Companies will invest in employees with the tax cuts

Comments

-

All true. These are the positive consequences of lower tax rates and deregulation.UW_Doog_Bot said:

It's not that 3% are unemployable it's that 3% is essentially "structural" unemployment and we are considered at "full employment". Of course we add fewer jobs when we are essentially at full employment. What's been amazing about Trump is the number of people who weren't counted(under Obama) that have returned to the workforce though.greenblood said:Unemployment is never getting much below 3%. These 3% of Americans are unemployable.

Who gives a fuck if these companies buy back stock? It’s their money. This brings us back to the 3%. If 3% of Americans can’t even hold a broom, how can these companies invest in bigger workforces? What else are they going to spend their money on? Before you say, they should raise wages let me ask you this. Why would companies raise wages if competitors aren’t? Unless they can take quality workers from other conpanies, higher wages provide nothing for the company.

"noun: structural unemployment

unemployment resulting from industrial reorganization, typically due to technological change, rather than fluctuations in supply or demand." -

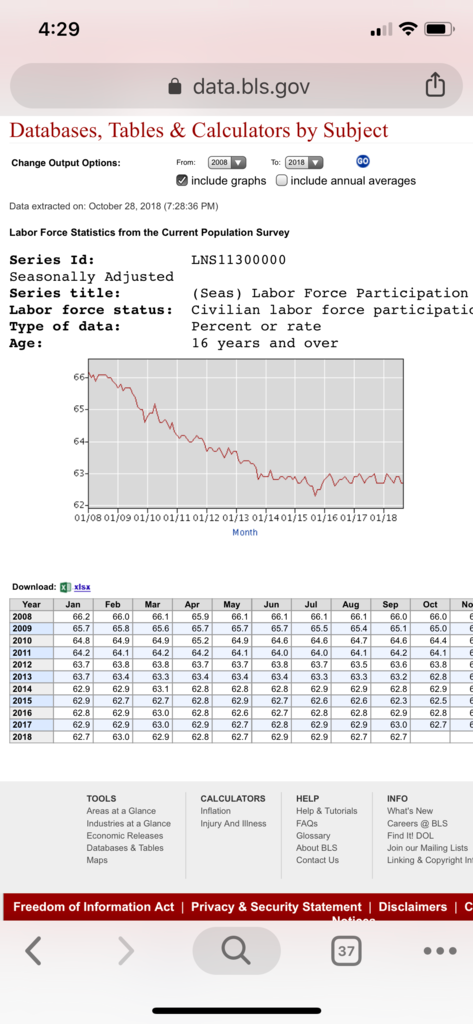

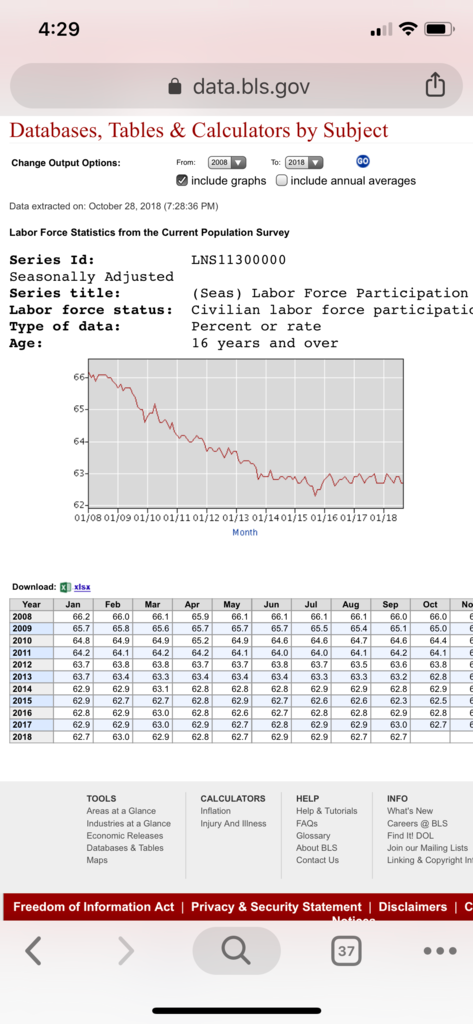

Wut? Labor force participation hasn't changed.UW_Doog_Bot said:

It's not that 3% are unemployable it's that 3% is essentially "structural" unemployment and we are considered at "full employment". Of course we add fewer jobs when we are essentially at full employment. What's been amazing about Trump is the number of people who weren't counted(under Obama) that have returned to the workforce though.greenblood said:Unemployment is never getting much below 3%. These 3% of Americans are unemployable.

Who gives a fuck if these companies buy back stock? It’s their money. This brings us back to the 3%. If 3% of Americans can’t even hold a broom, how can these companies invest in bigger workforces? What else are they going to spend their money on? Before you say, they should raise wages let me ask you this. Why would companies raise wages if competitors aren’t? Unless they can take quality workers from other conpanies, higher wages provide nothing for the company.

"noun: structural unemployment

unemployment resulting from industrial reorganization, typically due to technological change, rather than fluctuations in supply or demand."

-

It's Trump's fault Warren didn't buy low/sell high?!?!2001400ex said:Also, fun fact of the day. Employment grew more the last 21 months of Obama than the first 21 months of Trump.

It is the first time Berkshire has bought back stock since 2012. The decision, announced in a quarterly filing Saturday, illustrates the scarcity of attractively priced projects and deals that can satiate yield-hungry investors and firms more than nine years into a bull market.

