Pop Quiz...

So, what happens when we find out that the REAL number is only 5 million? So, after spending $1 Trillion of YOUR MONEY, we ACTUALLY have 1 million MORE uninsured people in this country.

Comments

-

-

So, I'll just ask the same question I asked back then; "How are you going to (KEEP) paying for it (FOREVER)?"YoureAFuckingJelly said:

crickets... -

-

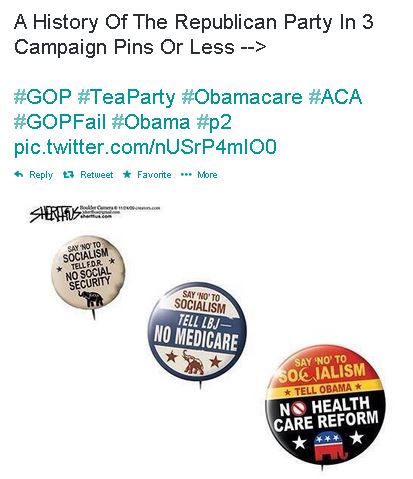

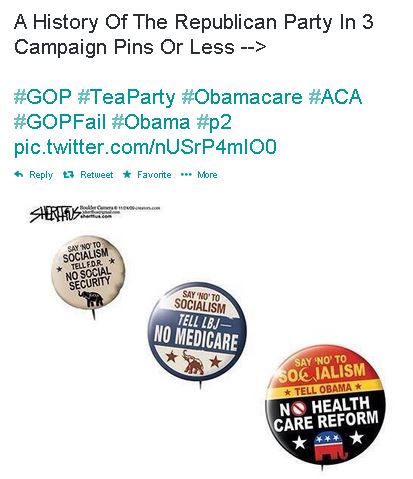

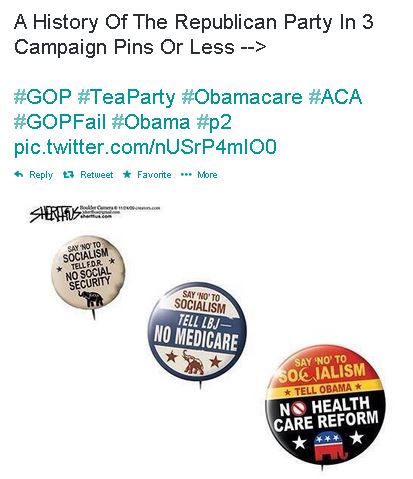

Looks like the GOP has done a really shitty jerb getting the nation to say 'NO' to socialism.YoureAFuckingJelly said:

-

Did he just disagree with the meme he posted?

-

People like free shit. Especially lazy ones.dnc said:

Looks like the GOP has done a really shitty jerb getting the nation to say 'NO' to socialism.YoureAFuckingJelly said:

-

The Patient Protection and Affordable Care Act (PPACA),[1][2] commonly called the Affordable Care Act (ACA) or "Obamacare",[3] is a United States federal statute signed into law by President Barack Obama on March 23, 2010. Together with the Health Care and Education Reconciliation Act,[4] it represents the most significant regulatory overhaul of the U.S. healthcare system since the passage ofMedicare and Medicaid in 1965.[5]

Overview of provisions

The ACA includes numerous provisions that take effect between 2010 and 2020. Policies issued before 2010 are exempted by a grandfather clause from many of the changes to insurance standards, but they are affected by other provisions.[17][18] Significant reforms, most of which took effect on January 1, 2014, include:

• Guaranteed issue prohibits insurers from denying coverage to individuals due to pre-existing conditions, and a partial community rating requires insurers to offer the same premium price to all applicants of the same age and geographical location without regard to gender or most pre-existing conditions (excluding tobaccouse).[19][20][21]

• Minimum standards for health insurance policies are established.[22][23][24][25][26]

• An individual mandate[27][28] requires all individuals not covered by an employer sponsored health plan, Medicaid, Medicare or other public insurance programs (such asTricare) to secure an approved private-insurance policy or pay a penalty, unless the applicable individual has a financial hardship or is a member of a recognized religious sect exempted by the Internal Revenue Service.[29] The law includes subsidies to help people with low incomes comply with the mandate.[30]

