Welcome to the Hardcore Husky Forums. Folks who are well-known in Cyberland and not that dumb.

Is anybody short the market right now?

Comments

-

Lottery tickets

-

-

-

They say to wait until the yield curve is inverted. Even tho that triggers a recession, the stock market values are less correlated.Baseman said:Why watch CNBC anymore?

-

Go ahead and hand that loaded gun to the child, what’s the worst that could happen?2001400ex said:

Don't need to. Buy a 3 times leveraged bear etf.PostGameOrangeSlices said:Dont short anything unless you really know what youre doing

https://www.fool.com/investing/2017/06/25/3-triple-leveraged-etfs-and-why-you-shouldnt-buy-a.aspx

Don’t try and time the market; Wall Street is full of professionals who’ve failed at that very thing. I’d recommend you buy diversified mutual funds and be patient. They’re not sexy and won’t give you that rush but your money will be there when you need it. I ‘day traded’ prior to the tech bubble burst and quadrupled my portfolio in 2-3 years. Then I lost 2/3 of it (on paper) in 2 weeks. I was lucky and most of my stocks recovered but it was still a painful lesson. -

You need an guy in the know

-

@Tequilla ?RaceBannon said:You need an guy in the know

-

ISAFNRC. @Swaye ?RaceBannon said:

-

The trick is to find the right downturn.. There was a market correction in 1998. It would have sucked to have sold then. But you don't seem then because you need to see the rest of market indicators be shit. Just like there was a 10% correction this year. But the rest of indicators, such as GDP growth and unemployment are good.USMChawk said:

Go ahead and hand that loaded gun to the child, what’s the worst that could happen?2001400ex said:

Don't need to. Buy a 3 times leveraged bear etf.PostGameOrangeSlices said:Dont short anything unless you really know what youre doing

https://www.fool.com/investing/2017/06/25/3-triple-leveraged-etfs-and-why-you-shouldnt-buy-a.aspx

Don’t try and time the market; Wall Street is full of professionals who’ve failed at that very thing. I’d recommend you buy diversified mutual funds and be patient. They’re not sexy and won’t give you that rush but your money will be there when you need it. I ‘day traded’ prior to the tech bubble burst and quadrupled my portfolio in 2-3 years. Then I lost 2/3 of it (on paper) in 2 weeks. I was lucky and most of my stocks recovered but it was still a painful lesson.

I put most of my retirement in cash in 2008. A little over half. My fuck up was I waited until October 2010 to put my money back in. The Dow was around 9,500 when I put it in. Should have done it a year earlier but still better off than if I left it in the market the whole time. -

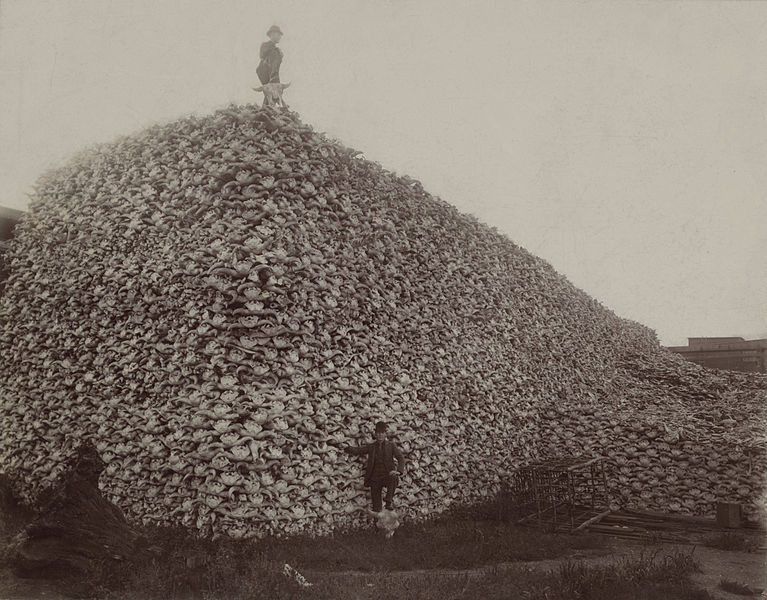

I imagine that scene as the bones of white devils.YellowSnow said: