Swipe the Card - National Debt

Comments

-

I was thinking literally the same thing as I mused over this thread. One could say that the "American Dream" is part of what makes all of this so difficult in that the dream presupposes that you get to retire at 60, travel to Europe with your wife and live in your house independent of family until you die. I remember my grandfather long ago telling me that in his time (born just after the turn of the century), retirement meant trusting your family to take care of you. When you couldn't work in Cuba you couldn't eat.louism2wash said:@HoustonHusky: "Would the same people lecturing everybody to stay home and not do anything be saying that if their retirement savings shrank 50%."

I agree with this. This also brings up an interesting predicament that 401Ks have put our country in... can any politician really afford to let the market "correct" that way markets, in theory, should? I think a huge reason that we're in the place we are now is because letting the market collapse would mean that 401Ks would be worth half as much and we'd have a crisis of retirement-age folks going on food stamps.

The old pension system didn't make sense because it assumed that companies would grow forever(which they don't). I feel like we've now created an environment where the markets are now forced to "grow forever" because it's politically unfeasible to let the markets correct. Could you imagine what would happen to our society if we had a Japan-style, multi-decade recession happen?

My wife's grand parents told similar stories. My wife's family were pioneer settlers in the Grays Harbor area and raised cattle on a ranch (they still own the land). My MIL's uncles would tell her when she was little, "don't be jealous of those kids who live up on the hill in town. you get to eat meat with all of your meals; they get to once or twice a week maybe," and they weren't kidding. It was a collective of siblings who built their own houses on this property and they invested in timber, ranched, etc. They felt lucky because when they got old the younger generation would take over and run things and take care of them. My family in Cuba did the same thing, but w/o the timber and ranching. You got old, you sat in a rocking chair and lived with or near someone who was bringing in money and looked after you on your way out.

Now everyone expects this great ending, which is fine, but perhaps we're finding it's unrealistic for everybody to have it???? Goes back to my earlier question: is it a good thing that everybody has retirement savings in the market? If pensions didn't work, then it's good old fashioned "save what you can" and then hope that's enough or that your kids will take care of you.

Totally agree with everything you and @HoustonHusky have said. Everybody in the club should read this thread. -

Bingo. See my post to @louism2wash .HoustonHusky said:Agree completely, but I'd also argue the crazy low rates of the Fed the last 10+ years resulted in the leveraging up of everything including companies/the stock market which destroyed the realistic expectations of everything.

And the problem isn't retirement-age folks going on food stamps...its the upper class retirement-age folks not having a boat and buying a new iPad every year. Average 401k holding for folks 50+ is something like $170k, but the median is only something like $60k.

https://www.personalcapital.com/blog/retirement-planning/average-401k-balance-age/

And that's for the people who have 401ks, which is only something like 1/3 of the population (may be a bit higher for those over 50...hadn't seen that data):

https://www.fool.com/retirement/2017/06/19/does-the-average-american-have-a-401k.aspx

Average retirement-age folks aren't depending on the stock market for retirement...they are depending on a few assets if they are lucky and a SS check. And working until they are really old. Its the upper class folks that are. And magically enough a subset of those folks are the ones making policy for the masses.

Agree with your pension system using unfunded assets and a "constantly growing company" assumption. Japan is an interesting and good comparison...as somebody else also mentioned the largest stock shareholder for most companies there is their Central Bank. I expect that process to kick in here whenever there is a stock downturn because of the the reasons you pointed out. -

I wonder at this point, even if someone at the Fed had the stones to try and pump the breaks would anyone in congress and or the President go along with it, and if they did could it even work. Didn't we start running deficits 50 years ago?

Have we printed so much money that we are past the point of no return?

I've wondered for the last decade if we had a national VAT tax of 1-2% with the understanding that the ONLY place it can go is to help paydown the debt would help walk us back, but am also aware that w/ politicians the tax only would keep going up and eventually it would just fall in the general budget.

-

Sounds good on the surface. Just don’t structure it like a Euro VAT, too complicated for small business. Wayfair vs SD was a good thing for big business, they can easily absorb the administration of it. It was a big hurt to smallish companies that sell across multiple states. Just implementing and running Avalara (which is a good product by the way) is the cost equivalent of ~half a headcount.godawgst said:I wonder at this point, even if someone at the Fed had the stones to try and pump the breaks would anyone in congress and or the President go along with it, and if they did could it even work. Didn't we start running deficits 50 years ago?

Have we printed so much money that we are past the point of no return?

