Welcome to the Hardcore Husky Forums. Folks who are well-known in Cyberland and not that dumb.

Shocking news is shocking

2001400ex

Member Posts: 29,457

in Tug Tavern

Some of you have mentioned it doesn't make sense the tax bill is unpopular (Hi Race). Remember the tax bill was sold that businesses would use the cash to invest in new businesses and therefore creating jobs and the trickle down theory would be fulfilled. Yet the reality is, the majority of the cash is going to stock buybacks and dividends, both of which help the shareholders, which aren't the workers. And the workers see that.

Americans for Tax Fairness, a liberal group that recently started a website detailing what corporations are doing with their tax cuts, which dropped the corporate rate to 21% from 35%, says workers are not getting their fair share.

The group's data, culled from corporate news releases, media reports, analysts and its own research, show that only 6.3 million workers are getting a one-time bonus or pay hike tied to the cuts. That compares with a total U.S. workforce of 155.2 million, according to the Bureau of Labor Statistics. The ATF analysis shows 126 companies have received $60.8 billion in total tax cuts, which it claims is nine times more than the $6.5 billion workers have received in bonuses and pay increases. Corporations, their data show, have spent 37 times more on stock buybacks than worker bonuses or raises since the law was enacted.

https://www.usatoday.com/story/money/2018/04/13/how-companies-spend-tax-windfall/505122002/

Americans for Tax Fairness, a liberal group that recently started a website detailing what corporations are doing with their tax cuts, which dropped the corporate rate to 21% from 35%, says workers are not getting their fair share.

The group's data, culled from corporate news releases, media reports, analysts and its own research, show that only 6.3 million workers are getting a one-time bonus or pay hike tied to the cuts. That compares with a total U.S. workforce of 155.2 million, according to the Bureau of Labor Statistics. The ATF analysis shows 126 companies have received $60.8 billion in total tax cuts, which it claims is nine times more than the $6.5 billion workers have received in bonuses and pay increases. Corporations, their data show, have spent 37 times more on stock buybacks than worker bonuses or raises since the law was enacted.

https://www.usatoday.com/story/money/2018/04/13/how-companies-spend-tax-windfall/505122002/

Comments

-

If workers invested their money they would be getting paid.

-

Yes the guy making $50k a year has the money to invest when the CEO, COO, CIO, CFO, etc. are given stock and stock options.greenblood said:If workers invested their money they would be getting paid.

-

Anything with the acronym ATF is fucked as a source.

-

Sure the worker isn't given stock or stock options from work, but if the worker had invested $100-$200/month in the market, which is completely doable, then the worker would have seen a benefit. Especially if the worker had invested in companies that bought back stock.2001400ex said:

Yes the guy making $50k a year has the money to invest when the CEO, COO, CIO, CFO, etc. are given stock and stock options.greenblood said:If workers invested their money they would be getting paid.

Oh...and unemployment is at all time lows, and labor participation rates have stabilized. So there's that...

Workers might not being getting as big of a raise, but there's also more people working. -

Yes 1/100000000 of the benefit that the CEO is getting.greenblood said:

Sure the worker isn't given stock or stock options from work, but if the worker had invested $100-$200/month in the market, which is completely doable, then the worker would have seen a benefit. Especially if the worker had invested in companies that bought back stock.2001400ex said:

Yes the guy making $50k a year has the money to invest when the CEO, COO, CIO, CFO, etc. are given stock and stock options.greenblood said:If workers invested their money they would be getting paid.

Oh...and unemployment is at all time lows, and labor participation rates have stabilized. So there's that...

Workers might not being getting as big of a raise, but there's also more people working. -

The CEO is making 100000000 times the employee to begin with. Why would that change?2001400ex said:

Yes 1/100000000 of the benefit that the CEO is getting.greenblood said:

Sure the worker isn't given stock or stock options from work, but if the worker had invested $100-$200/month in the market, which is completely doable, then the worker would have seen a benefit. Especially if the worker had invested in companies that bought back stock.2001400ex said:

Yes the guy making $50k a year has the money to invest when the CEO, COO, CIO, CFO, etc. are given stock and stock options.greenblood said:If workers invested their money they would be getting paid.

Oh...and unemployment is at all time lows, and labor participation rates have stabilized. So there's that...

Workers might not being getting as big of a raise, but there's also more people working. -

That's part of the issue. At least from the employee point of view. You know the working class average voter.greenblood said:

The CEO is making 100000000 times the employee to begin with. Why would that change?2001400ex said:

Yes 1/100000000 of the benefit that the CEO is getting.greenblood said:

Sure the worker isn't given stock or stock options from work, but if the worker had invested $100-$200/month in the market, which is completely doable, then the worker would have seen a benefit. Especially if the worker had invested in companies that bought back stock.2001400ex said:

Yes the guy making $50k a year has the money to invest when the CEO, COO, CIO, CFO, etc. are given stock and stock options.greenblood said:If workers invested their money they would be getting paid.

Oh...and unemployment is at all time lows, and labor participation rates have stabilized. So there's that...

Workers might not being getting as big of a raise, but there's also more people working. -

The tax cuts are popular

Run against them pussy -

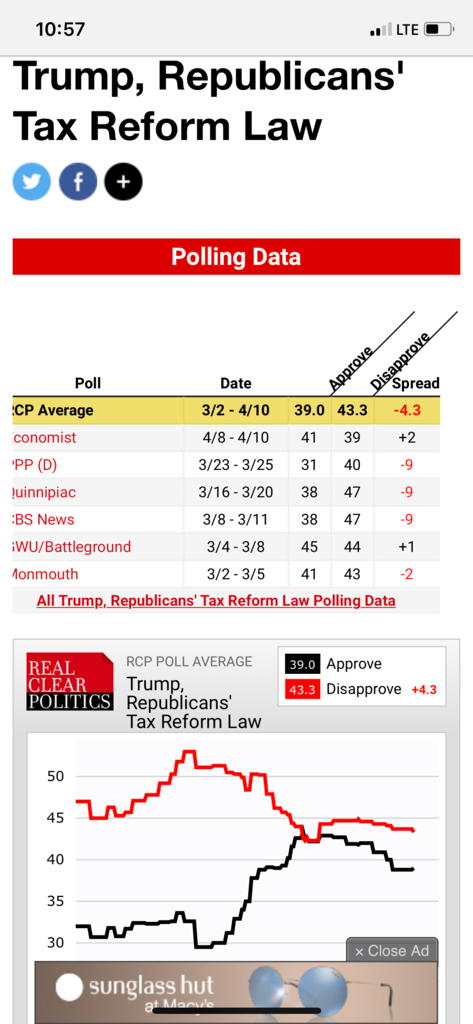

Let's get some RCP up in this bitch. Race doesn't know shit as always.RaceBannon said:The tax cuts are popular

Run against them pussy

-

Run against them pussy