Welcome to the Hardcore Husky Forums. Folks who are well-known in Cyberland and not that dumb.

WSJ: Who's paying what in taxes

Comments

-

racist.GrundleStiltzkin said:Top 20% of Earners Pay 84% of Income Tax

The data comes from estimates by the nonpartisan Tax Policy Center, a Washington-based research group, as Internal Revenue Service data for 2014 won’t be available for at least two years. Unlike IRS data, it includes information about nonfilers—both people who didn’t need to file and people who should have filed but didn’t. The total also includes Americans living overseas and others, which is why it is greater than the U.S. Census estimate of 319 million.

Another important difference: The income cited on the table includes untaxed amounts for employer-provided health coverage, tax-exempt interest and retirement-plan contributions and growth, among other things. This can be significant.

On average, such benefits double the income of people in the bottom quintile and add more than 25% to the income of people in the top quintile, says Roberton Williams, an income-tax specialist at the Tax Policy Center. That means a taxpayer whose stated pay is $130,000 might be reaping another $35,000 annually in untaxed income.

“Most people focus on the income they see in their paychecks or portfolios and forget about untaxed benefits they receive,” Mr. Williams says.

The tables show just how progressive the income tax is. The three million people in the top 1% of earners pay nearly half the income tax.

Why is the share of income taxes negative for 40% of Americans? In recent decades Congress has chosen to funnel important benefits for lower-income earners through the income tax rather than other channels. Some of these benefits, such as the Earned Income Tax Credit and the American Opportunity Credit for education, make cash payments to people who don’t owe income tax.

People receiving such payments do pay other federal taxes, of course, such as those for Social Security and Medicare. If these taxes are included, the share of federal taxes paid by the lowest two quintiles turns positive. -

Thanks for the fucking reminder that I have to do my taxes this weekend.

-

Yeah because America isnt a country of haves and have nots, it's a country of haves and soon to haves.RaceBannon said:If you hate the rich and successful you'll never be either

-

How about rich people start paying their employees higher wages? Then those people will pay more in taxes. Problem solved.

-

Yeah, but if you got rid of minimum wage, the unemployment rate would plummet. Then in 2025 we'd get to hear fat cats call people making $4 an hour on contract, living in shacks, lazy parasites. It would be just like Mexico. They're a country I think we should all aspire to emulate.allpurpleallgold said:How about rich people start paying their employees higher wages? Then those people will pay more in taxes. Problem solved.

-

It's a country of whining victims I guessallpurpleallgold said:

Yeah because America isnt a country of haves and have nots, it's a country of haves and soon to haves.RaceBannon said:If you hate the rich and successful you'll never be either

-

It's true - I'm just not sure who whines more - rich people or poor people.RaceBannon said:

It's a country of whining victims I guessallpurpleallgold said:

Yeah because America isnt a country of haves and have nots, it's a country of haves and soon to haves.RaceBannon said:If you hate the rich and successful you'll never be either

'

Less whining - more working. Then everyone would have less time to whine, and less to whine about.

-

Is always the people who don't pay taxes - relatively speaking - that think taxing more will solve all our problems.allpurpleallgold said:How about rich people start paying their employees higher wages? Then those people will pay more in taxes. Problem solved.

-

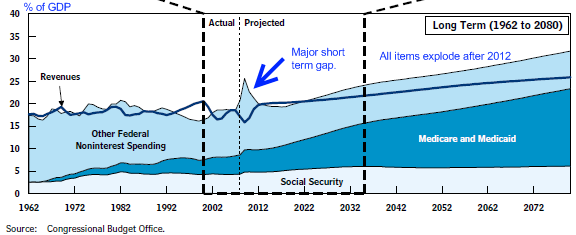

What's funny is that this country hit the sweet spot, taxation-wise, during the Clinton years. After Clinton's tax hike in 1992, Congress and the executive were able to start reining in spending (and some credit for that goes to the GOP, I might add) and making some sensible reforms to social spending. Suddenly we had surpluses as far as the eye could see, low unemployment, and things were looking pretty damn good. Even the recession brought on by the dot-com bust and the September 11 attack was fairly mild.

Then, we had the Bush tax cuts, which neither stimulated the economy nor created jobs. Then the Iraq and Afghanistan wars, which were not paid for by appropriations, but which were waged with "contingency funding," which is to say made-up dollars minted from thin air. Then the 2008 bubble and collapse.

Since then, we had the Obama stimulus (too small to make much of an effect on the overall economy), and then the meat-cleaver of sequestration. Remember folks, discretionary federal spending isn't that much outside the military.

-

But how do big executives not have my best interests in mind?