Welcome to the Hardcore Husky Forums. Folks who are well-known in Cyberland and not that dumb.

DM to Financial Market Guru guy

doogie

Member Posts: 15,072

Looks like things are looking up!

Comments

-

-

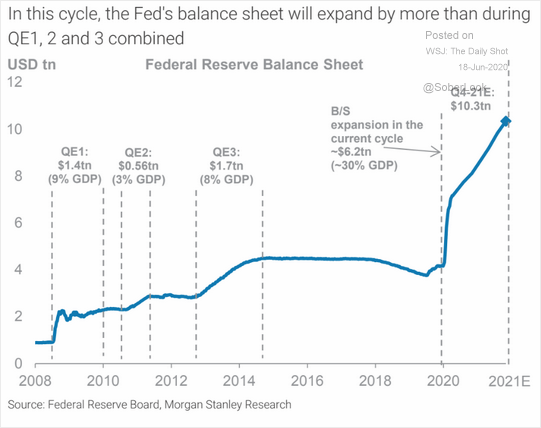

But there won’t be inflation.

Everybody says so. -

Have you seen it in the last decade?Kaepsknee said:But there won’t be inflation.

Everybody says so. -

It's almost as if something unprecedented took place.

-

We are living it right now, should be interesting how it plays outKaepsknee said: -

Yes. The idea house prices have, what doubled or tripled in the last 10 years but inflation is 1% makes zero sense when you step back and look at it. The fact the govt changed the calculation to try and pay less SS doesn't mean it doesn't exist...FireCohen said:

Have you seen it in the last decade?Kaepsknee said:But there won’t be inflation.

Everybody says so.

-

Stick to sports.Kaepsknee said:But there won’t be inflation.

Everybody says so. -

@HoustonHusky , we've written much here, and we are on the same page, about what we should be seeing. I don't get it. I think your position is more intellectually-based, mine is more gut-level, "how can that be?" based.HoustonHusky said:

Yes. The idea house prices have, what doubled or tripled in the last 10 years but inflation is 1% makes zero sense when you step back and look at it. The fact the govt changed the calculation to try and pay less SS doesn't mean it doesn't exist...FireCohen said:

Have you seen it in the last decade?Kaepsknee said:But there won’t be inflation.

Everybody says so.

But, fuck, the one thing on which I do not think we (the royal we) have settled is, what is the "right" inflation test analysis? Even if we settle on the right bundle of goods, it doesn't feel inflationary to me if there is a reasonable, or at least rational, economic explanation for price increase other than monetary inflation and pure loss of buying power. That is, if the currency is still a proxy for a robust economy, or the expectation / speculation of it, then do we have real inflation? So stories about supply chains and actual robust demand need not apply to our conversation.

One example is the stock market. Earnings, real value stories and other normal measures of the pie getting larger are disconnected from prevailing prices. There has to be some speculation built in there for post-COVID economis parties. But still, major disconnect. Not inflation in the Germany post WWI sense; but inflationary nonetheless.

For monetary policy inflation, I'm still waiting for the $15 loaf of bread. Am I wrong here? -

We’ve hidden a lot of it through banking/finance...it used to be 20% down on a mortgage with 7% interest. Now it’s 0% down on a house with 3% 30-yr mortgage...keeps the “payments” from ramping up even though the underlying asset’s prices do. For cars you can get, what a 6 or 8 year note now at 2% rate? Unheard of 20 years ago. IPhones are $1,300, but they roll into a monthly fee on the cell plan so nobody knows or cares. College tuition is up 500%, but the govt let’s you finance more $$$ for longer periods of time at artificially low interest rates. It’s why people have so much shite and are still up to their ears in debt.

A lot of this changed with the budget deals with Clinton and Gingrich and even Greenspan way back when...they were looking for ways to limit the SS spending going forward and juice the GDP numbers. It some ways it works, but long-term it helps further divide the haves from the have-nots. And the unforeseen consequence has been that it let the Federal Govt spend itself silly racking up debt.