Welcome to the Hardcore Husky Forums. Folks who are well-known in Cyberland and not that dumb.

Tesla's Valuation ?

Comments

-

-

Sources said:

Saw today that 1/21/21 700c is only $55. That's essentially free money for anyone who likes intermediate horizonsFireCohen said:

Putting my order in nowinsinceredawg said:Ektard weighs in

And you should really love two days later at $40...HoustonHusky said:

If you liked it at $55 you'll love it at $48 today...Sources said:

Saw today that 1/21/21 700c is only $55. That's essentially free money for anyone who likes intermediate horizonsFireCohen said:

Putting my order in nowinsinceredawg said:Ektard weighs in

I'm just giving you a hard time...its Tesla...it will probably melt up sometime between now and Jan... -

Probably will still melt up, but that $700 call is down to $30 today...almost a 50% discount...HoustonHusky said:Sources said:

Saw today that 1/21/21 700c is only $55. That's essentially free money for anyone who likes intermediate horizonsFireCohen said:

Putting my order in nowinsinceredawg said:Ektard weighs in

And you should really love two days later at $40...HoustonHusky said:

If you liked it at $55 you'll love it at $48 today...Sources said:

Saw today that 1/21/21 700c is only $55. That's essentially free money for anyone who likes intermediate horizonsFireCohen said:

Putting my order in nowinsinceredawg said:Ektard weighs in

I'm just giving you a hard time...its Tesla...it will probably melt up sometime between now and Jan... -

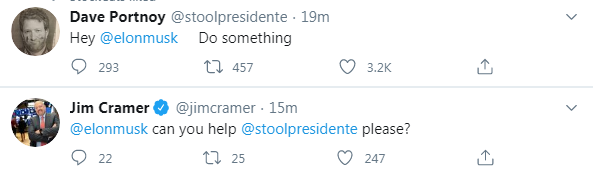

This one just made me laugh for those that get the reference...

-

-

HoustonHusky said:

HoustonHusky said:

Probably will still melt up, but that $700 call is down to $30 today...almost a 50% discount...HoustonHusky said:Sources said:

Saw today that 1/21/21 700c is only $55. That's essentially free money for anyone who likes intermediate horizonsFireCohen said:

Putting my order in nowinsinceredawg said:Ektard weighs in

And you should really love two days later at $40...HoustonHusky said:

If you liked it at $55 you'll love it at $48 today...Sources said:

Saw today that 1/21/21 700c is only $55. That's essentially free money for anyone who likes intermediate horizonsFireCohen said:

Putting my order in nowinsinceredawg said:Ektard weighs in

I'm just giving you a hard time...its Tesla...it will probably melt up sometime between now and Jan...

-

TSLA (currently $338) 50 day moving average is ~$330...for the TSLA bulls it should hopefully bounce off of that and back up. If it pushes below that and it could really get ugly...

-

Not a chart worshiper, but would like to point out TSLA dropped to $330.02 before bouncing up...trading at $359 currently...HoustonHusky said:TSLA (currently $338) 50 day moving average is ~$330...for the TSLA bulls it should hopefully bounce off of that and back up. If it pushes below that and it could really get ugly...

-

Time to get in guys, glad s&p took a pass

-

Back to $44 - with barely 100% IV.HoustonHusky said:

Probably will still melt up, but that $700 call is down to $30 today...almost a 50% discount...HoustonHusky said:Sources said:

Saw today that 1/21/21 700c is only $55. That's essentially free money for anyone who likes intermediate horizonsFireCohen said:

Putting my order in nowinsinceredawg said:Ektard weighs in

And you should really love two days later at $40...HoustonHusky said:

If you liked it at $55 you'll love it at $48 today...Sources said:

Saw today that 1/21/21 700c is only $55. That's essentially free money for anyone who likes intermediate horizonsFireCohen said:

Putting my order in nowinsinceredawg said:Ektard weighs in

I'm just giving you a hard time...its Tesla...it will probably melt up sometime between now and Jan...