• Health insurance exchanges operate as a new avenue by which individuals and small businesses in every state can compare policies and buy insurance (with a government subsidy if eligible).[31] In the first year of operation, open enrollment on the exchanges runs from October 1, 2013 to March 31, 2014. The original purchase deadline date to be covered for January 1, 2014 was December 15, 2013, but the deadline was pushed back, first to December 23, 2013 and later to December 24, 2013.[32][33][34][35] For plans starting in 2015, the proposed enrollment period is November 15, 2014–February 15, 2015.[36]

• Low-income individuals and families whose incomes are between 100% and 400% of the federal poverty level will receive federal subsidies on a sliding scale if they purchase insurance via an exchange.[37]Those from 133% to 150% of the poverty level will be subsidized such that their premium costs will be 3% to 4% of income.[38] In 2013, the subsidy would apply for incomes up to $45,960 for an individual or $94,200 for a family of four; consumers can choose to receive their tax credits in advance, and the exchange will send the money directly to the insurer every month.[39] Small businesses will be eligible for subsidies.[40]

• Medicaid eligibility expanded to include individuals and families with incomes up to 133% of the federal poverty level, including adults without disabilities and without dependent children.[41] The law also provides for a 5% "income disregard", making the effective income eligibility limit for Medicaid 138% of the poverty level.[42] Furthermore, the State Children's Health Insurance Program (CHIP) enrollment process is simplified.[41] However, in National Federation of Independent Business v. Sebelius, the Supreme Court ruled that states may opt out of the Medicaid expansion, and several have done so.

• Reforms to the Medicare payment system are meant to promote greater efficiency in the healthcare delivery system by restructuring Medicare reimbursements from fee-for-service to bundled payments.[43][44]Under the new payment system, a single payment is paid to a hospital and a physician group for a defined episode of care (such as a hip replacement) rather than individual payments to individual service providers. In addition, it has been asserted that the Medicare Part D coverage gap (commonly called the "donut hole") will shrink incrementally, closing completely by January 1, 2020.[45]

• Businesses which employ 50 or more people but do not offer health insurance to their full-time employees will pay a tax penalty if the government has subsidized a full-time employee's healthcare through tax deductions or other means. This is commonly known as the employer mandate.[46][47] In July 2013, however, this provision was unilaterally delayed for one year by President Obama.[48]

Implementation

Early implementation efforts for the healthcare exchanges, especially the exchanges operated by the federal government, have received nearly universally negative reactions in the media and from politicians.[179][180][181] HealthCare.gov, the website that allows people to apply for insurance through the exchanges operated by the federal government, crashed on opening and suffered from a rash of problems throughout the first month.[182] Many users have also found the available plans to be unattractive.[183][184][185][186] Ongoing problems with the website have prompted the development of HealthSherpa, an independently produced alternative to HealthCare.gov, that contains consumer

Effects on insurance premiums

For the effect on health insurance premiums, the CBO forecast that by 2016 the individual market would comprise 17% of the market, and that premiums per person would increase by 10% to 13% but that over half of these individuals would receive subsidies that would decrease the premium paid to "well below" premiums charged under current law.[220][221] It also forecast that for the small group market, 13% of the market, premiums would be impacted 1% to −3%, and −8% to −11% for those receiving subsidies; for the large group market comprising 70% of the market, premiums would be impacted 0% to −3%, with those under high premium plans subject to excise taxes being charged −9% to −12% less. Factors taken into account by this analysis included: increased benefits particularly for the individual market, more healthy policyholders due to the mandate, administrative efficiencies related to the health exchanges, and high-premium insurance plans reducing some benefits in response to the tax.[221] As of September 2013, the final projections of the average monthly premium scheduled to be offered in the exchanges came in below CBO expectations, reducing expected costs not only for consumers but also for the government by reducing the overall cost of the subsidies.[222][223][224][225]

In June 2013, a study by the Kaiser Family Foundation focused on actual experience under the Act as it affected individual market consumers (those buying insurance on their own). The study found that the Medical Loss Ratio provision of the Act had saved this group of consumers $1.2 billion in 2011 and $2.1 billion in 2012, reducing their 2012 costs by 7.5%.[151] The bulk of the savings were in reduced premiums for individual insurance, but some came from premium rebates paid to consumers by insurance companies that had failed to meet the requirements of the Act. The Associated Press reported that, as a result of ACA's provisions closing the Medicare Part D coverage gap (between the "initial coverage limit" and the "catastrophic coverage threshold" in the prescription drug program), individuals formerly falling in this "donut hole" would save about 40 percent.[227] Almost all of the savings came reportedly because, with regard to brand-name drugs, ACA secured a discount from pharmaceutical companies.[227] The change benefited more than two million people, most of them in the middle class.[227]

