Serious question on health care

Comments

-

This was Bernie's plan.HoustonHusky said:

Mean income is ~$70k, but only idiots like you don't realize that the wealth that skews it higher isn't salary wealth...it's capital gains, dividends, and such which is handled much differently tax-wise.2001400ex said:

Median income? Lol that's awesome. Median income is meaningless in this exercise.HoustonHusky said:

The median household income is ~$50k and the average household has 2.6 people. That means you somehow think a govt run healthcare system that covers everything Medicare/Medicaid covers will cost a touch over $1,000 per person.2001400ex said:

And the explanation is....HoustonHusky said:

Math is hard for morons.2001400ex said:Why not just open Medicare to everyone and change the tax to like 6%. You can still buy supplemental insurance if you choose. Keep the private/non profit hospitals and everything else the same. Forget all these stupid rules, tax cuts, insurance subsidies, premiums, etc.

Now compare that to what current Medicare or Medicaid actually spends per person.

Speed limit...

6% might be too low, but your math isn't close to right.

So you are off anywhere from 500% to 900% on your math, which for someone with a speed limit IQ is still pretty bad. But go ahead and tell yourself you have thought about this seriously...

HOW MUCH WILL IT COST AND HOW DO WE PAY FOR IT?

HOW MUCH WILL IT COST?

This plan has been estimated to cost $1.38 trillion per year.

THE PLAN WOULD BE FULLY PAID FOR BY:

A 6.2 percent income-based health care premium paid by employers.

Revenue raised: $630 billion per year.

A 2.2 percent income-based premium paid by households.

Revenue raised: $210 billion per year.This year, a family of four taking the standard deduction can have income up to $28,800 and not pay this tax under this plan.A family of four making $50,000 a year taking the standard deduction would only pay $466 this year.

Progressive income tax rates.

Revenue raised: $110 billion a year.Under this plan the marginal income tax rate would be:

37 percent on income between $250,000 and $500,000.

43 percent on income between $500,000 and $2 million.

48 percent on income between $2 million and $10 million. (In 2013, only 113,000 households, the top 0.08 percent of taxpayers, had income between $2 million and $10 million.)

52 percent on income above $10 million. (In 2013, only 13,000 households, just 0.01 percent of taxpayers, had income exceeding $10 million.)

Taxing capital gains and dividends the same as income from work.

Revenue raised: $92 billion per year.Warren Buffett, the second wealthiest American in the country, has said that he pays a lower effective tax rate than his secretary. The reason is that he receives most of his income from capital gains and dividends, which are taxed at a much lower rate than income from work. This plan will end the special tax break for capital gains and dividends on household income above $250,000.

Limit tax deductions for rich.

Revenue raised: $15 billion per year. Under Bernie’s plan, households making over $250,000 would no longer be able to save more than 28 cents in taxes from every dollar in tax deductions. This limit would replace more complicated and less effective limits on tax breaks for the rich including the AMT, the personal exemption phase-out and the limit on itemized deductions.

The Responsible Estate Tax.

Revenue raised: $21 billion per year.This provision would tax the estates of the wealthiest 0.3 percent (three-tenths of 1 percent) of Americans who inherit over $3.5 million at progressive rates and close loopholes in the estate tax.

Savings from health tax expenditures.

Revenue raised: $310 billion per year. Several tax breaks that subsidize health care (health-related “tax expenditures”) would become obsolete and disappear under a single-payer health care system, saving $310 billion per year.Most importantly, health care provided by employers is compensation that is not subject to payroll taxes or income taxes under current law. This is a significant tax break that would effectively disappear under this plan because all Americans would receive health care through the new single-payer program instead of employer-based health care. -

Irrelevant. Bernie lost and has chosen to remove his voice from the discussion, bailing on his supporters at the exact time they seek strong leadership.

When the going got tuff, Bernie took hush money and quit. -

Completely agree with the idea of combining catastrophic health care coverage with HSAs. As you point out, the former would shield against getting wiped out in the event of major injury/illness and the latter would be used to cover out of pocket heath care costs in a way that forces more free market participation. But I totally disagree with the idea of forcing people to a government run single payer system to make this work. That is problematic on a number of levels, especially in the absence of a private sector free market alternative.YellowSnow said:

Because that's way too logical. What ever the fuck we do, we've got to get away from an employer based system; it makes no god damned sense.2001400ex said:Why not just open Medicare to everyone and change the tax to like 6%. You can still buy supplemental insurance if you choose. Keep the private/non profit hospitals and everything else the same. Forget all these stupid rules, tax cuts, insurance subsidies, premiums, etc.

