Crony capitalism

Comments

-

and asking for bail outs is a form of rent seeking, hth. Now we have a market where even market funds are essentially FDIC insured, that should work out well for us long term.

-

Why were lenders still able to give loans to people who didn't have the income to make the payments on those loans? Surely a bank wouldn't loan to someone if they thought they weren't going to get repaid. That is unless the lender knew that he was never going to have to keep that loan on his books. Now, what was it that allowed the lender to move all of those questionable loans off of their books?2001400ex said:

There wouldn't have been a meltdown if banks didn't lend on stated income loans and actually had standards for who they were giving loans too. And big business didn't fire half the company. There's a whole host of causes. But wall Street created the mess, fired half the workforce, then asked for a bailout.UW_Doog_Bot said:

You mean like the last collapse that was largely caused by government intervention in the housing markets and artificially low interest rates set by the fed? Thanks for literally illustrating the cartoon to make my point.2001400ex said:

Question. When the free market needs money during economic collapse. Where does it come from? Axin for a fren.UW_Doog_Bot said:The term "Crony Capitalism" is a progressive re-branding of the term Rent Seeking.

[Rent-seeking is an attempt to obtain economic rent (i.e., the portion of income paid to a factor of production in excess of what is needed to keep it employed in its current use) by manipulating the social or political environment in which economic activities occur, rather than by creating new wealth. Rent-seeking implies extraction of uncompensated value from others without making any contribution to productivity.]

It is a trademark failure of a centrally(government) planned economy and not one of free markets aka capitalism. Freer more "capitalist" markets = less Rent Seeking or "crony capitalism"

The Left points to capitalism as the cause of Rent Seeking, or "crony capitalism", and demands ever more government intervention to solve an issue that is caused by government intervention in the first place.

Both the Left and the Right are guilty of rent seeking for their favored industries. The term "crony capitalism" just pisses me off as it is a form of double speak at its highest order. -

SFGbob said:

Why were lenders still able to give loans to people who didn't have the income to make the payments on those loans? Surely a bank wouldn't loan to someone if they thought they weren't going to get repaid. That is unless the lender knew that he was never going to have to keep that loan on his books. Now, what was it that allowed the lender to move all of those questionable loans off of their books?2001400ex said:

There wouldn't have been a meltdown if banks didn't lend on stated income loans and actually had standards for who they were giving loans too. And big business didn't fire half the company. There's a whole host of causes. But wall Street created the mess, fired half the workforce, then asked for a bailout.UW_Doog_Bot said:

You mean like the last collapse that was largely caused by government intervention in the housing markets and artificially low interest rates set by the fed? Thanks for literally illustrating the cartoon to make my point.2001400ex said:

Question. When the free market needs money during economic collapse. Where does it come from? Axin for a fren.UW_Doog_Bot said:The term "Crony Capitalism" is a progressive re-branding of the term Rent Seeking.

[Rent-seeking is an attempt to obtain economic rent (i.e., the portion of income paid to a factor of production in excess of what is needed to keep it employed in its current use) by manipulating the social or political environment in which economic activities occur, rather than by creating new wealth. Rent-seeking implies extraction of uncompensated value from others without making any contribution to productivity.]

It is a trademark failure of a centrally(government) planned economy and not one of free markets aka capitalism. Freer more "capitalist" markets = less Rent Seeking or "crony capitalism"

The Left points to capitalism as the cause of Rent Seeking, or "crony capitalism", and demands ever more government intervention to solve an issue that is caused by government intervention in the first place.

Both the Left and the Right are guilty of rent seeking for their favored industries. The term "crony capitalism" just pisses me off as it is a form of double speak at its highest order.

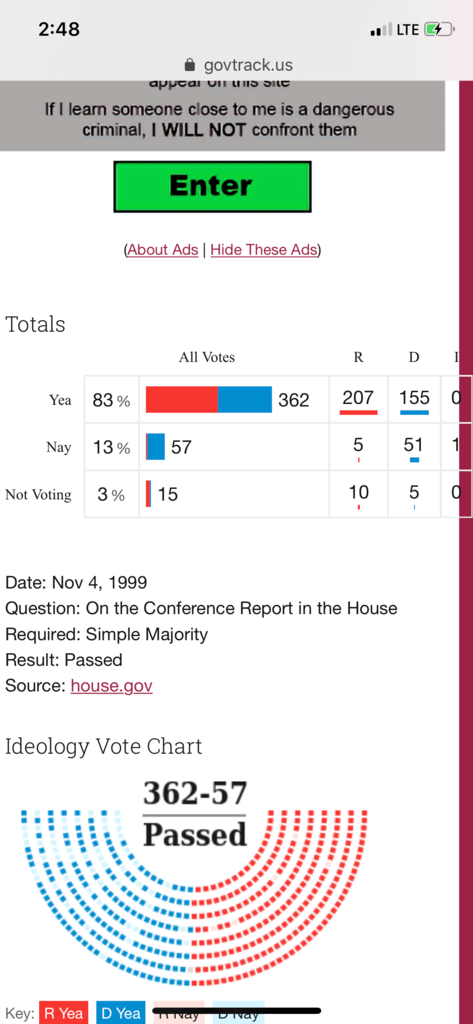

https://www.govtrack.us/congress/votes/106-1999/h570

-

Hondo showing he doesn’t understand basic economics... again.

-

Great argument as always.CuntWaffle said:Hondo showing he doesn’t understand basic economics... again.

-

And this Kunt accuses others of relying on talking points.2001400ex said:

Great argument as always.CuntWaffle said:Hondo showing he doesn’t understand basic economics... again.

Repealing Glass-Steagall had nothing to do with the mortgage market meltdown. Bravo Hondo, your streak of dumbfuckery is still intact. -

That's the talk around here. If you ask sledog it's was purely that repeal and the community reinvestment act. But ok!SFGbob said:

And this Kunt accuses others of relying on talking points.2001400ex said:

Great argument as always.CuntWaffle said:Hondo showing he doesn’t understand basic economics... again.

Repealing Glass-Steagall had nothing to do with the mortgage market meltdown. Bravo Hondo, your streak of dumbfuckery is still intact. -

But I'm not talking to Sledog, I'm talking to you and you just put your head up your ass. Hondo stick to topics you actually know something about, like posting "funny" pictures and tonguing Coug's ass.2001400ex said:

That's the talk around here. If you ask sledog it's was purely that repeal and the community reinvestment act. But ok!SFGbob said:

And this Kunt accuses others of relying on talking points.2001400ex said:

Great argument as always.CuntWaffle said:Hondo showing he doesn’t understand basic economics... again.

Repealing Glass-Steagall had nothing to do with the mortgage market meltdown. Bravo Hondo, your streak of dumbfuckery is still intact. -

I love how the dipshit thinks his posting the House vote totals from the repeal of Glass-Steagall addresses even one of the questions I asked. Hondo lets go of the side of the kiddie pool and sinks like a rock.

-

Ok. Give me your synopsis of the recession.SFGbob said:I love how the dipshit thinks his posting the House vote totals from the repeal of Glass-Steagall addresses even one of the questions I asked. Hondo lets go of the side of the kiddie pool and sinks like a rock.