In a May 2010 presentation on "Health Costs and the Federal Budget", the CBO stated that "Rising health costs will put tremendous pressure on the federal budget during the next few decades and beyond. In CBO's judgment, the health legislation enacted earlier this year does not substantially diminish that pressure."[228]

The CBO further observed that "Putting the federal budget on a sustainable path would almost certainly require a significant reduction in the growth of federal health spending relative to current law (including this year's health legislation)."[228] and concluded,

... there is considerable agreement that a substantial share of current spending on health care contributes little if anything to people's health, and providers and health analysts are making significant efforts to make the health system more efficient... [though] it is not clear what specific policies the federal government can adopt to generate fundamental changes in the health system; that is, it is not clear what specific policies would translate the potential for significant cost savings into reality.[228]

Jonathan Cohn, a health policy analyst, commented:

CBO doesn't produce estimates of how reform will affect overall health care spending — that is, the amount of money our society, as a whole, will devote to health care. But the official actuary for Medicare does. The actuary determined that ... the long-term trend is towards less spending: Inflation after ten years would be lower than it is now. And it's the long-term trend that matters most ... [The Affordable Care Act] will reduce the cost of care—not by a lot and not by as much as possible in theory, but as much as is possible in this political universe.[130][229]

He and fellow The New Republic editor Noam Scheiber claimed the CBO did not include in its estimate various cost-saving provisions intended to reduce health inflation,[230] also positing that the CBO has a history of consistently underestimating the impact of health legislation.[231]

Jonathan Gruber, a consultant who helped develop both the Massachusetts healthcare reform under Mitt Romney and the ACA,[66] has acknowledged that the ACA is not guaranteed to significantly "bend the curve" of rising healthcare costs:[232]

The real question is how far the ACA will go in slowing cost growth. Here, there is great uncertainty—mostly because there is such uncertainty in general about how to control cost growth in health care. There is no shortage of good ideas for ways of doing so ... There is, however, a shortage of evidence regarding which approaches will actually work—and therefore no consensus on which path is best to follow. In the face of such uncertainty, the ACA pursued the path of considering a range of different approaches to controlling health care costs ... Whether these policies by themselves can fully solve the long run health care cost problem in the United States is doubtful. They may, however, provide a first step towards controlling costs—and understanding what does and does not work to do so more broadly.[233]

The law created the Center for Medicare and Medicaid Innovation and requires numerous pilot programs and demonstrations that may affect healthcare costs.[234] These cost reductions were not factored into CBO cost estimates.[235]

The Business Roundtable, an association of CEOs, commissioned a report from the consulting company Hewitt Associates which found that the legislation "could potentially reduce that trend line by more than $3,000 per employee, to $25,435," with respect to insurance premiums. It also stated that the legislation "could potentially reduce the rate of future health care cost increases by 15% to 20% when fully phased in by 2019." The group cautioned that all of this would be dependent upon the success of the cost-saving government pilot programs which must then be wholly copied in the private market.[236]

The Centers for Medicare and Medicaid Services reported in 2013 that, while costs per capita continue to rise, the rate of increase in annual healthcare costs has fallen since 2002. Per capita cost increases have averaged 5.4% annually since 2000. Costs relative to GDP, which had been rising, have stagnated since 2009.[237] Several studies have attempted to explain the reduction in the rate of annual increase. Reasons include, among others:

• Higher unemployment due to the 2008-2010 recession, which has limited the ability of consumers to purchase healthcare;

• Out-of-pocket payments, and deductibles, which constitute the amount an individual pays for their health costs before insurance begins to cover claims, have risen. These rising costs generally cause less consumption of healthcare services.[238] The proportion of workers with employer-sponsored health insurance requiring a deductible climbed to about three-quarters in 2012 from about half in 2006.[239][240]

• Structural changes[239] in the healthcare system made by the ACA that aim to shift the healthcare system from paying-for-quantity to paying-for-quality. Examples include incentives to reduce hospital infectionsand to use electronic medical records, accountable care organizations, and bundled payments to coordinate care and prioritize quality over quantity.[241] Some of these changes have occurred due to healthcare providers acting in anticipation of future implementation of reforms.[241][242]