If anyone has the time for some light reading, this the best piece I've ever read on healthcare reform. TL;DR version is Single Payer for "catastrophic"- i.e., no one goes bankrupt because of a medical issue, and mandatory HSA accounts for everything else to get the consumer to have more influence over pricing in the marketplace. https://www.theatlantic.com/magazine/archive/2009/09/how-american-health-care-killed-my-father/307617/ -

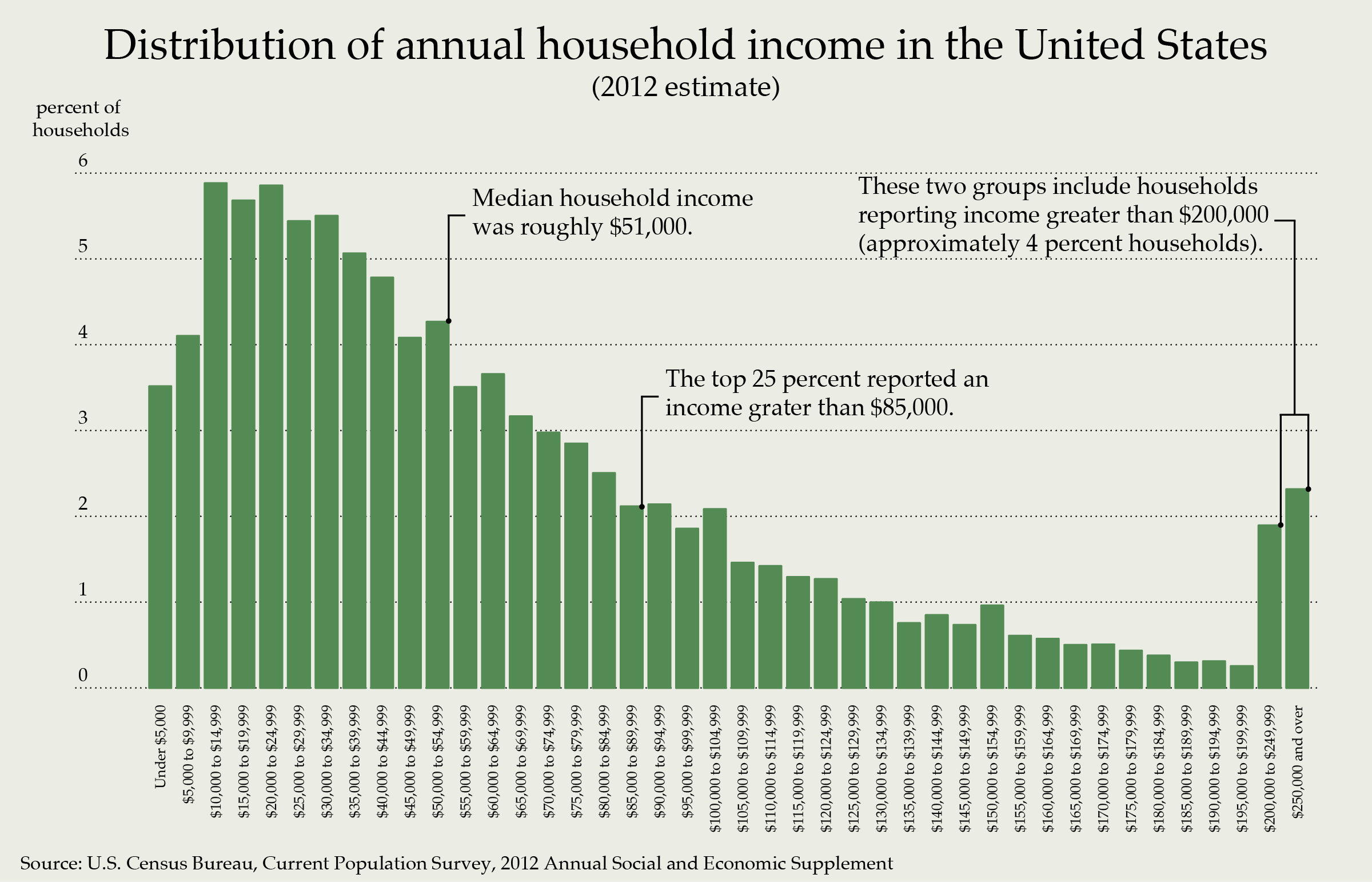

You are saying he's wrong because ($50k * 6%) / 2.3 = $1,304? Are you having a stroke or do you not know that half the population makes more than $50k? One guy making $500k is worth 10 making $50k. The difference is made up in the top half of the curve.HoustonHusky said:

