Is anybody short the market right now?

What is the least risky way to take that position? Buy gold? Options?

Comments

-

This is the first place I come for investment advice too.

-

Options spreads. But why short the market at all? Timing that shit is close to impossible. Let the bears take those risks, wait for a drop and go long.

-

Squirt said:

This is the first place I come for investment advice too.

What bet; and how to do it are two different things. -

SPXS. I'll move some over soon. Not yet. Also hedging with Cannabis stocks.pawz said:What's the best way to do that?

What is the least risky way to take that position? Buy gold? Options? -

HR, YK. Buying gold now is also stupid. When the market crashes everything crashes, including gold.oregonblitzkrieg said:Options spreads. But why short the market at all? Timing that shit is close to impossible. Let the bears take those risks, wait for a drop and go long.

Wait for the crash then buy a leveraged gold account like NUGT. During the last crash that was by far my best performer as hard times lingered for a very long time and the dollar took a shit driving that account into the heavens.

When the market started its long climb I just put everything in a high yield mutual and made somewhere around 73% in an 18 month period. My TSP split between the C & S funds did extremely well during that time for that vehicle as well.

Right now is a terrible time to be in the market, IMO. -

Dont short anything unless you really know what youre doing

-

-

Don't need to. Buy a 3 times leveraged bear etf.PostGameOrangeSlices said:Dont short anything unless you really know what youre doing

-

-

Why watch CNBC anymore?

-

Lottery tickets

-

-

-

They say to wait until the yield curve is inverted. Even tho that triggers a recession, the stock market values are less correlated.Baseman said:Why watch CNBC anymore?

-

Go ahead and hand that loaded gun to the child, what’s the worst that could happen?2001400ex said:

Don't need to. Buy a 3 times leveraged bear etf.PostGameOrangeSlices said:Dont short anything unless you really know what youre doing

https://www.fool.com/investing/2017/06/25/3-triple-leveraged-etfs-and-why-you-shouldnt-buy-a.aspx

Don’t try and time the market; Wall Street is full of professionals who’ve failed at that very thing. I’d recommend you buy diversified mutual funds and be patient. They’re not sexy and won’t give you that rush but your money will be there when you need it. I ‘day traded’ prior to the tech bubble burst and quadrupled my portfolio in 2-3 years. Then I lost 2/3 of it (on paper) in 2 weeks. I was lucky and most of my stocks recovered but it was still a painful lesson. -

You need an guy in the know

-

@Tequilla ?RaceBannon said:You need an guy in the know

-

ISAFNRC. @Swaye ?RaceBannon said:

-

The trick is to find the right downturn.. There was a market correction in 1998. It would have sucked to have sold then. But you don't seem then because you need to see the rest of market indicators be shit. Just like there was a 10% correction this year. But the rest of indicators, such as GDP growth and unemployment are good.USMChawk said:

Go ahead and hand that loaded gun to the child, what’s the worst that could happen?2001400ex said:

Don't need to. Buy a 3 times leveraged bear etf.PostGameOrangeSlices said:Dont short anything unless you really know what youre doing

https://www.fool.com/investing/2017/06/25/3-triple-leveraged-etfs-and-why-you-shouldnt-buy-a.aspx

Don’t try and time the market; Wall Street is full of professionals who’ve failed at that very thing. I’d recommend you buy diversified mutual funds and be patient. They’re not sexy and won’t give you that rush but your money will be there when you need it. I ‘day traded’ prior to the tech bubble burst and quadrupled my portfolio in 2-3 years. Then I lost 2/3 of it (on paper) in 2 weeks. I was lucky and most of my stocks recovered but it was still a painful lesson.

I put most of my retirement in cash in 2008. A little over half. My fuck up was I waited until October 2010 to put my money back in. The Dow was around 9,500 when I put it in. Should have done it a year earlier but still better off than if I left it in the market the whole time. -