Federal deficit

The 2011 comprehensive CBO estimate projected a net deficit reduction of more than $200 billion during the 2012–2021 period:[248][249] it calculated the law would result in $604 billion in total outlays offset by $813 billion in total receipts, resulting in a $210 billion net reduction in the deficit.[248] The CBO separately noted that while most of the spending provisions do not begin until 2014,[250][251] revenue will still exceed spending in those subsequent years.[252] The CBO averred that the bill would "substantially reduce the growth of Medicare's payment rates for most services; impose an excise tax on insurance plans with relatively high premiums; and make various other changes to the federal tax code, Medicare, Medicaid, and other programs"[220]—ultimately extending the solvency of the Medicare trust fund by 8 years.[253]

Major sources of deficit reduction include:[202] higher Medicare taxes on the wealthy; new annual fees on health insurance providers; similar fees on the healthcare industry such as manufacturers and importers of brand-name pharmaceutical drugs and certain medical devices; limits on tax deductions of medical expenses and flexible spending accounts; a new 40% excise tax on "Cadillac" insurance policies - plans with annual insurance premiums in excess of $10,200 for an individual or $27,500 for a family; revenue from mandate penalty payments; a 10% federal sales tax on indoor tanning services; and spending offsets such as a reduction in Medicare reimbursements to insurers and drug companies for private Medicare Advantage policies that the Government Accountability Officeand Medicare Payment Advisory Commission found to be overpaid (relative to government Medicare);[256][257] and reductions in Medicare reimbursements to hospitals that do not meet standards of efficiency and care.[256]

-

disagreeRon_Fairly said:The Patient Protection and Affordable Care Act (PPACA),[1][2] commonly called the Affordable Care Act (ACA) or "Obamacare",[3] is a United States federal statute signed into law by President Barack Obama on March 23, 2010. Together with the Health Care and Education Reconciliation Act,[4] it represents the most significant regulatory overhaul of the U.S. healthcare system since the passage ofMedicare and Medicaid in 1965.[5]

Overview of provisions

The ACA includes numerous provisions that take effect between 2010 and 2020. Policies issued before 2010 are exempted by a grandfather clause from many of the changes to insurance standards, but they are affected by other provisions.[17][18] Significant reforms, most of which took effect on January 1, 2014, include:

• Guaranteed issue prohibits insurers from denying coverage to individuals due to pre-existing conditions, and a partial community rating requires insurers to offer the same premium price to all applicants of the same age and geographical location without regard to gender or most pre-existing conditions (excluding tobaccouse).[19][20][21]

• Minimum standards for health insurance policies are established.[22][23][24][25][26]

• An individual mandate[27][28] requires all individuals not covered by an employer sponsored health plan, Medicaid, Medicare or other public insurance programs (such asTricare) to secure an approved private-insurance policy or pay a penalty, unless the applicable individual has a financial hardship or is a member of a recognized religious sect exempted by the Internal Revenue Service.[29] The law includes subsidies to help people with low incomes comply with the mandate.[30]

• Health insurance exchanges operate as a new avenue by which individuals and small businesses in every state can compare policies and buy insurance (with a government subsidy if eligible).[31] In the first year of operation, open enrollment on the exchanges runs from October 1, 2013 to March 31, 2014. The original purchase deadline date to be covered for January 1, 2014 was December 15, 2013, but the deadline was pushed back, first to December 23, 2013 and later to December 24, 2013.[32][33][34][35] For plans starting in 2015, the proposed enrollment period is November 15, 2014–February 15, 2015.[36]

• Low-income individuals and families whose incomes are between 100% and 400% of the federal poverty level will receive federal subsidies on a sliding scale if they purchase insurance via an exchange.[37]Those from 133% to 150% of the poverty level will be subsidized such that their premium costs will be 3% to 4% of income.[38] In 2013, the subsidy would apply for incomes up to $45,960 for an individual or $94,200 for a family of four; consumers can choose to receive their tax credits in advance, and the exchange will send the money directly to the insurer every month.[39] Small businesses will be eligible for subsidies.[40]

• Medicaid eligibility expanded to include individuals and families with incomes up to 133% of the federal poverty level, including adults without disabilities and without dependent children.[41] The law also provides for a 5% "income disregard", making the effective income eligibility limit for Medicaid 138% of the poverty level.[42] Furthermore, the State Children's Health Insurance Program (CHIP) enrollment process is simplified.[41] However, in National Federation of Independent Business v. Sebelius, the Supreme Court ruled that states may opt out of the Medicaid expansion, and several have done so.