The median household income is ~$50k and the average household has 2.6 people. That means you somehow think a govt run healthcare system that covers everything Medicare/Medicaid covers will cost a touch over $1,000 per person.2001400ex said:

And the explanation is....HoustonHusky said:

Math is hard for morons.2001400ex said:Why not just open Medicare to everyone and change the tax to like 6%. You can still buy supplemental insurance if you choose. Keep the private/non profit hospitals and everything else the same. Forget all these stupid rules, tax cuts, insurance subsidies, premiums, etc.

Now compare that to what current Medicare or Medicaid actually spends per person.

Speed limit...

I'm still amazed that every one of our peer countries are able to cover their citizens through taxes yet the richest country in the world doesn't think it's possible. We are paying three times as much in many cases.

Most of the savings come from a reduction in overhead. When everyone is covered you lose almost all your administration costs. Think how much time is wasted between hospitals and insurance companies going back and forth to determine what is covered. -

But death panels!UWhuskytskeet said:

You are saying he's wrong because ($50k * 6%) / 2.3 = $1,304? Are you having a stroke or do you not know that half the population makes more than $50k? One guy making $500k is worth 10 making $50k. The difference is made up in the top half of the curve.HoustonHusky said:

The median household income is ~$50k and the average household has 2.6 people. That means you somehow think a govt run healthcare system that covers everything Medicare/Medicaid covers will cost a touch over $1,000 per person.2001400ex said:

And the explanation is....HoustonHusky said:

Math is hard for morons.2001400ex said:Why not just open Medicare to everyone and change the tax to like 6%. You can still buy supplemental insurance if you choose. Keep the private/non profit hospitals and everything else the same. Forget all these stupid rules, tax cuts, insurance subsidies, premiums, etc.

Now compare that to what current Medicare or Medicaid actually spends per person.

Speed limit...

I'm still amazed that every one of our peer countries are able to cover their citizens through taxes yet the richest country in the world doesn't think it's possible. We are paying three times as much in many cases.

Most of the savings come from a reduction in overhead. When everyone is covered you lose almost all your administration costs. Think how much time is wasted between hospitals and insurance companies going back and forth to determine what is covered. -

Tax you for your health care. Love how he tosses in how few rich people he's trying to victimize by percentage. Of course killing all the farmers is another goal of his ilk. Control the food, starve them out of existence. Fucking commie asshat!2001400ex said:

This was Bernie's plan.HoustonHusky said:

Mean income is ~$70k, but only idiots like you don't realize that the wealth that skews it higher isn't salary wealth...it's capital gains, dividends, and such which is handled much differently tax-wise.2001400ex said:

Median income? Lol that's awesome. Median income is meaningless in this exercise.HoustonHusky said:

The median household income is ~$50k and the average household has 2.6 people. That means you somehow think a govt run healthcare system that covers everything Medicare/Medicaid covers will cost a touch over $1,000 per person.2001400ex said:

And the explanation is....HoustonHusky said:

Math is hard for morons.2001400ex said:Why not just open Medicare to everyone and change the tax to like 6%. You can still buy supplemental insurance if you choose. Keep the private/non profit hospitals and everything else the same. Forget all these stupid rules, tax cuts, insurance subsidies, premiums, etc.

Now compare that to what current Medicare or Medicaid actually spends per person.

Speed limit...

6% might be too low, but your math isn't close to right.

So you are off anywhere from 500% to 900% on your math, which for someone with a speed limit IQ is still pretty bad. But go ahead and tell yourself you have thought about this seriously...

HOW MUCH WILL IT COST AND HOW DO WE PAY FOR IT?

HOW MUCH WILL IT COST?

This plan has been estimated to cost $1.38 trillion per year.

THE PLAN WOULD BE FULLY PAID FOR BY:

A 6.2 percent income-based health care premium paid by employers.

