Q for the resident economists

Comments

-

Look, at him stroke Obama's dick. All because Obama made it easier for him to have sex with children.2001400ex said:

Agreed. They definitely should have raised rates earlier. And slowly.greenblood said:

But they created a market where zero interest rates were the norm. They should have gradually increased interest rates 3-4 years ago. If they would have taken one to two .25% increases in 13’, 14’, 15’, and 16’, the market would have been much better off.2001400ex said:

Go read my other comments on rising interest rates. I'm very aware of their effect. The main reason they have risen slowly is the 08 recession freaked the fed out. Their quick rising of rates in 06/07 was one of the main triggers of the recession.greenblood said:

I haven’t heard any solution from you on how to defend our? intellectual property. A short term trade war is a good trade off for long term intellectual property protection.2001400ex said:

Weren't rising interest rates known when we were sold that this was going to prop up the economy and stock market?greenblood said:Rising interest rates and a trade war. Hopefully, now you’re informed.

Trade war.... So what should we do about the trade war? Who is the person behind that again?

Regarding interest rates...when was the last time we had a rise in interest rates? About a decade? Now think about how much debt businesses accrued during that time. With rising interest rates this debt creates valuation issues in the market. Obviously, you aren’t very smart, or you would know that. The market also priced in for three rate increases this year, not four. With the fear of a forth increase coming in December, it’s driving stocks down.

There is also the fear of a global slow down. At times like this it’s best to compare similar countries. Just so you know, Europe’s growth projection is a full percentage point lower than the US for the next couple quarters. When compared to Europe, the US is very strong. The strengthening dollar is another example of our economic strengthening compared to the rest of the developed world markets.

