US Real Estate - Bubble Pop or Run Away Inflation

US Real Estate - Bubble Pop or Run Away Inflation 7 votes

Comments

-

More complicated than a simple bubble. It's not going to be much of a bubble in Seattle versus place like Nevada, Arizona, etc. I think it flattens out in 2023.

-

Yes. Don't think it will pop as much as peter out with slowly but surely rising rates (absent an inflationary or deflationary black swan of course). The Fed finally will slow down their money printing / creation of money out of thin air. Housing and the stock market won't like it but it's heightened social tensions and a lack of societal buy-in needed for the Republic.BleachedAnusDawg said:More complicated than a simple bubble. It's not going to be much of a bubble in Seattle versus place like Nevada, Arizona, etc. I think it flattens out in 2023.

-

Pop!"What Congress did in 1986 to real-estate tax shelters was deliberate. What it did to S&Ls, community lending, investors, capital markets and Main Street was unintended. This time, it’s much the same, but the effect will be broader. Everyone is directly or indirectly exposed to the CMBS market, and sharply declining real-estate values are highly disruptive. Total CMBS loans today are approaching $4 trillion.

If passed, the Democrats’ real-estate tax proposals will tank property values. This sudden, broad decline will be recessionary. Recessions hit all Americans, not the few that Congress and the president are targeting with this legislation. Washington is at serious risk of replaying a historic economic blunder."

https://www.wsj.com/articles/democrats-tax-plan-would-sink-real-estate-rates-interest-savings-loans-11635180636?mod=e2tw -

Pop!

Mass exodus from places like the former to low density population areas like the latter are going to make the effects flatter across the boared imo. I can see high inventory places like Vegas popping(it always does) and Boise with all the new building but I think markets like Nashville are going to see a real increase in value because of internal US immigration.BleachedAnusDawg said:More complicated than a simple bubble. It's not going to be much of a bubble in Seattle versus place like Nevada, Arizona, etc. I think it flattens out in 2023.

-

Pop!Relatedly, another Chinese developer missed a bond payment. I don't see that having much of an impact on rural areas where foreign investment is nill but places like LA, Seattle, and Vancouver will probably see a reduction in demand when the Chinese bubble pops.

-

Pop!

VP Harris is talking about another stimulus payment to every American, at $1,500.HFNY said:

Yes. Don't think it will pop as much as peter out with slowly but surely rising rates (absent an inflationary or deflationary black swan of course). The Fed finally will slow down their money printing / creation of money out of thin air. Housing and the stock market won't like it but it's heightened social tensions and a lack of societal buy-in needed for the Republic.BleachedAnusDawg said:More complicated than a simple bubble. It's not going to be much of a bubble in Seattle versus place like Nevada, Arizona, etc. I think it flattens out in 2023.

-

Pop!