• Reforms to the Medicare payment system are meant to promote greater efficiency in the healthcare delivery system by restructuring Medicare reimbursements from fee-for-service to bundled payments.[43][44]Under the new payment system, a single payment is paid to a hospital and a physician group for a defined episode of care (such as a hip replacement) rather than individual payments to individual service providers. In addition, it has been asserted that the Medicare Part D coverage gap (commonly called the "donut hole") will shrink incrementally, closing completely by January 1, 2020.[45]

• Businesses which employ 50 or more people but do not offer health insurance to their full-time employees will pay a tax penalty if the government has subsidized a full-time employee's healthcare through tax deductions or other means. This is commonly known as the employer mandate.[46][47] In July 2013, however, this provision was unilaterally delayed for one year by President Obama.[48]

Implementation

Early implementation efforts for the healthcare exchanges, especially the exchanges operated by the federal government, have received nearly universally negative reactions in the media and from politicians.[179][180][181] HealthCare.gov, the website that allows people to apply for insurance through the exchanges operated by the federal government, crashed on opening and suffered from a rash of problems throughout the first month.[182] Many users have also found the available plans to be unattractive.[183][184][185][186] Ongoing problems with the website have prompted the development of HealthSherpa, an independently produced alternative to HealthCare.gov, that contains consumer

Effects on insurance premiums

For the effect on health insurance premiums, the CBO forecast that by 2016 the individual market would comprise 17% of the market, and that premiums per person would increase by 10% to 13% but that over half of these individuals would receive subsidies that would decrease the premium paid to "well below" premiums charged under current law.[220][221] It also forecast that for the small group market, 13% of the market, premiums would be impacted 1% to −3%, and −8% to −11% for those receiving subsidies; for the large group market comprising 70% of the market, premiums would be impacted 0% to −3%, with those under high premium plans subject to excise taxes being charged −9% to −12% less. Factors taken into account by this analysis included: increased benefits particularly for the individual market, more healthy policyholders due to the mandate, administrative efficiencies related to the health exchanges, and high-premium insurance plans reducing some benefits in response to the tax.[221] As of September 2013, the final projections of the average monthly premium scheduled to be offered in the exchanges came in below CBO expectations, reducing expected costs not only for consumers but also for the government by reducing the overall cost of the subsidies.[222][223][224][225]

In June 2013, a study by the Kaiser Family Foundation focused on actual experience under the Act as it affected individual market consumers (those buying insurance on their own). The study found that the Medical Loss Ratio provision of the Act had saved this group of consumers $1.2 billion in 2011 and $2.1 billion in 2012, reducing their 2012 costs by 7.5%.[151] The bulk of the savings were in reduced premiums for individual insurance, but some came from premium rebates paid to consumers by insurance companies that had failed to meet the requirements of the Act. The Associated Press reported that, as a result of ACA's provisions closing the Medicare Part D coverage gap (between the "initial coverage limit" and the "catastrophic coverage threshold" in the prescription drug program), individuals formerly falling in this "donut hole" would save about 40 percent.[227] Almost all of the savings came reportedly because, with regard to brand-name drugs, ACA secured a discount from pharmaceutical companies.[227] The change benefited more than two million people, most of them in the middle class.[227]

In a May 2010 presentation on "Health Costs and the Federal Budget", the CBO stated that "Rising health costs will put tremendous pressure on the federal budget during the next few decades and beyond. In CBO's judgment, the health legislation enacted earlier this year does not substantially diminish that pressure."[228]

The CBO further observed that "Putting the federal budget on a sustainable path would almost certainly require a significant reduction in the growth of federal health spending relative to current law (including this year's health legislation)."[228] and concluded,

... there is considerable agreement that a substantial share of current spending on health care contributes little if anything to people's health, and providers and health analysts are making significant efforts to make the health system more efficient... [though] it is not clear what specific policies the federal government can adopt to generate fundamental changes in the health system; that is, it is not clear what specific policies would translate the potential for significant cost savings into reality.[228]

Jonathan Cohn, a health policy analyst, commented:

CBO doesn't produce estimates of how reform will affect overall health care spending — that is, the amount of money our society, as a whole, will devote to health care. But the official actuary for Medicare does. The actuary determined that ... the long-term trend is towards less spending: Inflation after ten years would be lower than it is now. And it's the long-term trend that matters most ... [The Affordable Care Act] will reduce the cost of care—not by a lot and not by as much as possible in theory, but as much as is possible in this political universe.[130][229]