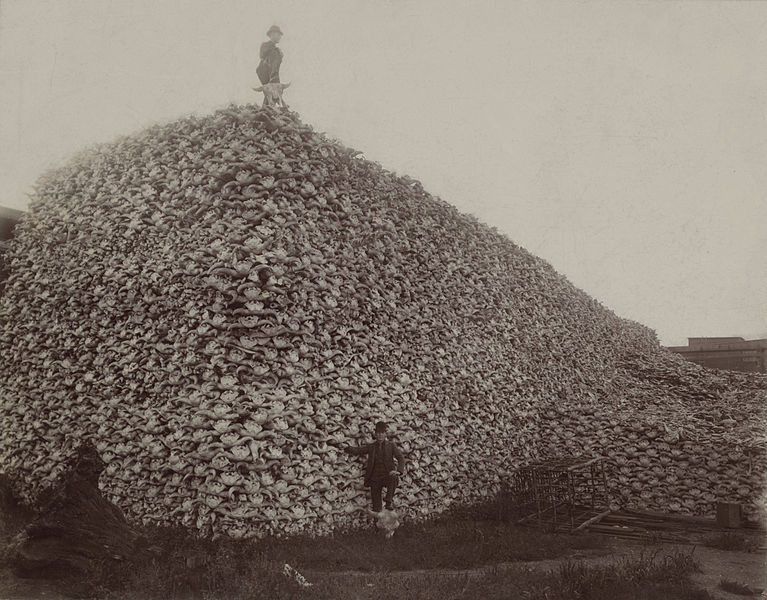

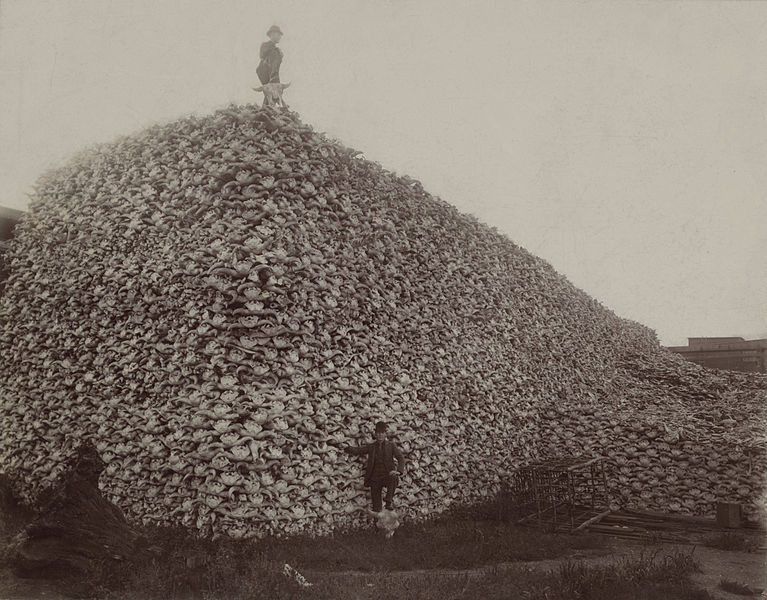

I imagine that scene as the bones of white devils.YellowSnow said: -

Too much stress to sit around and worry about what the market is gonna do. Put money in the retirement account on a 30 year plan and let it do its thing. Say, the Dow loses 30% this year, I'd still think I've made money in the past 10 years.

-

You need the germs my fren. Nobody has beaten whitey since the bubonic plague.Swaye said:

I imagine that scene as the bones of white devils.YellowSnow said: -

Gonna need BBQ superiority guy to weigh in here. Tatonka brisket, yay or nay?RaceBannon said:

-

I had high hopes for AIDS, but it kind of fizzled.YellowSnow said:

You need the germs my fren. Nobody has beaten whitey since the bubonic plague.Swaye said:

I imagine that scene as the bones of white devils.YellowSnow said: -

AIDS was designed to take down blacks and gay men.Swaye said:

I had high hopes for AIDS, but it kind of fizzled.YellowSnow said:

You need the germs my fren. Nobody has beaten whitey since the bubonic plague.Swaye said:

I imagine that scene as the bones of white devils.YellowSnow said: -

https://www.hivplusmag.com/research/2014/03/12/are-odds-stacked-against-native-americans-hivSwaye said:

I had high hopes for AIDS, but it kind of fizzled.YellowSnow said:

You need the germs my fren. Nobody has beaten whitey since the bubonic plague.Swaye said:

I imagine that scene as the bones of white devils.YellowSnow said:

-

You need something that attacks our credit score.Swaye said:

I had high hopes for AIDS, but it kind of fizzled.YellowSnow said:

You need the germs my fren. Nobody has beaten whitey since the bubonic plague.Swaye said:

I imagine that scene as the bones of white devils.YellowSnow said:

-

I understand the conservative, long-term strategies very well.YellowSnow said:Too much stress to sit around and worry about what the market is gonna do. Put money in the retirement account on a 30 year plan and let it do its thing. Say, the Dow loses 30% this year, I'd still think I've made money in the past 10 years.

I specifically want to play the correction.

TIA -

I know you know it came from a paid troll. But I told you the answer.pawz said:

I understand the conservative, long-term strategies very well.YellowSnow said:Too much stress to sit around and worry about what the market is gonna do. Put money in the retirement account on a 30 year plan and let it do its thing. Say, the Dow loses 30% this year, I'd still think I've made money in the past 10 years.

I specifically want to play the correction.

TIA -

Those decay. Do you average down on those etfs too?2001400ex said:

Don't need to. Buy a 3 times leveraged bear etf.PostGameOrangeSlices said:Dont short anything unless you really know what youre doing

https://www.youtube.com/watch?v=ng7P0pbPkxo

https://www.youtube.com/watch?v=ng7P0pbPkxo