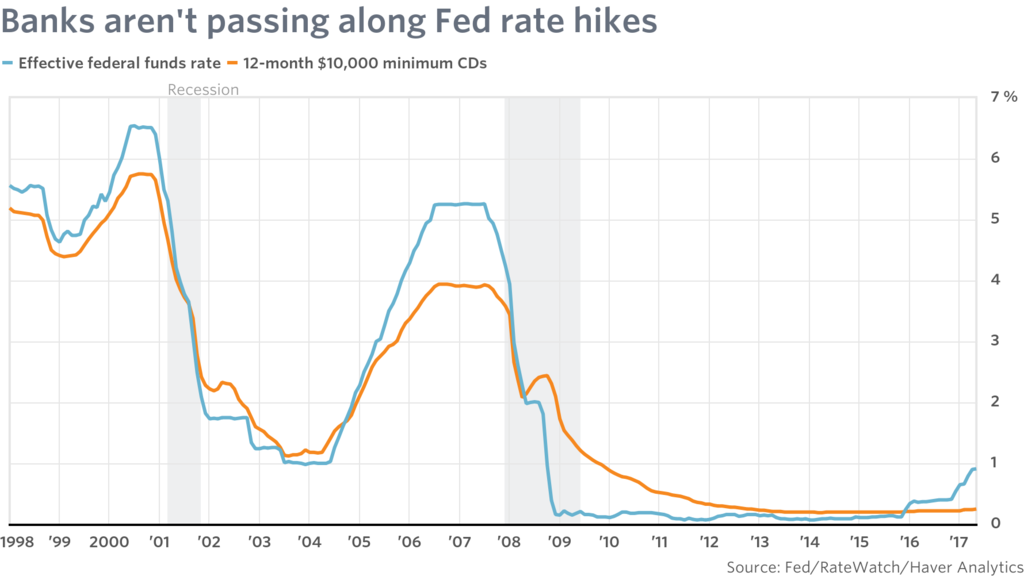

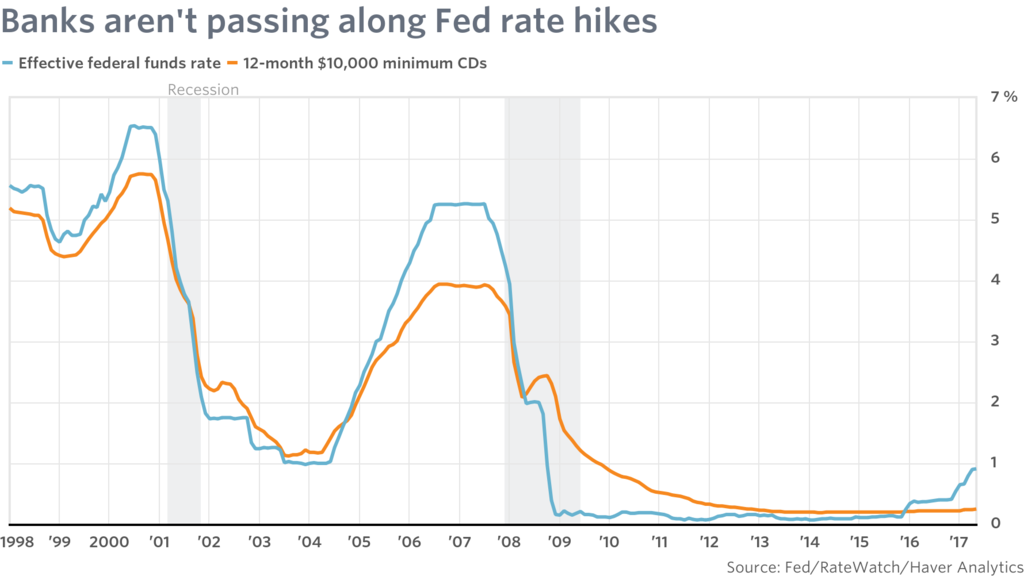

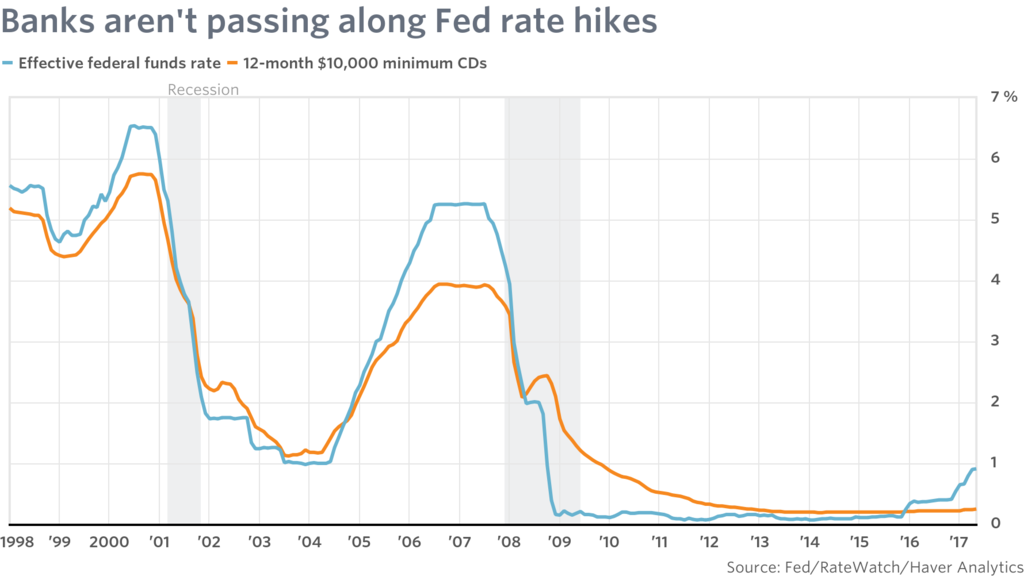

This is some historical context on the fed funds rate.

-

Obama deserves credit/blame for the economy up to a certain point in tim, let's call it mid-2018. That tim is debatable and fucktards will argue a different point in tim based upon how it makes their guy look. Irregardless it's a mute poont.

How it goes from there rests with Trumptard.

Godspeed Donny. Us old, rich, and white men are counting on you to not fuck it up. -

-

I agree that we need to get away from zero percent interest rates, but I think the Fed is being a little too hawkish here, and they are potentially repeating history for the third time.2001400ex said:

Agreed. They definitely should have raised rates earlier. And slowly.greenblood said:

But they created a market where zero interest rates were the norm. They should have gradually increased interest rates 3-4 years ago. If they would have taken one to two .25% increases in 13’, 14’, 15’, and 16’, the market would have been much better off.2001400ex said:

Go read my other comments on rising interest rates. I'm very aware of their effect. The main reason they have risen slowly is the 08 recession freaked the fed out. Their quick rising of rates in 06/07 was one of the main triggers of the recession.greenblood said:

I haven’t heard any solution from you on how to defend our? intellectual property. A short term trade war is a good trade off for long term intellectual property protection.2001400ex said:

Weren't rising interest rates known when we were sold that this was going to prop up the economy and stock market?greenblood said:Rising interest rates and a trade war. Hopefully, now you’re informed.

Trade war.... So what should we do about the trade war? Who is the person behind that again?

Regarding interest rates...when was the last time we had a rise in interest rates? About a decade? Now think about how much debt businesses accrued during that time. With rising interest rates this debt creates valuation issues in the market. Obviously, you aren’t very smart, or you would know that. The market also priced in for three rate increases this year, not four. With the fear of a forth increase coming in December, it’s driving stocks down.

There is also the fear of a global slow down. At times like this it’s best to compare similar countries. Just so you know, Europe’s growth projection is a full percentage point lower than the US for the next couple quarters. When compared to Europe, the US is very strong. The strengthening dollar is another example of our economic strengthening compared to the rest of the developed world markets.

This is some historical context on the fed funds rate.

-

A trigger isn't the same as an underlying cause. Extended low rates with no raises created bubbles. Other than the bitcoin bubble(which was small and curbed early) I don't see a lot of bubbles in the economy atm. Then again, people usually don't. Still, slowly raised interest rates are due and it's a good time for the fed to do it.2001400ex said:

Go read my other comments on rising interest rates. I'm very aware of their effect. The main reason they have risen slowly is the 08 recession freaked the fed out. Their quick rising of rates in 06/07 was one of the main triggers of the recession.greenblood said:

I haven’t heard any solution from you on how to defend our? intellectual property. A short term trade war is a good trade off for long term intellectual property protection.2001400ex said:

Weren't rising interest rates known when we were sold that this was going to prop up the economy and stock market?greenblood said:Rising interest rates and a trade war. Hopefully, now you’re informed.