I've wondered for the last decade if we had a national VAT tax of 1-2% with the understanding that the ONLY place it can go is to help paydown the debt would help walk us back, but am also aware that w/ politicians the tax only would keep going up and eventually it would just fall in the general budget. -

My issue with most regulation is that only businesses with teams of lawyers, hr, etc can navigate it.Bob_C said:

Sounds good on the surface. Just don’t structure it like a Euro VAT, too complicated for small business. Wayfair vs SD was a good thing for big business, they can easily absorb the administration of it. It was a big hurt to smallish companies that sell across multiple states. Just implementing and running Avalara (which is a good product by the way) is the cost equivalent of ~half a headcount.godawgst said:I wonder at this point, even if someone at the Fed had the stones to try and pump the breaks would anyone in congress and or the President go along with it, and if they did could it even work. Didn't we start running deficits 50 years ago?

Have we printed so much money that we are past the point of no return?

I've wondered for the last decade if we had a national VAT tax of 1-2% with the understanding that the ONLY place it can go is to help paydown the debt would help walk us back, but am also aware that w/ politicians the tax only would keep going up and eventually it would just fall in the general budget. -

You think Congress is there to pass laws that help the little guy?Bob_C said:

Sounds good on the surface. Just don’t structure it like a Euro VAT, too complicated for small business. Wayfair vs SD was a good thing for big business, they can easily absorb the administration of it. It was a big hurt to smallish companies that sell across multiple states. Just implementing and running Avalara (which is a good product by the way) is the cost equivalent of ~half a headcount.godawgst said:I wonder at this point, even if someone at the Fed had the stones to try and pump the breaks would anyone in congress and or the President go along with it, and if they did could it even work. Didn't we start running deficits 50 years ago?

Have we printed so much money that we are past the point of no return?

I've wondered for the last decade if we had a national VAT tax of 1-2% with the understanding that the ONLY place it can go is to help paydown the debt would help walk us back, but am also aware that w/ politicians the tax only would keep going up and eventually it would just fall in the general budget. -

"A Keleven gets you home by seven"RaceBannon said:

Herbert Hoover, Jimmy Carter, and Bush 1 agree. Bush 2 as well but it was his second termcreepycoug said:

I think @louism2wash nailed it: nobody wants to be the one to say, "Let's let the economy cool down a little."HoustonHusky said:

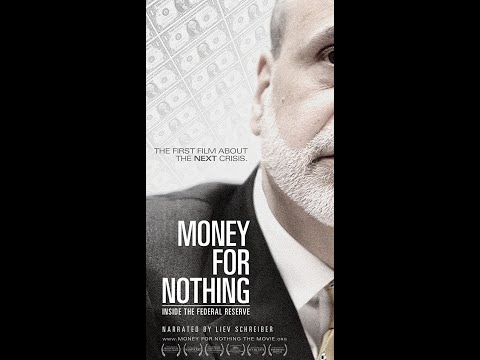

Hadn't seen this but guessing I'm of similar mindset...I'll try and watch it this weekend as well.louism2wash said:Great documentary released a few years back on the Fed and how we've handled the recovery from 2008 to now. Long story short, nobody wants to be the person to say "we need to put the brakes on the economy" even if the economy badly needs to be slowed down. All we've done since 2008 is stimulate our way out of a recession with greater and greater stimulus being needed to keep the party rolling. How long will it last? Who knows?

https://www.youtube.com/watch?v=lA0obw6PbCU

https://www.youtube.com/watch?v=lA0obw6PbCU

The entire business cycle is based on expansions and contractions (where all the poor business decisions come back to haunt folks)...the idea of the "Great Moderation" cheered on by the Central Bankers where the cycles aren't as severely because of the increased size/diversity of the economy has somehow mutated to the idea that the government and indirectly the Fed should print money to paper over/prevent any possible downturn.

Its comically stupid from a bunch of supposedly smart people.

Of course, they wouldn't be, because that would pre-suppose the economy needed cooling down. The real economy doesn't. What you really don't want to be is the guy who says, "Let's stop this charade and let the shit hit the fan because that would be keeping it real."

And frankly, I wouldn't want to be that guy either. But the chickens will come home to roost eventually. They always do.

Pretty sure both parties now fix the numbers with accounting tricks and they aren't going to volunteer to be the one out front

Headline today - new unemployment claims down in California!!!111!!!. Well most of us are on old claims. And before the pandemic when UI had an expiration date they stopped counting you as unemployed when your bennies ran out

At this point we better hope they can keep it going -

Politicians know paying off the debt doesn't get you re-elected.godawgst said:I wonder at this point, even if someone at the Fed had the stones to try and pump the breaks would anyone in congress and or the President go along with it, and if they did could it even work. Didn't we start running deficits 50 years ago?

Have we printed so much money that we are past the point of no return?

I've wondered for the last decade if we had a national VAT tax of 1-2% with the understanding that the ONLY place it can go is to help paydown the debt would help walk us back, but am also aware that w/ politicians the tax only would keep going up and eventually it would just fall in the general budget.