Taxes

Comments

-

Have you assumed that Sled isn't really a retard and has been practicing sarcasm for the past several months?SFGbob said: -

https://www.bloomberg.com/graphics/2018-tax-plan-consequences/UW_Doog_Bot said:

Cool article from 2017. Maybe get an update.HHusky said: -

Look at the month to month. Pretty much every other much had less revenue. This was posted long time ago and you fail to comprehend.SFGbob said:

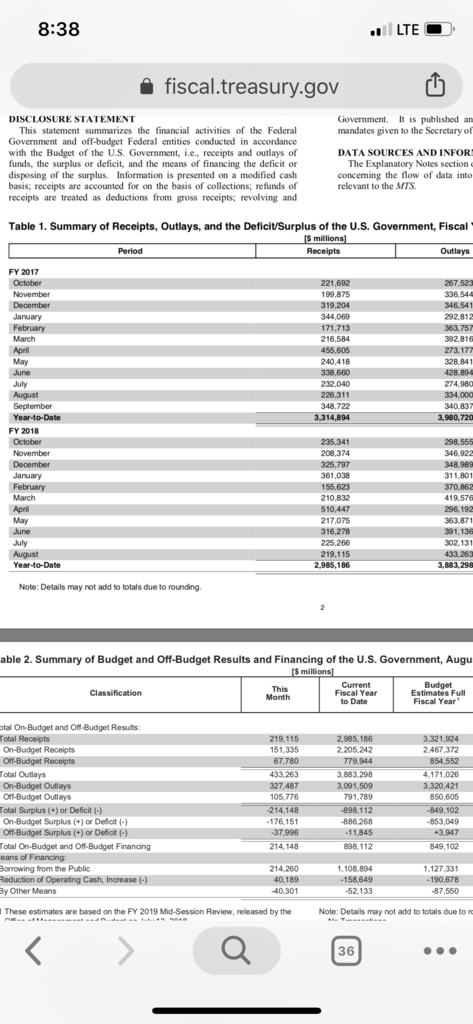

But that still doesn't explain why tax revenue for all of fiscal year 2018 is up over FY 2017 Hondo. And where does a pathological liar like yourself get off calling anyone else a liar?2001400ex said:

Houston lies and forgets that the first 4 months of 18 were under the old tax structure along with April.HoustonHusky said:

Known burger flipper and fake finance guy quotes H&R Block on federal taxes. Brilliant, mainly in that he is unwittingly reinforcing the fact the little man got most of the tax breaks. Specifically, how many really rich people go to H&R Block in the local strip mall or use their software to have their taxes done vs. little guys?2001400ex said:This is how you lie with stats. Although they did a great job of showing that taxes don't actually bring in more revenue.

In total, H&R Block found that federal taxes were down almost 25 percent for 2018.

The average household is seeing tax savings of almost $27,000 over the next decade, according to estimates released by the Heritage Foundation.

Meanwhile, in reality Individual income tax revenue and overall tax revenue was up slightly in Fiscal Year 2018 over Fiscal Year 2017. So if H&R Block's clients federal taxes went down that much and yet overall govt revenue went up...wonder where most of the tax burden shifted to.

HondoFS...

-

Well you'll have to forgive me Hondo I don't read every thread.

-

I assumed he was being sarcastic and you were clueless.HHusky said:

Have you assumed that Sled isn't really a retard and has been practicing sarcasm for the past several months?SFGbob said: -

2001400ex said:

Houston lies and forgets that the first 4 months of 18 were under the old tax structure along with April.HoustonHusky said:

Known burger flipper and fake finance guy quotes H&R Block on federal taxes. Brilliant, mainly in that he is unwittingly reinforcing the fact the little man got most of the tax breaks. Specifically, how many really rich people go to H&R Block in the local strip mall or use their software to have their taxes done vs. little guys?2001400ex said:This is how you lie with stats. Although they did a great job of showing that taxes don't actually bring in more revenue.

In total, H&R Block found that federal taxes were down almost 25 percent for 2018.

The average household is seeing tax savings of almost $27,000 over the next decade, according to estimates released by the Heritage Foundation.

Meanwhile, in reality Individual income tax revenue and overall tax revenue was up slightly in Fiscal Year 2018 over Fiscal Year 2017. So if H&R Block's clients federal taxes went down that much and yet overall govt revenue went up...wonder where most of the tax burden shifted to.

HondoFS...

For HondoFS its first 'Look at H&R Block claims on 2018'...now its '2018 data isn't important because of an arbitrary rule I have in my head'.

HondoFS...

-

Trumptards are totally shredding hondo.HoustonHusky said:2001400ex said:

Houston lies and forgets that the first 4 months of 18 were under the old tax structure along with April.HoustonHusky said:

Known burger flipper and fake finance guy quotes H&R Block on federal taxes. Brilliant, mainly in that he is unwittingly reinforcing the fact the little man got most of the tax breaks. Specifically, how many really rich people go to H&R Block in the local strip mall or use their software to have their taxes done vs. little guys?2001400ex said:This is how you lie with stats. Although they did a great job of showing that taxes don't actually bring in more revenue.

In total, H&R Block found that federal taxes were down almost 25 percent for 2018.

The average household is seeing tax savings of almost $27,000 over the next decade, according to estimates released by the Heritage Foundation.

Meanwhile, in reality Individual income tax revenue and overall tax revenue was up slightly in Fiscal Year 2018 over Fiscal Year 2017. So if H&R Block's clients federal taxes went down that much and yet overall govt revenue went up...wonder where most of the tax burden shifted to.

HondoFS...

For HondoFS its first 'Look at H&R Block claims on 2018'...now its '2018 data isn't important because of an arbitrary rule I have in my head'.

HondoFS...

Pathological liar. Moving goal post.

MAGA! winning!

-

Why? communists lie. But then you love communists and communism.HHusky said:

Have you assumed that Sled isn't really a retard and has been practicing sarcasm for the past several months?SFGbob said: -

Obviously.Sledog said:

Why? communists lie. But then you love communists and communism.HHusky said:

Have you assumed that Sled isn't really a retard and has been practicing sarcasm for the past several months?SFGbob said: -

[The vast majority of Americans get some tax cut, at least at first. Just one in 20 families face a higher tax burden this year because of the law, the left-leaning Tax Policy Center estimates, including 7.3 percent of middle-income groups.HHusky said:

https://www.bloomberg.com/graphics/2018-tax-plan-consequences/UW_Doog_Bot said:

Cool article from 2017. Maybe get an update.HHusky said:

The benefits of the tax law are spread pretty evenly in the next few years. But, measured as a percentage of their tax bills, the group getting the largest cut is clear: Families earning from $200,000 to $1 million will see their tax bills drop about 9 percent next year according to Congress’s official scorekeeper, the nonpartisan Joint Committee on Taxation. That’s 1 percentage point more than the tax cut for households earning $75,000 to $100,000.

And, the cuts for middle-class wage earners fade over time. By 2026, changes to individual tax rules expire, while corporate changes are permanent. Unless Congress acts, 53 percent of all taxpayers will see a modest tax hike by 2027, the Tax Policy Center says, including almost 70 percent of middle-income families.]

I'm ok with making those middle class tax cuts permanent. I'm glad we could find some mutual ground.