Welcome to the Hardcore Husky Forums. Folks who are well-known in Cyberland and not that dumb.

Is anybody short the market right now?

Comments

-

They decay and essentially reset in a bull market. In a bear market, they kick ass.oregonblitzkrieg said:

Those decay. Do you average down on those etfs too?2001400ex said:

Don't need to. Buy a 3 times leveraged bear etf.PostGameOrangeSlices said:Dont short anything unless you really know what youre doing

-

Mutual funds rape you in their expense ratio and generally do worse or the same compared to ETFs.USMChawk said:

Go ahead and hand that loaded gun to the child, what’s the worst that could happen?2001400ex said:

Don't need to. Buy a 3 times leveraged bear etf.PostGameOrangeSlices said:Dont short anything unless you really know what youre doing

https://www.fool.com/investing/2017/06/25/3-triple-leveraged-etfs-and-why-you-shouldnt-buy-a.aspx

Don’t try and time the market; Wall Street is full of professionals who’ve failed at that very thing. I’d recommend you buy diversified mutual funds and be patient. They’re not sexy and won’t give you that rush but your money will be there when you need it. I ‘day traded’ prior to the tech bubble burst and quadrupled my portfolio in 2-3 years. Then I lost 2/3 of it (on paper) in 2 weeks. I was lucky and most of my stocks recovered but it was still a painful lesson. -

You'll lose money on it over time unless your timing is good. If you buy it (shorting the market) at the wrong time, it will just keep decaying. Better off not shorting the market at all, or using options calendars on SPY/IWM/QQQ. Get paid while you wait for a drop. Less risky, put them on when Vix is low, price can rally well past your entry point, and when volatility picks back up later, you can still be profitable even though price is higher than your entry point, due to the rise in volatility.2001400ex said:

They decay and essentially reset in a bull market. In a bear market, they kick ass.oregonblitzkrieg said:

Those decay. Do you average down on those etfs too?2001400ex said:

Don't need to. Buy a 3 times leveraged bear etf.PostGameOrangeSlices said:Dont short anything unless you really know what youre doing

-

Axe hondo. He’s apparently a fucking expert.pawz said:What's the best way to do that?

What is the least risky way to take that position? Buy gold? Options? -

No chance.MikeDamone said:

Axe hondo. He’s apparently a fucking expert.pawz said:What's the best way to do that?

What is the least risky way to take that position? Buy gold? Options? -

Buy great businesses that pay dividends. Reinvest the dividends. Buy more when opportunity presents. NEVER, EVER sell.

-

Even Warren Buffett sells on occasion.Baseman said:Buy great businesses that pay dividends. Reinvest the dividends. Buy more when opportunity presents. NEVER, EVER sell.

-

MORL. 20 % dividend the 4 years I've owned it.Baseman said:Buy great businesses that pay dividends. Reinvest the dividends. Buy more when opportunity presents. NEVER, EVER sell.

-

Yep, when shit is more bleek than Memphis the ETF's shine. I made one last little play in the gold one for the election. Either way it's chaos and gold spikes. Hit that 24% and have been 100% out of the market since then and put the TSP in G on April 30th because May-Sep is always a shit show for fund backed vehicles.2001400ex said:

They decay and essentially reset in a bull market. In a bear market, they kick ass.oregonblitzkrieg said:

Those decay. Do you average down on those etfs too?2001400ex said:

Don't need to. Buy a 3 times leveraged bear etf.PostGameOrangeSlices said:Dont short anything unless you really know what youre doing

There are some oil ETF's that play well too. Buy and hold, whenever any kind of natural disaster happens oil jumps. -

That was some deep dark shit there.dnc said:

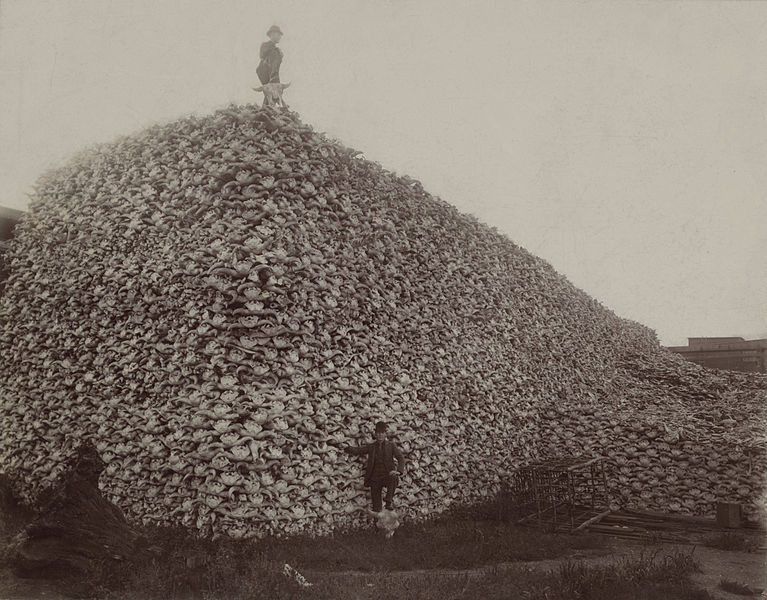

Gonna need BBQ superiority guy to weigh in here. Tatonka brisket, yay or nay?RaceBannon said:

Fuck. Never mind. Meant to reply to...

Who fucking cares. FYFMFE.