).

With these folks in charge we might get some of those Chinese empty cities built yet...

I'd avoid Spanish banks.

I'm not opposed to still borrowing money at amazingly low interest rates, but that spending has to go into things like infrastructure and/or R&D which increase productivity and have long term ROI. I don't see the point in just giving everyone $2K.

I'm sure if somebody asked him he'd realize/admit the only reason the interest rates are low is because the Fed is monetizing the debt...I doubt he'd ever admit that process drives massive asset inflation currently happening that isn't recorded in the Fed inflation stats. I'm sure the guy LOVES Krugman.

Seriously though...the idea the govt has a list of infrastructure/R&D projects to fund that have any meaningful return is not realistic, much less $2 trillion worth of them. You may get a few more worthless Solyndras out of it, but most of that money is for bailing out cities and states on money already spent, and the idea bailing out NYC or the state of Illinois from their funding mess has a 5x multiple (or whatever this guy was using) is just comical. Its amazing at times how people say things with such authority that if they stopped to think about it for a second they would realize it sounds completely asinine.

In our the other guys spend to much politics we are in the wrong cycle for military spending but we did do some build up the last few years

Really think we missed an opportunity on infrastructure. Blame who you want on the tug but we had a big spending president with a big spending congress and couldn't get it done.

For free.

-

Take it to the histry bored!YellowSnow said:

Sad how far we've fallen. We used to have no problem building cool shit in the country.RaceBannon said:

I'll keep this coolYellowSnow said:

There's a lot of freeways and bridges that need fixing for starters. And I'm all for places like Seattle building out mass transit even if it's a bit of a boondoggle. I also think we need to treat China as a Sputnik type moment and spend money on military R&D accordingly. We don't want to let those guys catch up to us in military technology. Historically, the spin offs from military R&D have been very advantageous.HoustonHusky said:

You'd be amazed at the US GDP multiple of funding gender studies in Pakistan...YellowSnow said:

Probably someone like Krugman.HoustonHusky said:Guy got a question on if there is a limit to how much money the Fed can print and how large the Federal Government deficits can go and he replied by saying 'the interest rates are incredibly low so the Federal Government should be borrowing everything it can'.

Same guy literally got several questions about unnaturally high oil prices considering the reduction in usage, rapidly rising housing prices, and if the stock market is overvalued and then went on a long talk about how amazingly low inflation numbers are...

Guy forecasts 6% GDP growth for at least the next 2 years...

Had a sweet graph too on how the economy as a whole will be above prepandamic forecasts for 2023 if we pass the large stimulus in front of Congress...admitted under questioning that there is a minor assumption of just using standard multipliers (i.e. if you borrow 10 trillion than the GDP will grow to 50 trillion, or the more the govt spends the better the economy looks...).

With these folks in charge we might get some of those Chinese empty cities built yet...

I'd avoid Spanish banks.

I'm not opposed to still borrowing money at amazingly low interest rates, but that spending has to go into things like infrastructure and/or R&D which increase productivity and have long term ROI. I don't see the point in just giving everyone $2K.

I'm sure if somebody asked him he'd realize/admit the only reason the interest rates are low is because the Fed is monetizing the debt...I doubt he'd ever admit that process drives massive asset inflation currently happening that isn't recorded in the Fed inflation stats. I'm sure the guy LOVES Krugman.

Seriously though...the idea the govt has a list of infrastructure/R&D projects to fund that have any meaningful return is not realistic, much less $2 trillion worth of them. You may get a few more worthless Solyndras out of it, but most of that money is for bailing out cities and states on money already spent, and the idea bailing out NYC or the state of Illinois from their funding mess has a 5x multiple (or whatever this guy was using) is just comical. Its amazing at times how people say things with such authority that if they stopped to think about it for a second they would realize it sounds completely asinine.

In our the other guys spend to much politics we are in the wrong cycle for military spending but we did do some build up the last few years

Really think we missed an opportunity on infrastructure. Blame who you want on the tug but we had a big spending president with a big spending congress and couldn't get it done.

-

Howdy there stranger!dnc said:Economis are important

-

I think I found an Econ major.Blu82 said:

Probably dumbfucks that think like you.HHusky said:They are people, so I'm sure some are. I've seen precious little evidence that they are especially dumb or that they uniformly agree with one another.

What got your goat?

lol

Houston is going with the Eeyore narrative, so he's not having anyone tell him any different. 6% sounds pretty optimistic to me, too, but I'm not a practicing economist, so I'm not ready to make a counter-argument. I looked for HH's counter argument, but didn't see it. -

I don't see the poont of bailing out the repo market to the tune of $4 Trillion.YellowSnow said:

Probably someone like Krugman.HoustonHusky said:Guy got a question on if there is a limit to how much money the Fed can print and how large the Federal Government deficits can go and he replied by saying 'the interest rates are incredibly low so the Federal Government should be borrowing everything it can'.

Same guy literally got several questions about unnaturally high oil prices considering the reduction in usage, rapidly rising housing prices, and if the stock market is overvalued and then went on a long talk about how amazingly low inflation numbers are...

Guy forecasts 6% GDP growth for at least the next 2 years...

Had a sweet graph too on how the economy as a whole will be above prepandamic forecasts for 2023 if we pass the large stimulus in front of Congress...admitted under questioning that there is a minor assumption of just using standard multipliers (i.e. if you borrow 10 trillion than the GDP will grow to 50 trillion, or the more the govt spends the better the economy looks...).

With these folks in charge we might get some of those Chinese empty cities built yet...

I'd avoid Spanish banks.

I'm not opposed to still borrowing money at amazingly low interest rates, but that spending has to go into things like infrastructure and/or R&D which increase productivity and have long term ROI. I don't see the point in just giving everyone $2K.

You're never going to have a truly healthy economy if you don't allow it to crash and burn on occasion and clean itself out. You just blow the bubble up even bigger. Which also causes massive income inequality - the effects of which is a convo for the Tug. (People forget what started the French Revolution. People forget that.)