He and fellow The New Republic editor Noam Scheiber claimed the CBO did not include in its estimate various cost-saving provisions intended to reduce health inflation,[230] also positing that the CBO has a history of consistently underestimating the impact of health legislation.[231]

Jonathan Gruber, a consultant who helped develop both the Massachusetts healthcare reform under Mitt Romney and the ACA,[66] has acknowledged that the ACA is not guaranteed to significantly "bend the curve" of rising healthcare costs:[232]

The real question is how far the ACA will go in slowing cost growth. Here, there is great uncertainty—mostly because there is such uncertainty in general about how to control cost growth in health care. There is no shortage of good ideas for ways of doing so ... There is, however, a shortage of evidence regarding which approaches will actually work—and therefore no consensus on which path is best to follow. In the face of such uncertainty, the ACA pursued the path of considering a range of different approaches to controlling health care costs ... Whether these policies by themselves can fully solve the long run health care cost problem in the United States is doubtful. They may, however, provide a first step towards controlling costs—and understanding what does and does not work to do so more broadly.[233]

The law created the Center for Medicare and Medicaid Innovation and requires numerous pilot programs and demonstrations that may affect healthcare costs.[234] These cost reductions were not factored into CBO cost estimates.[235]

The Business Roundtable, an association of CEOs, commissioned a report from the consulting company Hewitt Associates which found that the legislation "could potentially reduce that trend line by more than $3,000 per employee, to $25,435," with respect to insurance premiums. It also stated that the legislation "could potentially reduce the rate of future health care cost increases by 15% to 20% when fully phased in by 2019." The group cautioned that all of this would be dependent upon the success of the cost-saving government pilot programs which must then be wholly copied in the private market.[236]

The Centers for Medicare and Medicaid Services reported in 2013 that, while costs per capita continue to rise, the rate of increase in annual healthcare costs has fallen since 2002. Per capita cost increases have averaged 5.4% annually since 2000. Costs relative to GDP, which had been rising, have stagnated since 2009.[237] Several studies have attempted to explain the reduction in the rate of annual increase. Reasons include, among others:

• Higher unemployment due to the 2008-2010 recession, which has limited the ability of consumers to purchase healthcare;

• Out-of-pocket payments, and deductibles, which constitute the amount an individual pays for their health costs before insurance begins to cover claims, have risen. These rising costs generally cause less consumption of healthcare services.[238] The proportion of workers with employer-sponsored health insurance requiring a deductible climbed to about three-quarters in 2012 from about half in 2006.[239][240]

• Structural changes[239] in the healthcare system made by the ACA that aim to shift the healthcare system from paying-for-quantity to paying-for-quality. Examples include incentives to reduce hospital infectionsand to use electronic medical records, accountable care organizations, and bundled payments to coordinate care and prioritize quality over quantity.[241] Some of these changes have occurred due to healthcare providers acting in anticipation of future implementation of reforms.[241][242]

Federal deficit

The 2011 comprehensive CBO estimate projected a net deficit reduction of more than $200 billion during the 2012–2021 period:[248][249] it calculated the law would result in $604 billion in total outlays offset by $813 billion in total receipts, resulting in a $210 billion net reduction in the deficit.[248] The CBO separately noted that while most of the spending provisions do not begin until 2014,[250][251] revenue will still exceed spending in those subsequent years.[252] The CBO averred that the bill would "substantially reduce the growth of Medicare's payment rates for most services; impose an excise tax on insurance plans with relatively high premiums; and make various other changes to the federal tax code, Medicare, Medicaid, and other programs"[220]—ultimately extending the solvency of the Medicare trust fund by 8 years.[253]

Major sources of deficit reduction include:[202] higher Medicare taxes on the wealthy; new annual fees on health insurance providers; similar fees on the healthcare industry such as manufacturers and importers of brand-name pharmaceutical drugs and certain medical devices; limits on tax deductions of medical expenses and flexible spending accounts; a new 40% excise tax on "Cadillac" insurance policies - plans with annual insurance premiums in excess of $10,200 for an individual or $27,500 for a family; revenue from mandate penalty payments; a 10% federal sales tax on indoor tanning services; and spending offsets such as a reduction in Medicare reimbursements to insurers and drug companies for private Medicare Advantage policies that the Government Accountability Officeand Medicare Payment Advisory Commission found to be overpaid (relative to government Medicare);[256][257] and reductions in Medicare reimbursements to hospitals that do not meet standards of efficiency and care.

-

disagree

-

ybed2d said:.