More faux news

Comments

-

No bigger Trumpet than #aclockworkshill #rightontim

-

I thought this was going to be about your lie regarding the rich paying a greater percentage of the income tax back in the 1950s than they do today.2001400ex said: -

34 > 42 according to Bob.

-

Poor reading comprehension from Hondo.

Doesn't understand the difference between income taxes and an overall tax rate. So you're either lying Hondo our you're a fucking moron. Take your pick. -

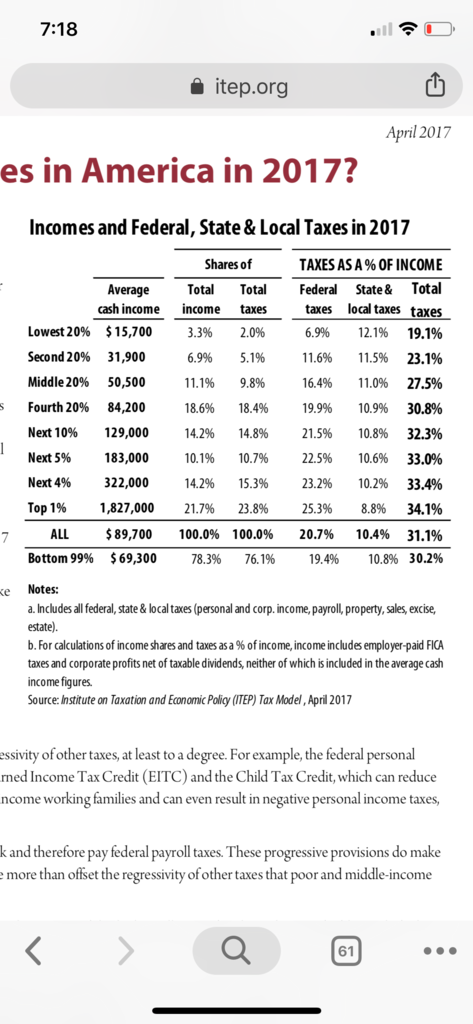

How could it be that the tax code of the 1950s had a top marginal tax rate of 91 percent, but resulted in an effective tax rate of only 42 percent on the wealthiest taxpayers? In fact, the situation is even stranger. The 42.0 percent tax rate on the top 1 percent takes into account all taxes levied by federal, state, and local governments, including: income, payroll, corporate, excise, property, and estate taxes. When we look at income taxes specifically, the top 1 percent of taxpayers paid an average effective rate of only 16.9 percent in income taxes during the 1950s.[4]

-

Like I said 34.1% greater than 42% according to Bob.SFGbob said:How could it be that the tax code of the 1950s had a top marginal tax rate of 91 percent, but resulted in an effective tax rate of only 42 percent on the wealthiest taxpayers? In fact, the situation is even stranger. The 42.0 percent tax rate on the top 1 percent takes into account all taxes levied by federal, state, and local governments, including: income, payroll, corporate, excise, property, and estate taxes. When we look at income taxes specifically, the top 1 percent of taxpayers paid an average effective rate of only 16.9 percent in income taxes during the 1950s.[4]

Now STFU you obsessed little bitch. -

Like I said, Hondo's so fucking stupid he doesn't understand the difference between the percentage of income taxes paid and an overall tax rates.

Got to love how Mr. Reading comprehension is either flat out lying or is too stupid to understand the distinction. Appears you're having the same reading comprehension problem in that other thread with that table you trying to defend Hondo.

-

Read..... Yes read..... Both of our links are all taxes, not just federal income.SFGbob said:Like I said, Hondo's so fucking stupid he doesn't understand the difference between the percentage of income taxes paid and an overall tax rates.

Got to love how Mr. Reading comprehension is either flat out lying or is too stupid to understand the distinction. Appears you're having the same reading comprehension problem in that other thread with that table you trying to defend Hondo. -

Poor reading comprehension.