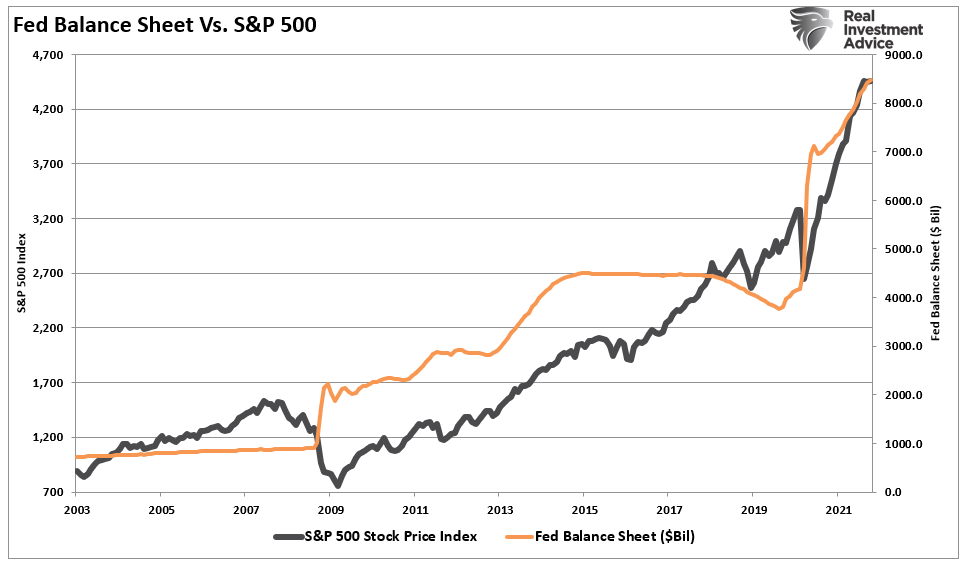

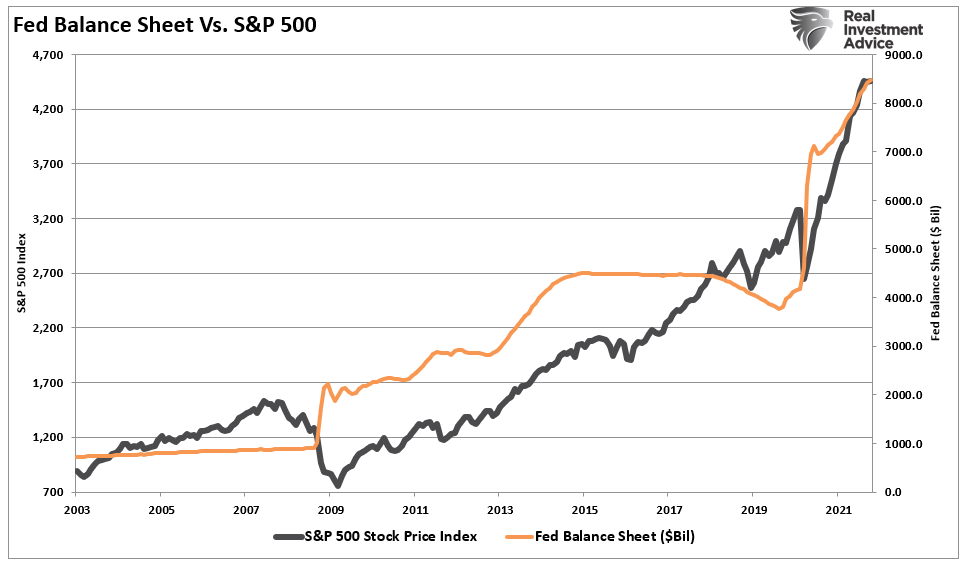

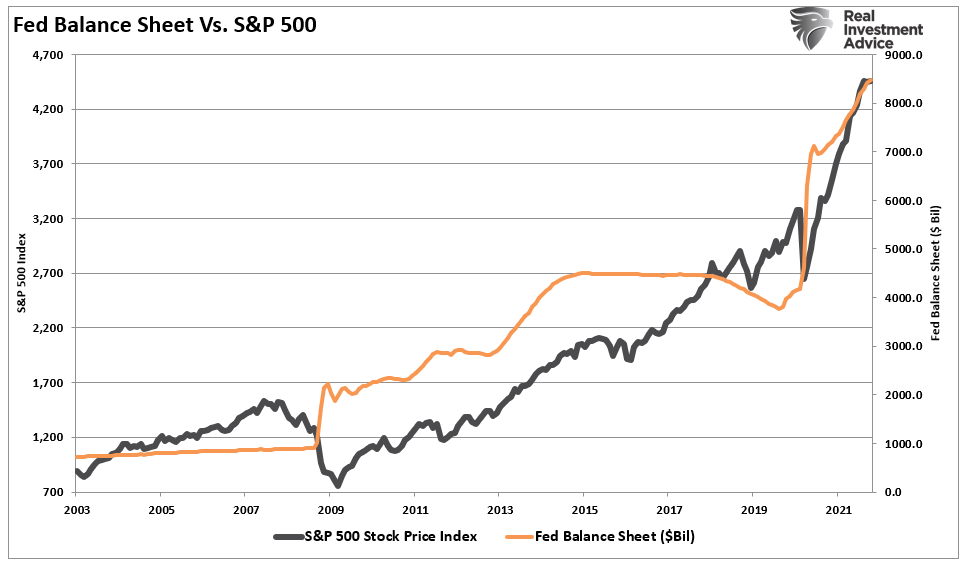

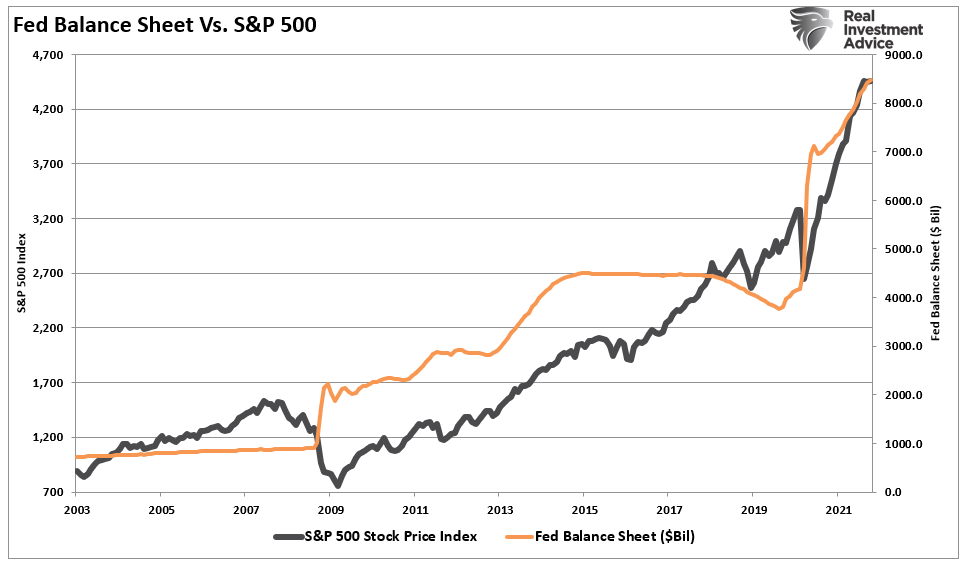

A lot this, so much depends on what the Fed decides to do. They seem to be trapped between stagflation and deflation. Which one will they pick?HFNY said:

Yes. Don't think it will pop as much as peter out with slowly but surely rising rates (absent an inflationary or deflationary black swan of course). The Fed finally will slow down their money printing / creation of money out of thin air. Housing and the stock market won't like it but it's heightened social tensions and a lack of societal buy-in needed for the Republic.BleachedAnusDawg said:More complicated than a simple bubble. It's not going to be much of a bubble in Seattle versus place like Nevada, Arizona, etc. I think it flattens out in 2023.

-

Pop!

I'm being totally serious -- they should take at least 2% of the treasury and buy BitcoinUW_Doog_Bot said:

A lot this, so much depends on what the Fed decides to do. They seem to be trapped between stagflation and deflation. Which one will they pick?HFNY said:

Yes. Don't think it will pop as much as peter out with slowly but surely rising rates (absent an inflationary or deflationary black swan of course). The Fed finally will slow down their money printing / creation of money out of thin air. Housing and the stock market won't like it but it's heightened social tensions and a lack of societal buy-in needed for the Republic.BleachedAnusDawg said:More complicated than a simple bubble. It's not going to be much of a bubble in Seattle versus place like Nevada, Arizona, etc. I think it flattens out in 2023.