Revenue raised: $630 billion per year.

A 2.2 percent income-based premium paid by households.

Revenue raised: $210 billion per year.This year, a family of four taking the standard deduction can have income up to $28,800 and not pay this tax under this plan.A family of four making $50,000 a year taking the standard deduction would only pay $466 this year.

Progressive income tax rates.

Revenue raised: $110 billion a year.Under this plan the marginal income tax rate would be:

37 percent on income between $250,000 and $500,000.

43 percent on income between $500,000 and $2 million.

48 percent on income between $2 million and $10 million. (In 2013, only 113,000 households, the top 0.08 percent of taxpayers, had income between $2 million and $10 million.)

52 percent on income above $10 million. (In 2013, only 13,000 households, just 0.01 percent of taxpayers, had income exceeding $10 million.)

Taxing capital gains and dividends the same as income from work.

Revenue raised: $92 billion per year.Warren Buffett, the second wealthiest American in the country, has said that he pays a lower effective tax rate than his secretary. The reason is that he receives most of his income from capital gains and dividends, which are taxed at a much lower rate than income from work. This plan will end the special tax break for capital gains and dividends on household income above $250,000.

Limit tax deductions for rich.

Revenue raised: $15 billion per year. Under Bernie’s plan, households making over $250,000 would no longer be able to save more than 28 cents in taxes from every dollar in tax deductions. This limit would replace more complicated and less effective limits on tax breaks for the rich including the AMT, the personal exemption phase-out and the limit on itemized deductions.

The Responsible Estate Tax.

Revenue raised: $21 billion per year.This provision would tax the estates of the wealthiest 0.3 percent (three-tenths of 1 percent) of Americans who inherit over $3.5 million at progressive rates and close loopholes in the estate tax.

Savings from health tax expenditures.

Revenue raised: $310 billion per year. Several tax breaks that subsidize health care (health-related “tax expenditures”) would become obsolete and disappear under a single-payer health care system, saving $310 billion per year.Most importantly, health care provided by employers is compensation that is not subject to payroll taxes or income taxes under current law. This is a significant tax break that would effectively disappear under this plan because all Americans would receive health care through the new single-payer program instead of employer-based health care. -

Did you have a chance to read this piece? It's still a pretty free market based idea; he says for $50,000 and above single payer and less than this mandatory HSA's. You have to make them mandatory (HSA's) to ensure that people have the money set aside for healthcare costs. It's not different than forcing people to save for retirement which is what Social Security is in essence.Southerndawg said:

Completely agree with the idea of combining catastrophic health care coverage with HSAs. As you point out, the former would shield against getting wiped out in the event of major injury/illness and the latter would be used to cover out of pocket heath care costs in a way that forces more free market participation. But I totally disagree with the idea of forcing people to a government run single payer system to make this work. That is problematic on a number of levels, especially in the absence of a private sector free market alternative.YellowSnow said:

Because that's way too logical. What ever the fuck we do, we've got to get away from an employer based system; it makes no god damned sense.2001400ex said:Why not just open Medicare to everyone and change the tax to like 6%. You can still buy supplemental insurance if you choose. Keep the private/non profit hospitals and everything else the same. Forget all these stupid rules, tax cuts, insurance subsidies, premiums, etc.

If anyone has the time for some light reading, this the best piece I've ever read on healthcare reform. TL;DR version is Single Payer for "catastrophic"- i.e., no one goes bankrupt because of a medical issue, and mandatory HSA accounts for everything else to get the consumer to have more influence over pricing in the marketplace. https://www.theatlantic.com/magazine/archive/2009/09/how-american-health-care-killed-my-father/307617/ -

I know this may seem like a foreign concept to you. But we're actually trying to help people by giving then healthcare that they can affordSledog said:

Tax you for your health care. Love how he tosses in how few rich people he's trying to victimize by percentage. Of course killing all the farmers is another goal of his ilk. Control the food, starve them out of existence. Fucking commie asshat!2001400ex said:

This was Bernie's plan.HoustonHusky said:

Mean income is ~$70k, but only idiots like you don't realize that the wealth that skews it higher isn't salary wealth...it's capital gains, dividends, and such which is handled much differently tax-wise.2001400ex said:

Median income? Lol that's awesome. Median income is meaningless in this exercise.HoustonHusky said:

The median household income is ~$50k and the average household has 2.6 people. That means you somehow think a govt run healthcare system that covers everything Medicare/Medicaid covers will cost a touch over $1,000 per person.2001400ex said:

And the explanation is....HoustonHusky said:

Math is hard for morons.2001400ex said:Why not just open Medicare to everyone and change the tax to like 6%. You can still buy supplemental insurance if you choose. Keep the private/non profit hospitals and everything else the same. Forget all these stupid rules, tax cuts, insurance subsidies, premiums, etc.

