Effect of Student Debt on the Economy Stupid

Comments

-

Bring back the Pod. There was good hawt talk about getting nice real estate on the cheap in Temecula and the I.E.RaceBannon said:

They go around the country. As has been stated here before, if you live where no one wants to live you can get a 3500 sf pool house for 250KYellowSnow said:

They should make a spin off about "easy" house hunting. So many of us have PTSD about overpaying for shitty little houses built during the Coolidge administration.RaceBannon said:

Fuck off2001400ex said:

House hunters is so real life. Lemme guess, they make $45k a year each and can afford a $3.2 million vacation home in Costa Rica.RaceBannon said:On House Hunters last night a couple of Asian doctors were buying their first house and wondered if they should buy for themselves or get a income property to pay off student roans.

They got the house for themselves. CSB

House Hunters is must see TV

In Seattle or other coastal areas you will get that "charming" 900 sf craftsman for 600K with lots of opportunity to "put your own stamp on it"

I prefer the million dollar listing shows to the poor people stuck in Kansas City -

Unfortunately the do gooders in Sacramento pulled the plug on most foreclosures for now.YellowSnow said:

Bring back the Pod. There was good hawt talk about getting nice real estate on the cheap in Temecula and the I.E.RaceBannon said:

They go around the country. As has been stated here before, if you live where no one wants to live you can get a 3500 sf pool house for 250KYellowSnow said:

They should make a spin off about "easy" house hunting. So many of us have PTSD about overpaying for shitty little houses built during the Coolidge administration.RaceBannon said:

Fuck off2001400ex said:

House hunters is so real life. Lemme guess, they make $45k a year each and can afford a $3.2 million vacation home in Costa Rica.RaceBannon said:On House Hunters last night a couple of Asian doctors were buying their first house and wondered if they should buy for themselves or get a income property to pay off student roans.

They got the house for themselves. CSB

House Hunters is must see TV

In Seattle or other coastal areas you will get that "charming" 900 sf craftsman for 600K with lots of opportunity to "put your own stamp on it"

I prefer the million dollar listing shows to the poor people stuck in Kansas City

Lets help people keep their homes. Sure why not just forget about the speculators and families looking for cheap homes

Oddly enough many of the folks who lost their house the first time also went into default the second time after the intervention.

There is a lot of undervalued housing stock hidden from the market to prop up the latest bubble we are in -

Well, I'm not sure I agree with the first part, but I agree with the second part.RaceBannon said:

Why the fuck would I aim anything at you?creepycoug said:

If that is aimed at me, I don't recall saying "many", but they are out there. I have two kids attending two separate such places.RaceBannon said:People forget that many universities have endowments that would allow free tuition without the feds paying for it or the student going into debt

Of course, we're full pay, so what do I know?

You all sound poor.

Almost all universities have massive endowments where the INTEREST would cover the cost of a student education.

Instead they blow that money on uneducated general contractors so we can smoke weed and talk shit like high school dropouts

And if we're going to bag on blow, general contractors and weed, then I'm out!!!!!!!!!!! -

You need to contact BRAVO televisionpawz said:

I actually *live* the million dollar listing shows IRL .RaceBannon said:

They go around the country. As has been stated here before, if you live where no one wants to live you can get a 3500 sf pool house for 250KYellowSnow said:

They should make a spin off about "easy" house hunting. So many of us have PTSD about overpaying for shitty little houses built during the Coolidge administration.RaceBannon said:

Fuck off2001400ex said:

House hunters is so real life. Lemme guess, they make $45k a year each and can afford a $3.2 million vacation home in Costa Rica.RaceBannon said:On House Hunters last night a couple of Asian doctors were buying their first house and wondered if they should buy for themselves or get a income property to pay off student roans.

They got the house for themselves. CSB

House Hunters is must see TV

In Seattle or other coastal areas you will get that "charming" 900 sf craftsman for 600K with lots of opportunity to "put your own stamp on it"

I prefer the million dollar listing shows to the poor people stuck in Kansas City

-

Asians ....RaceBannon said:On House Hunters last night a couple of Asian doctors were buying their first house and wondered if they should buy for themselves or get a income property to pay off student roans.

They got the house for themselves. CSB -

deserves a double chinwhlinder said:

It's not just spending expendable dollars on debt, it's spending expendable dollars on education instead of other consumer goods (or savings). I'm going to have to take {some large number, but my starting point is 50K/year} out of what I spend on fun shit and divert it to some college 5 years from now. College Administrator Welfare is not really the most efficient use of that money and it sure as fuck doesn't make me happy like hookers and blow do.pawz said:

Going full circle, the article is suggesting if people are forced to spend their expendable-dollar on debt, they won't spend it in the economy - thus no economic growth. -

another perfect example why nobody likes you.pawz said:

sarksure.gif2001400ex said:

When you present a grown up argument, I'll recognize that. Until then you are a right wing parrot.pawz said:

Run along and let the grown-ups talk. You're in over your head, son.2001400ex said:

Ironic POTD. It's awesome watching someone ignore basic facts and tout the "liberal arts degree" rallying cry, then try to call someone else out for being a parrot.pawz said:

Nobody is surprised that a) you don't understand basic, fundamental microeconomic concepts, and b) you're parroting the establishment line to keep people enslaved by debt.2001400ex said:While I do agree the cost of college has escalated to a point of being fucktarded. (I paid $3,500 a year in the late 90s, good luck finding that now).