A legendary value investor best known for striking deals when prices are low, Mr. Buffett has struggled to find large investments that aren’t overvalued. Berkshire hasn’t made a major acquisition since it bought Precision Castparts Corp. for about $32 billion in 2016.

https://www.wsj.com/articles/warren-buffetts-berkshire-hathaway-repurchases-more-than-900-million-of-stock-1541248428

Also seems to me that a stock buyback is good for the shareholders and raises the value of their shares instead of the company sitting on a boatload of cash. -

Exactly.PurpleThrobber said:

It's Trump's fault Warren didn't buy low/sell high?!?!2001400ex said:Also, fun fact of the day. Employment grew more the last 21 months of Obama than the first 21 months of Trump.

It is the first time Berkshire has bought back stock since 2012. The decision, announced in a quarterly filing Saturday, illustrates the scarcity of attractively priced projects and deals that can satiate yield-hungry investors and firms more than nine years into a bull market.

A legendary value investor best known for striking deals when prices are low, Mr. Buffett has struggled to find large investments that aren’t overvalued. Berkshire hasn’t made a major acquisition since it bought Precision Castparts Corp. for about $32 billion in 2016.

https://www.wsj.com/articles/warren-buffetts-berkshire-hathaway-repurchases-more-than-900-million-of-stock-1541248428

Also seems to me that a stock buyback is good for the shareholders and raises the value of their shares instead of the company sitting on a boatload of cash.

-

Adjust for demographics, or don't, if you're only trying to score talking points.2001400ex said:

Wut? Labor force participation hasn't changed.UW_Doog_Bot said:

It's not that 3% are unemployable it's that 3% is essentially "structural" unemployment and we are considered at "full employment". Of course we add fewer jobs when we are essentially at full employment. What's been amazing about Trump is the number of people who weren't counted(under Obama) that have returned to the workforce though.greenblood said:Unemployment is never getting much below 3%. These 3% of Americans are unemployable.

Who gives a fuck if these companies buy back stock? It’s their money. This brings us back to the 3%. If 3% of Americans can’t even hold a broom, how can these companies invest in bigger workforces? What else are they going to spend their money on? Before you say, they should raise wages let me ask you this. Why would companies raise wages if competitors aren’t? Unless they can take quality workers from other conpanies, higher wages provide nothing for the company.

"noun: structural unemployment

unemployment resulting from industrial reorganization, typically due to technological change, rather than fluctuations in supply or demand."

https://bloomberg.com/news/articles/2018-07-06/participation-rate-emerges-as-fed-s-big-job-market-mystery

TLDR our labor participation rate should be going down with all the boomers retiring but instead it's stable because of all the people being added back into the workforce. -

You are completely missing the boat on the point of the thread. As is every other conservative here.PurpleThrobber said:

It's Trump's fault Warren didn't buy low/sell high?!?!2001400ex said:Also, fun fact of the day. Employment grew more the last 21 months of Obama than the first 21 months of Trump.

It is the first time Berkshire has bought back stock since 2012. The decision, announced in a quarterly filing Saturday, illustrates the scarcity of attractively priced projects and deals that can satiate yield-hungry investors and firms more than nine years into a bull market.

A legendary value investor best known for striking deals when prices are low, Mr. Buffett has struggled to find large investments that aren’t overvalued. Berkshire hasn’t made a major acquisition since it bought Precision Castparts Corp. for about $32 billion in 2016.

https://www.wsj.com/articles/warren-buffetts-berkshire-hathaway-repurchases-more-than-900-million-of-stock-1541248428

Also seems to me that a stock buyback is good for the shareholders and raises the value of their shares instead of the company sitting on a boatload of cash.

On tax cuts, Republicans said: will increase job as companies will use the money to invest in businesses and employ people.

Democrats said: businesses are already flush with cash. All they will do is buy back stock, which enriches the wealthy and does very little for the middle class.

Guess who was right?

Not to mention that job growth is slower the last 21 months than the last 21 months of Obama. What does that fact mean? -

That we've come close to reaching full employment? Which we never did under Obama.2001400ex said:

You are completely missing the boat on the point of the thread. As is every other conservative here.PurpleThrobber said:

It's Trump's fault Warren didn't buy low/sell high?!?!2001400ex said:Also, fun fact of the day. Employment grew more the last 21 months of Obama than the first 21 months of Trump.

It is the first time Berkshire has bought back stock since 2012. The decision, announced in a quarterly filing Saturday, illustrates the scarcity of attractively priced projects and deals that can satiate yield-hungry investors and firms more than nine years into a bull market.

A legendary value investor best known for striking deals when prices are low, Mr. Buffett has struggled to find large investments that aren’t overvalued. Berkshire hasn’t made a major acquisition since it bought Precision Castparts Corp. for about $32 billion in 2016.

https://www.wsj.com/articles/warren-buffetts-berkshire-hathaway-repurchases-more-than-900-million-of-stock-1541248428

Also seems to me that a stock buyback is good for the shareholders and raises the value of their shares instead of the company sitting on a boatload of cash.

On tax cuts, Republicans said: will increase job as companies will use the money to invest in businesses and employ people.

Democrats said: businesses are already flush with cash. All they will do is buy back stock, which enriches the wealthy and does very little for the middle class.

Guess who was right?

Not to mention that job growth is slower the last 21 months than the last 21 months of Obama. What does that fact mean? -

Thank you, hondo for pointing out the Democrats are either too stupid to tie their own shoes, bald face liars and/or a combo of both.

-

No one loves hurting businesses like the dems

Putting stupid regulations in place that hardly affect major corporations but jam up small and medium businesses is all they do.

Pandering to their shitty poor base by screwing over local businesses in the name of "stopping corporate malprwctice' is the move -

I knew you'd come back with relevant facts.sarktastic said:Thank you, hondo for pointing out the Democrats are either too stupid to tie their own shoes, bald face liars and/or a combo of both.