Now compare that to what current Medicare or Medicaid actually spends per person.

Speed limit...

6% might be too low, but your math isn't close to right.

So you are off anywhere from 500% to 900% on your math, which for someone with a speed limit IQ is still pretty bad. But go ahead and tell yourself you have thought about this seriously...

HOW MUCH WILL IT COST AND HOW DO WE PAY FOR IT?

HOW MUCH WILL IT COST?

This plan has been estimated to cost $1.38 trillion per year.

THE PLAN WOULD BE FULLY PAID FOR BY:

A 6.2 percent income-based health care premium paid by employers.

Revenue raised: $630 billion per year.

A 2.2 percent income-based premium paid by households.

Revenue raised: $210 billion per year.This year, a family of four taking the standard deduction can have income up to $28,800 and not pay this tax under this plan.A family of four making $50,000 a year taking the standard deduction would only pay $466 this year.

Progressive income tax rates.

Revenue raised: $110 billion a year.Under this plan the marginal income tax rate would be:

37 percent on income between $250,000 and $500,000.

43 percent on income between $500,000 and $2 million.

48 percent on income between $2 million and $10 million. (In 2013, only 113,000 households, the top 0.08 percent of taxpayers, had income between $2 million and $10 million.)

52 percent on income above $10 million. (In 2013, only 13,000 households, just 0.01 percent of taxpayers, had income exceeding $10 million.)

Taxing capital gains and dividends the same as income from work.

Revenue raised: $92 billion per year.Warren Buffett, the second wealthiest American in the country, has said that he pays a lower effective tax rate than his secretary. The reason is that he receives most of his income from capital gains and dividends, which are taxed at a much lower rate than income from work. This plan will end the special tax break for capital gains and dividends on household income above $250,000.

Limit tax deductions for rich.

Revenue raised: $15 billion per year. Under Bernie’s plan, households making over $250,000 would no longer be able to save more than 28 cents in taxes from every dollar in tax deductions. This limit would replace more complicated and less effective limits on tax breaks for the rich including the AMT, the personal exemption phase-out and the limit on itemized deductions.

The Responsible Estate Tax.

Revenue raised: $21 billion per year.This provision would tax the estates of the wealthiest 0.3 percent (three-tenths of 1 percent) of Americans who inherit over $3.5 million at progressive rates and close loopholes in the estate tax.

Savings from health tax expenditures.

Revenue raised: $310 billion per year. Several tax breaks that subsidize health care (health-related “tax expenditures”) would become obsolete and disappear under a single-payer health care system, saving $310 billion per year.Most importantly, health care provided by employers is compensation that is not subject to payroll taxes or income taxes under current law. This is a significant tax break that would effectively disappear under this plan because all Americans would receive health care through the new single-payer program instead of employer-based health care.

-

You are citing household income...as I said and as is the case the upper echelon don't make their money on salary. The make it off of capital gains, dividends from businesses (ask Buffet again why he pays a lower tax rate than his secretary...or John Edwards what his overall tax rate was from his law firm), etc. The answer is somewhere between the median ($50k) and mean($70k), but it's heavily tilted towards the median. And it doesn't really matter, because either way you are still WAY off for balancing the numbers.UWhuskytskeet said:

You are saying he's wrong because ($50k * 6%) / 2.3 = $1,304? Are you having a stroke or do you not know that half the population makes more than $50k? One guy making $500k is worth 10 making $50k. The difference is made up in the top half of the curve.HoustonHusky said:

The median household income is ~$50k and the average household has 2.6 people. That means you somehow think a govt run healthcare system that covers everything Medicare/Medicaid covers will cost a touch over $1,000 per person.2001400ex said:

And the explanation is....HoustonHusky said:

Math is hard for morons.2001400ex said:Why not just open Medicare to everyone and change the tax to like 6%. You can still buy supplemental insurance if you choose. Keep the private/non profit hospitals and everything else the same. Forget all these stupid rules, tax cuts, insurance subsidies, premiums, etc.