Trade war.... So what should we do about the trade war? Who is the person behind that again?

Regarding interest rates...when was the last time we had a rise in interest rates? About a decade? Now think about how much debt businesses accrued during that time. With rising interest rates this debt creates valuation issues in the market. Obviously, you aren’t very smart, or you would know that. The market also priced in for three rate increases this year, not four. With the fear of a forth increase coming in December, it’s driving stocks down.

There is also the fear of a global slow down. At times like this it’s best to compare similar countries. Just so you know, Europe’s growth projection is a full percentage point lower than the US for the next couple quarters. When compared to Europe, the US is very strong. The strengthening dollar is another example of our economic strengthening compared to the rest of the developed world markets.

This is some historical context on the fed funds rate.

-

There is still a housing bubble. Low interest rates prop up the inflated pricing required to keep it above water. Lots of shadow stock still out there too

-

We've been over this Hondo so are you lying or being a dumbass? Maybe just *trolling*...2001400ex said:

No shit. I'm laughing cause of Trump's comments on the matter. And this is the dudes that stroke his dick:BennyBeaver said:

the stock market is not the economy.2001400ex said:We had the yugest tax cut ever and the most reduction in regulations ever. Why is the stock market at a net zero for 2018 then?

hth

Under Obama: stock market doesn't matter.. See labor participation.

Under Trump: see stock market!!!! Up bigly!!! What is labor participation?

Now: stock market doesn't matter.

Obama:Decent stock market numbers, shit labor participation among prime working ages(excuses of "this is the new norm")

Tump:Good stock market numbers, an increasing labor participation among prime working ages(what happened to "the new norm"???) -

Except labor participation isn't increasing.UW_Doog_Bot said:

We've been over this Hondo so are you lying or being a dumbass? Maybe just *trolling*...2001400ex said:

No shit. I'm laughing cause of Trump's comments on the matter. And this is the dudes that stroke his dick:BennyBeaver said:

the stock market is not the economy.2001400ex said:We had the yugest tax cut ever and the most reduction in regulations ever. Why is the stock market at a net zero for 2018 then?

hth

Under Obama: stock market doesn't matter.. See labor participation.

Under Trump: see stock market!!!! Up bigly!!! What is labor participation?

Now: stock market doesn't matter.

Obama:Decent stock market numbers, shit labor participation among prime working ages(excuses of "this is the new norm")

Tump:Good stock market numbers, an increasing labor participation among prime working ages(what happened to "the new norm"???) -

62.3% percent before 2016, now 62.9%. Not increasing much, but still increasing. What I do like is the fact that the participation rate is no longer falling since it's highs in 2000.2001400ex said:

Except labor participation isn't increasing.UW_Doog_Bot said:

We've been over this Hondo so are you lying or being a dumbass? Maybe just *trolling*...2001400ex said:

No shit. I'm laughing cause of Trump's comments on the matter. And this is the dudes that stroke his dick:BennyBeaver said:

the stock market is not the economy.2001400ex said:We had the yugest tax cut ever and the most reduction in regulations ever. Why is the stock market at a net zero for 2018 then?

hth

Under Obama: stock market doesn't matter.. See labor participation.

Under Trump: see stock market!!!! Up bigly!!! What is labor participation?

Now: stock market doesn't matter.

Obama:Decent stock market numbers, shit labor participation among prime working ages(excuses of "this is the new norm")

Tump:Good stock market numbers, an increasing labor participation among prime working ages(what happened to "the new norm"???) -

My photophucket isn't working. But the last 4 years it's basically been stagnant, slight variations up and down. You can't say it's increasing and saying Trump's economy is the reason. I've said this for a long time, labor participation is effected by a lot of things, one of them being societal changes. It increased when more women started working, for instance.greenblood said:

62.3% percent before 2016, now 62.9%. Not increasing much, but still increasing. What I do like is the fact that the participation rate is no longer falling since it's highs in 2000.2001400ex said:

Except labor participation isn't increasing.UW_Doog_Bot said:

We've been over this Hondo so are you lying or being a dumbass? Maybe just *trolling*...2001400ex said:

No shit. I'm laughing cause of Trump's comments on the matter. And this is the dudes that stroke his dick:BennyBeaver said:

the stock market is not the economy.2001400ex said:We had the yugest tax cut ever and the most reduction in regulations ever. Why is the stock market at a net zero for 2018 then?

hth

Under Obama: stock market doesn't matter.. See labor participation.

Under Trump: see stock market!!!! Up bigly!!! What is labor participation?

Now: stock market doesn't matter.

Obama:Decent stock market numbers, shit labor participation among prime working ages(excuses of "this is the new norm")

Tump:Good stock market numbers, an increasing labor participation among prime working ages(what happened to "the new norm"???)