S&P 500 at largest deviation w/ stocks in it since 1999

Comments

-

I just don’t stress about the 401k in the short term. I don’t need the money for 25 years.Tequilla said:I’m a big proponent that if you’re riding long term you take the ups and downs knowing in the long run that you’re a winner

-

Agreed. But my tim horizon is a little shorter - a lot shorter - and, not so much stress, but opportunity. I was just wondering if anybody had ever put their money where their mouth is, litterally, and go all-in on cash and other liquid short-terms while waiting for the big purge. I've always been too chicken shit to pull the trigger because of FOMO. So I've riden every waive since 1996 when I started working.YellowSnow said:

I just don’t stress about the 401k in the short term. I don’t need the money for 25 years.Tequilla said:I’m a big proponent that if you’re riding long term you take the ups and downs knowing in the long run that you’re a winner

-

Every year I look at my portfolio and 19 years ago I put a small position of money into the S & P 500 (SPY) Via vanguard and reinvested the dividends. In that time frame thru 9/11. 2008/09 financial crisis, 2020 free fall in Feb-March, etc it has returned 420% and I did nothing with it.creepycoug said:Sorry. Liquidiate 401-K was confusing. I meant, liquidiate my equity positions in the 401-k. I have, for example, a large balance in the S&P just because I like a portfolio to include "just the market" returns. Should I liquidate to money market and wait for the burst? Are we? that confident a bubble pop is on the way?

Said another way, have any of you guys ever been so confident that the market is overheated that you pulled out of equities entirely in your retirement accounts and sat around waiting for the market to drop?

95% + off all managed funds can't even being to sniff that return.

Yet I have other stocks that have double or tripled that, and if you bought Amazon, MSFT, Apple, FB, Tesla, etc those returns have produced generational wealth if you put enough in and just left it alone.

Guess this goes back to being a passive versus active investor. If I could give someone today just starting out what to do, it would be plow 90% of your retirement/401 plan money into that index fund (and please please please reinvest the dividends), 10% into whatever else you want to do, and in 40 years you will be a happy camper.

-

I like that. Sage advice. So much of this is psychology, and psychologically, I could never be the guy trying to pick 'em all day with the whole portfolio. Too much on the line and too much pressure, even if I were good at it; and I'm not. Literally the only individual stocks I ever fucked with were tech stocks after the bubble popped in March 2000. I didn't have a lot of cash, but I was buying Cisco at 12, 14, 18, shit like that. That's done well and I've held it just so I can say I have some stocks. I have a TON of company stock that is a good yield play and thereby have been breaking all the rules about diversification. But, I know the company and the business, so there's that.godawgst said:

Every year I look at my portfolio and 19 years ago I put a small position of money into the S & P 500 (SPY) Via vanguard and reinvested the dividends. In that time frame thru 9/11. 2008/09 financial crisis, 2020 free fall in Feb-March, etc it has returned 420% and I did nothing with it.creepycoug said:Sorry. Liquidiate 401-K was confusing. I meant, liquidiate my equity positions in the 401-k. I have, for example, a large balance in the S&P just because I like a portfolio to include "just the market" returns. Should I liquidate to money market and wait for the burst? Are we? that confident a bubble pop is on the way?

Said another way, have any of you guys ever been so confident that the market is overheated that you pulled out of equities entirely in your retirement accounts and sat around waiting for the market to drop?

95% + off all managed funds can't even being to sniff that return.

Yet I have other stocks that have double or tripled that, and if you bought Amazon, MSFT, Apple, FB, Tesla, etc those returns have produced generational wealth if you put enough in and just left it alone.

Guess this goes back to being a passive versus active investor. If I could give someone today just starting out what to do, it would be plow 90% of your retirement/401 plan money into that index fund (and please please please reinvest the dividends), 10% into whatever else you want to do, and in 40 years you will be a happy camper.