Now compare that to what current Medicare or Medicaid actually spends per person.

Speed limit...

I'm still amazed that every one of our peer countries are able to cover their citizens through taxes yet the richest country in the world doesn't think it's possible. We are paying three times as much in many cases.

Most of the savings come from a reduction in overhead. When everyone is covered you lose almost all your administration costs. Think how much time is wasted between hospitals and insurance companies going back and forth to determine what is covered.

That's why even Bernies plan had to raise taxes on all sorts of other things because even that pinko commie socialist idealist was smart enough to know a 6% income tax rate doesn't raise nearly enough money, and even with all his other tax increases he proposed on top of that he still had to assume a massive magical (42%?) increase in efficiency of health care service to make the numbers work...which is comical when you see what the govt spends on Medicare/Medicaid.

I always love the argument that bringing in the government to run anything will lower the overhead costs...it's like thousands of years of reality just don't exist. The other counties don't spend less because of lower overhead...they spend less because they use the monopoly to control spending on all sides, from doctors salaries to access to services to drug prices, access to suing, etc. It is a legit argument on how to limit spending on health care, but it's absolutely nuts to think you can give everyone blanket healthcare that covers everything with no limits and it will magically cost a lot less than what we spend now. -

There is a floor to income at $0. There isn't a ceiling. That's why your argument is dumb. There isn't a normal distribution to income. That's why the mean is greater than the median.HoustonHusky said:

You are citing household income...as I said and as is the case the upper echelon don't make their money on salary. The make it off of capital gains, dividends from businesses (ask Buffet again why he pays a lower tax rate than his secretary...or John Edwards what his overall tax rate was from his law firm), etc. The answer is somewhere between the median ($50k) and mean($70k), but it's heavily tilted towards the median. And it doesn't really matter, because either way you are still WAY off for balancing the numbers.UWhuskytskeet said:

You are saying he's wrong because ($50k * 6%) / 2.3 = $1,304? Are you having a stroke or do you not know that half the population makes more than $50k? One guy making $500k is worth 10 making $50k. The difference is made up in the top half of the curve.HoustonHusky said:

The median household income is ~$50k and the average household has 2.6 people. That means you somehow think a govt run healthcare system that covers everything Medicare/Medicaid covers will cost a touch over $1,000 per person.2001400ex said:

And the explanation is....HoustonHusky said:

Math is hard for morons.2001400ex said:Why not just open Medicare to everyone and change the tax to like 6%. You can still buy supplemental insurance if you choose. Keep the private/non profit hospitals and everything else the same. Forget all these stupid rules, tax cuts, insurance subsidies, premiums, etc.

Now compare that to what current Medicare or Medicaid actually spends per person.

Speed limit...

I'm still amazed that every one of our peer countries are able to cover their citizens through taxes yet the richest country in the world doesn't think it's possible. We are paying three times as much in many cases.

Most of the savings come from a reduction in overhead. When everyone is covered you lose almost all your administration costs. Think how much time is wasted between hospitals and insurance companies going back and forth to determine what is covered.

That's why even Bernies plan had to raise taxes on all sorts of other things because even that pinko commie socialist idealist was smart enough to know a 6% income tax rate doesn't raise nearly enough money, and even with all his other tax increases he proposed on top of that he still had to assume a massive magical (42%?) increase in efficiency of health care service to make the numbers work...which is comical when you see what the govt spends on Medicare/Medicaid.

I always love the argument that bringing in the government to run anything will lower the overhead costs...it's like thousands of years of reality just don't exist. The other counties don't spend less because of lower overhead...they spend less because they use the monopoly to control spending on all sides, from doctors salaries to access to services to drug prices, access to suing, etc. It is a legit argument on how to limit spending on health care, but it's absolutely nuts to think you can give everyone blanket healthcare that covers everything with no limits and it will magically cost a lot less than what we spend now.

"I always love the argument that bringing in the government to run anything will lower the overhead costs...it's like thousands of years of reality just don't exist."

Quit crying wolf about the government. It's about creating a single insurance pool, the only thing that reduces the risk and cost of insurance. Quit ignoring every country where it's been proven to work.