Inflation coming in hot boys!!

Comments

-

Yeah I think there is something to that. All this Fed talk on rates and tariffs is a sideshow to the main course which is the bond. Cut the spending and you need to issue less bonds and you’ll get better rates regardless of what the fed rate is.

-

As we've discussed, the opposite is mostly true as well, cut rates with no meaningful change and bond markets won't eat it.

You'd see a repeat of big lenders making a killing as their rates from the fed decrease while retail rates don't.

-

-

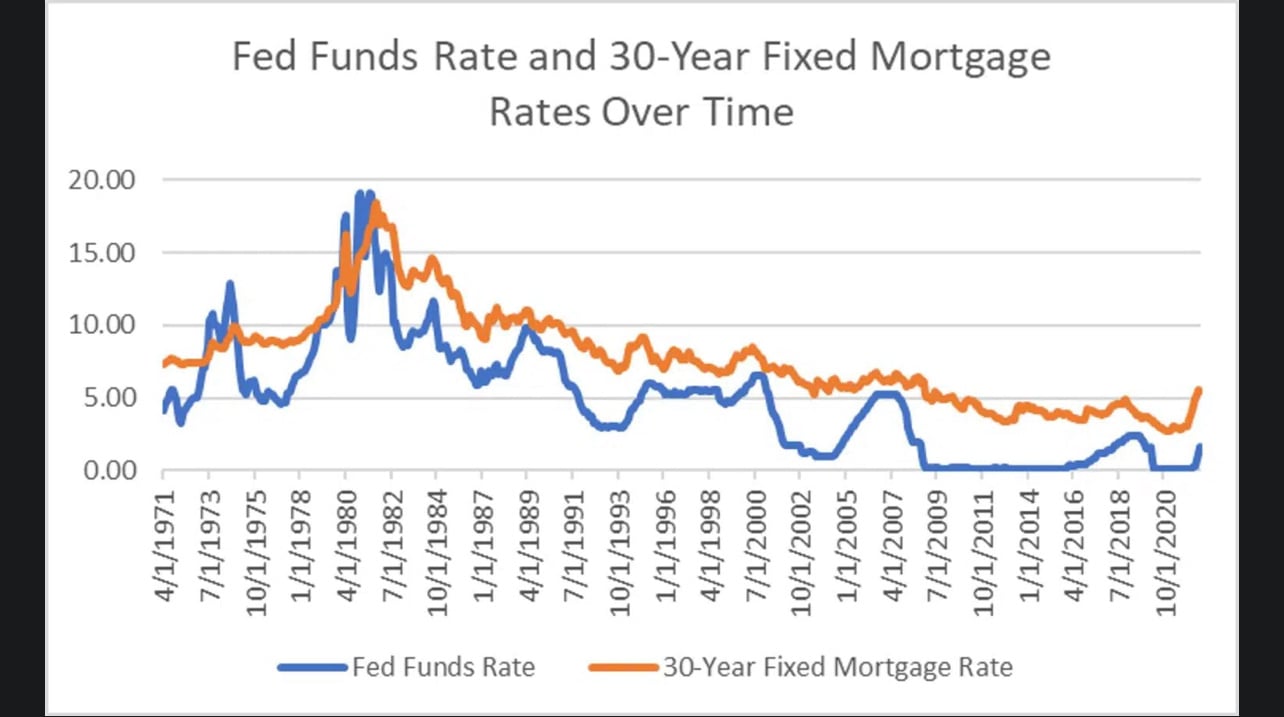

The only rate anyone on main street gives a shit about is the 30-year mortgage rate.

Also, the bigger issue with high housing costs is not rates, it's that prices in most areas have not dropped in any meaningful way after going nuts during COVID. They'll continue to stay up so long as new housing supply doesn't increase at a much quicker rate (see red states vs blue states to understand how to fuck up supply). Outside of the Great Recession and COVID hitting back-to-back, 6.5% is a pretty damn good rate to buy a house.

-

Correct. And the 30 year mortgage rate and every other kind of debt or equity valuation is based off the t bill rates.

-

I would say that interest rates are near the bottom of why housing is so hard to get for Average Joe

Land use, green energy requirement and excessive regulation top the list We bought at 11% in 1985 but the house was only 90 grand. It was old stock in an "up and coming" neighborhood.

-

Yeap, price is more so the issue than rates.

Which is the result of squeezing supply with regulations and subsidizing demand. Nothing like the government "making housing affordable" to help drive up property taxes.

-

The oligarch families that run the Fed get an extra trillion a year while the interest rate is high as it increases the interest on the national debt. That's why the rate has not come down and they know their goose is cooked and Trump may organize the end the fed.

-

lots of words to say the problem is fascism

-

You probably need to learn the difference between points and basis points first