The time has come to break up that party - stock is really up - and my plan with the proceeds is to spread out into other dividend payers. There's a good video of Kevin - Mr. Wonderful - on youtube about dividend stocks. That kind of play is more attuned to my personality. My bargain with the universe was, I don't need to get there tomorrow and am willing to wait. But in exchange for the Tony Gwyn slap swings, I have to have assurance that I'll get there. -

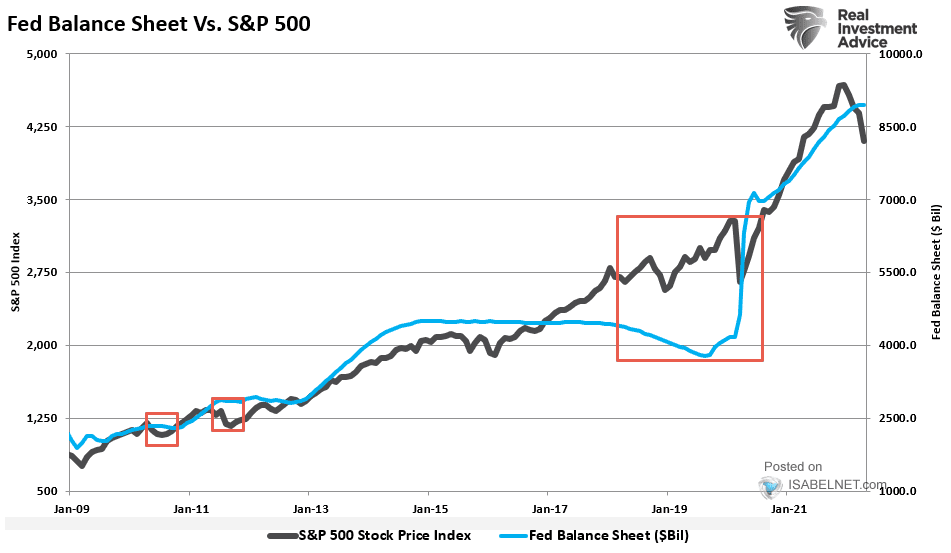

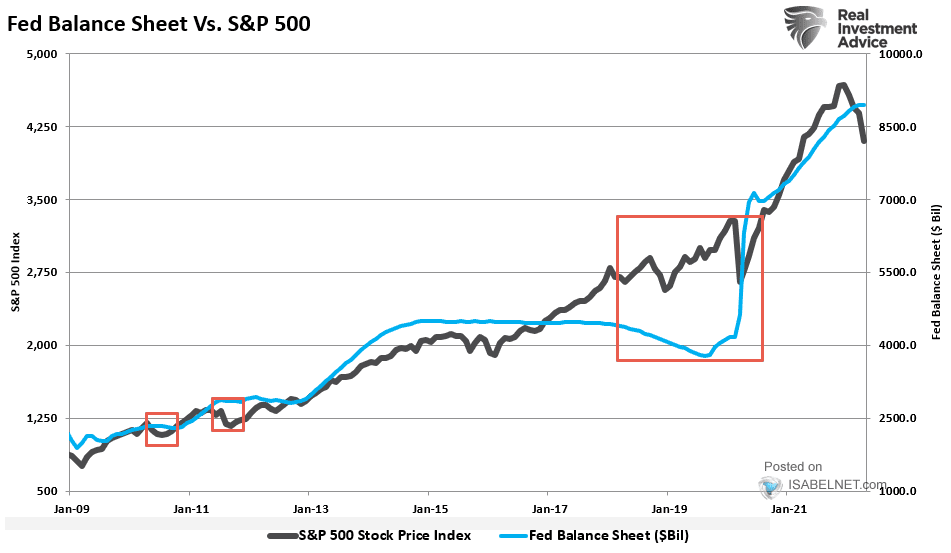

Don't fight the Fed, it's so sad but so true. The USA really needs to run an account surplus again though no one has will.

International Value isn't sexy right now but it's a pretty good way to put cash to work.

-

I've got some exposure to International in my 401-k, though I don't know if it's all value. I believe there is some growth and thus a diversified fund.HFNY said:Don't fight the Fed, it's so sad but so true. The USA really needs to run an account surplus again though no one has will.

International Value isn't sexy right now but it's a pretty good way to put cash to work.