Most if the rest of your post is idiotic and something a poor uneducated person thinks. First, how the fuck is there a monopoly?

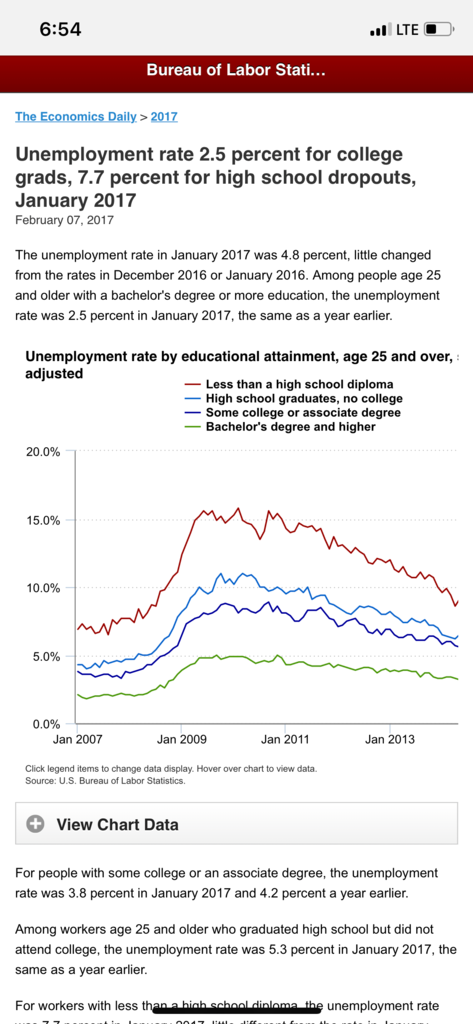

Then this is the unemployment rate, what group has the lowest unemployment? Is it the high school drop outs? Or the college educated folk? You can rail on liberal arts degrees but it looks like they have jobs.

#aclockworkshill

What about personal responsibility? If you want to go to Gonzaga and pay $50k a year and are too stupid to find scholarships, then you should be riddled with debt your whole life. -

Sadly, there's not a sliver of hyperbole in any of that.RaceBannon said:

They go around the country. As has been stated here before, if you live where no one wants to live you can get a 3500 sf pool house for 250KYellowSnow said:

They should make a spin off about "easy" house hunting. So many of us have PTSD about overpaying for shitty little houses built during the Coolidge administration.RaceBannon said:

Fuck off2001400ex said:

House hunters is so real life. Lemme guess, they make $45k a year each and can afford a $3.2 million vacation home in Costa Rica.RaceBannon said:On House Hunters last night a couple of Asian doctors were buying their first house and wondered if they should buy for themselves or get a income property to pay off student roans.

They got the house for themselves. CSB

House Hunters is must see TV

In Seattle or other coastal areas you will get that "charming" 900 sf craftsman for 600K with lots of opportunity to "put your own stamp on it"

I prefer the million dollar listing shows to the poor people stuck in Kansas City -

This has been my platform for a long time: like higher ed and exotic travel, home ownership is not for everyone, and we fucked up when we perverted the American dream with the idea that everyone gets a home. Doesn't work that way.RaceBannon said:

Unfortunately the do gooders in Sacramento pulled the plug on most foreclosures for now.YellowSnow said:

Bring back the Pod. There was good hawt talk about getting nice real estate on the cheap in Temecula and the I.E.RaceBannon said:

They go around the country. As has been stated here before, if you live where no one wants to live you can get a 3500 sf pool house for 250KYellowSnow said:

They should make a spin off about "easy" house hunting. So many of us have PTSD about overpaying for shitty little houses built during the Coolidge administration.RaceBannon said:

Fuck off2001400ex said:

House hunters is so real life. Lemme guess, they make $45k a year each and can afford a $3.2 million vacation home in Costa Rica.RaceBannon said:On House Hunters last night a couple of Asian doctors were buying their first house and wondered if they should buy for themselves or get a income property to pay off student roans.

They got the house for themselves. CSB

House Hunters is must see TV

In Seattle or other coastal areas you will get that "charming" 900 sf craftsman for 600K with lots of opportunity to "put your own stamp on it"

I prefer the million dollar listing shows to the poor people stuck in Kansas City

Lets help people keep their homes. Sure why not just forget about the speculators and families looking for cheap homes

Oddly enough many of the folks who lost their house the first time also went into default the second time after the intervention.

There is a lot of undervalued housing stock hidden from the market to prop up the latest bubble we are in -

No you didn’t. Your Dad did.2001400ex said:While I do agree the cost of college has escalated to a point of being fucktarded. (I paid $3,500 a year in the late 90s, good luck finding that now).

Most if the rest of my post is idiotic and something a poor uneducated person thinks. g">